Question

VERSITY FINANCIAL ANALYSIS-Lecture-1231 - FINN331 - 3 z 1 O a. 30,000 NIS O b. 40,000 NIS O c. 10,000 NIS O d. 20,000

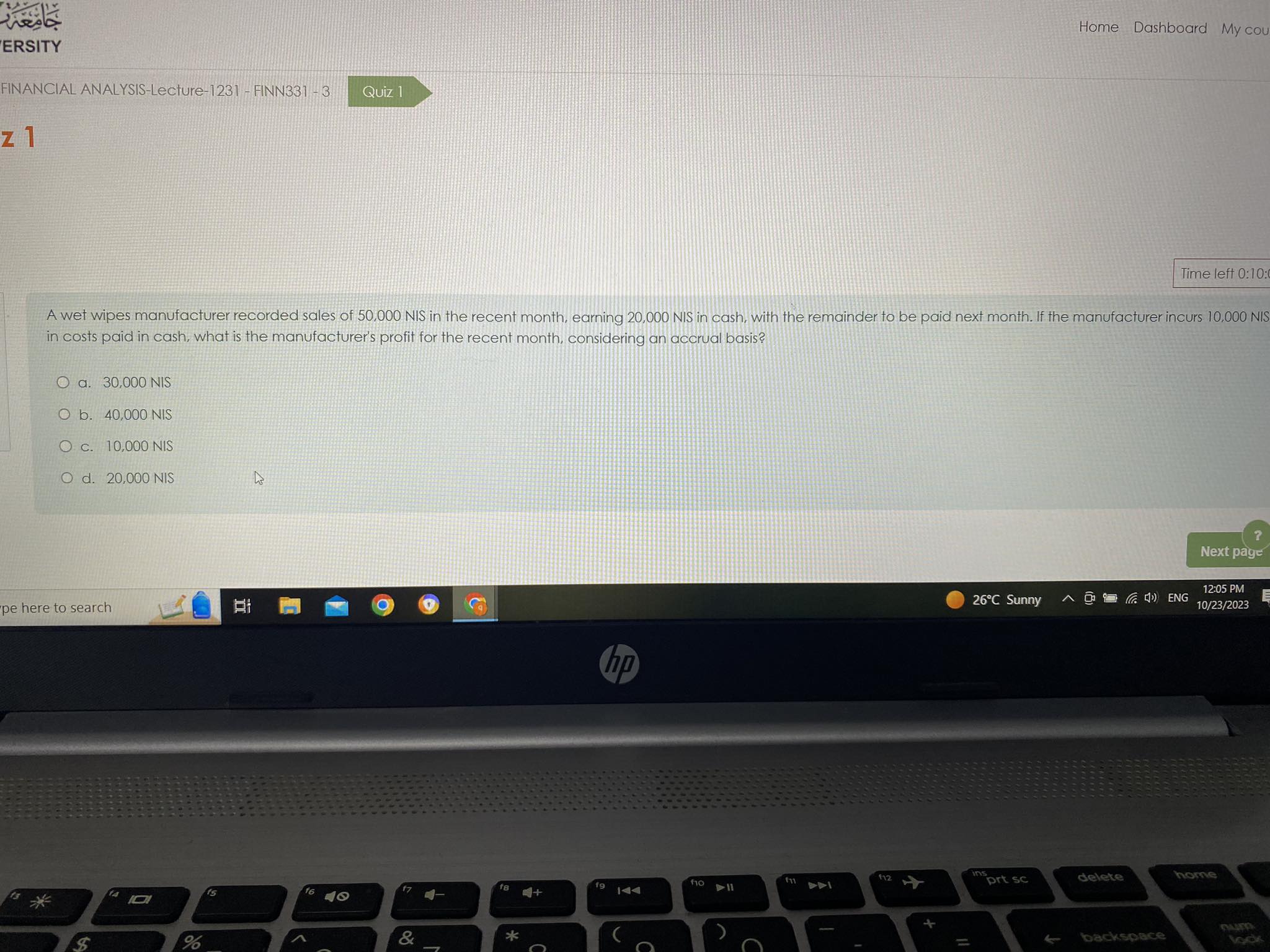

VERSITY FINANCIAL ANALYSIS-Lecture-1231 - FINN331 - 3 z 1 O a. 30,000 NIS O b. 40,000 NIS O c. 10,000 NIS O d. 20,000 NIS pe here to search A wet wipes manufacturer recorded sales of 50,000 NIS in the recent month, earning 20,000 NIS in cash, with the remainder to be paid next month. If the manufacturer incurs 10,000 NIS in costs paid in cash, what is the manufacturer's profit for the recent month, considering an accrual basis? 14 % Quiz 1 fs C f7 & -7 & f8 4+ hp fio II f11 112 26C Sunny ins Home Dashboard My cou prt sc delete Time left 0:10:C (4) ENG backspace ? Next page 12:05 PM 10/23/2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A wet wipes manufacturer recorded sales of 50000 NIS in the recent month earning 20000 NIS ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App