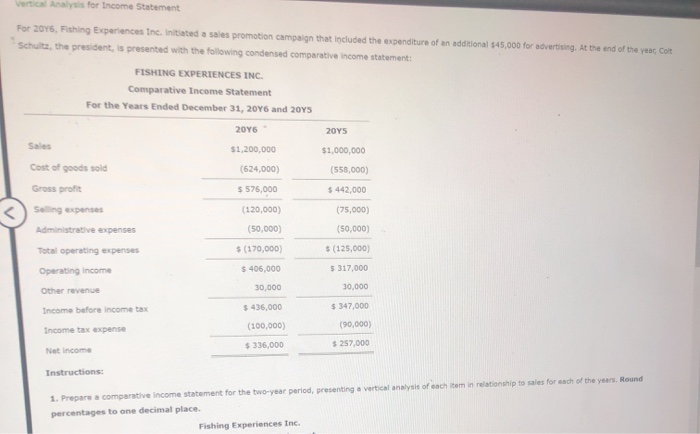

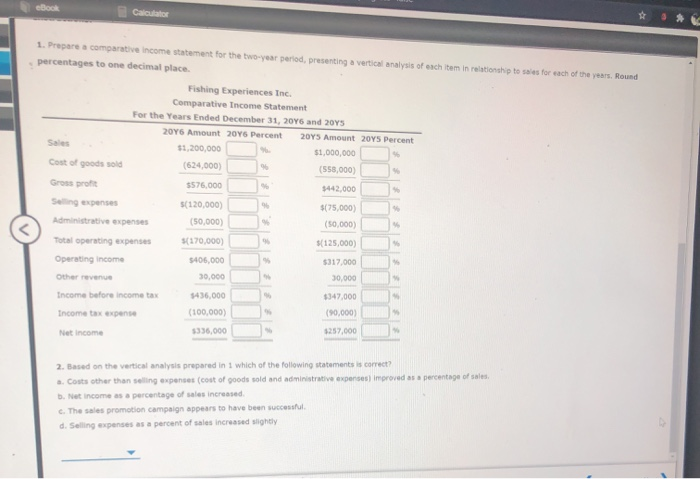

Vertical Analysis for Income Statement For 2016, Fishing Experiences Inc. Initiated a sales promotion campaign that included the expenditure of an additional $45,000 for advertising. At the end of the year, Colt Schultz, the president, is presented with the following condensed comparative Income statement: FISHING EXPERIENCES INC. Comparative Income Statement For the Years Ended December 31, 2016 and 2045 2046 2015 Sales $1,200,000 $1,000,000 Cost of goods sold (624,000) (558,000) Gross profit $575,000 $ 442,000 Song expenses (75,000) (120,000) (50,000) (50,000) Administrative expenses Total operating expenses $ (170,000) $(125,000) Operating income $ 406,000 5 317,000 Other revenue 30,000 30.000 Income before income tax $ 436,000 $ 347,000 (100,000) Income tax expense (90,000) $336,000 $257.000 Net Income Instructions: 1. Prepare a comparative Income statement for the two-year period, presenting a vertical analysis of each item in relationship to sales for each of the years, Round percentages to one decimal place. Fishing Experiences Inc. ebook Calculator 1. Prepare a comparative Income statement for the two-year period, presenting a vertical analysis of each item in relationship to sales for each of the years. Round percentages to one decimal place Fishing Experiences Inc. Comparative Income Statement For the Years Ended December 31, 2016 and 2045 2016 Amount 2015 percent 2015 Amount 2015 percent Sales $1,200,000 $1,000,000 Cost of goods sold (624,000) (558,000) Gross prot $575.000 $442,000 Seng expenses (120,000) $(75,000) Administrative expenses (50,000) (50,000) Total operating expenses ${170,000) $(125,000) Operating income 5406,000 $317.000 30,000 Other revenue 30,000 5436.000 $347.000 Income before income tax Income tax expense (100,000) (90,000) $336,000 $257,000 Net Income 2. Based on the vertical analysis prepared in 1 which of the following statements is correct? . Costs other than selling expenses (cost of goods sold and administrative expenses improved as a percentage of sales D. Net income as a percentage of sales increased c. The sales promotion campaign appears to have been succesul d. Selling expenses as a percent of sales increased slightly