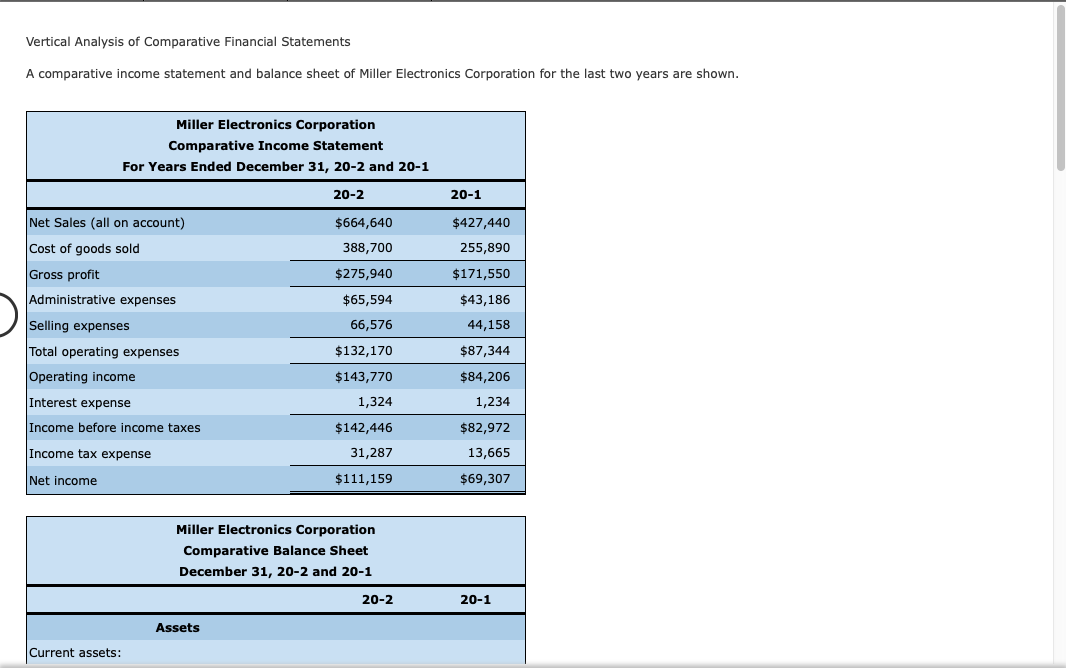

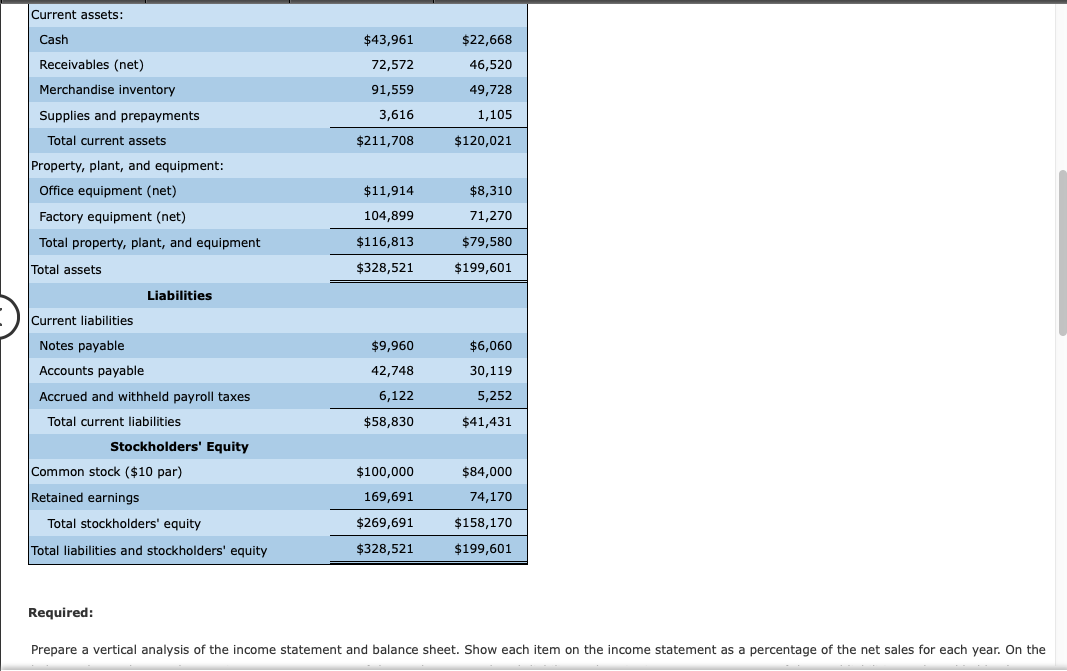

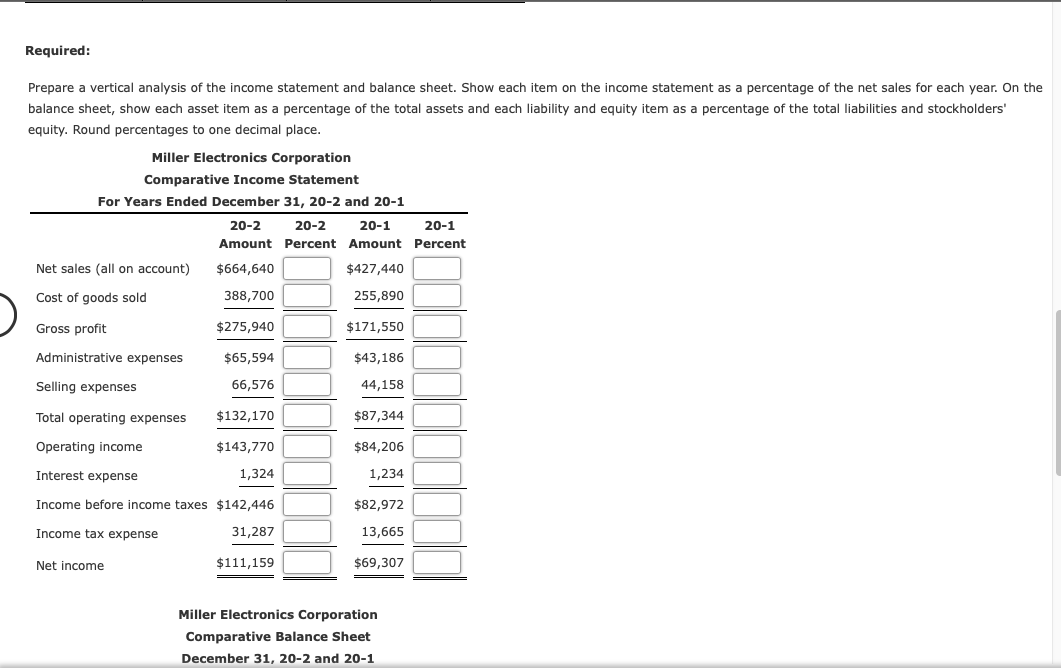

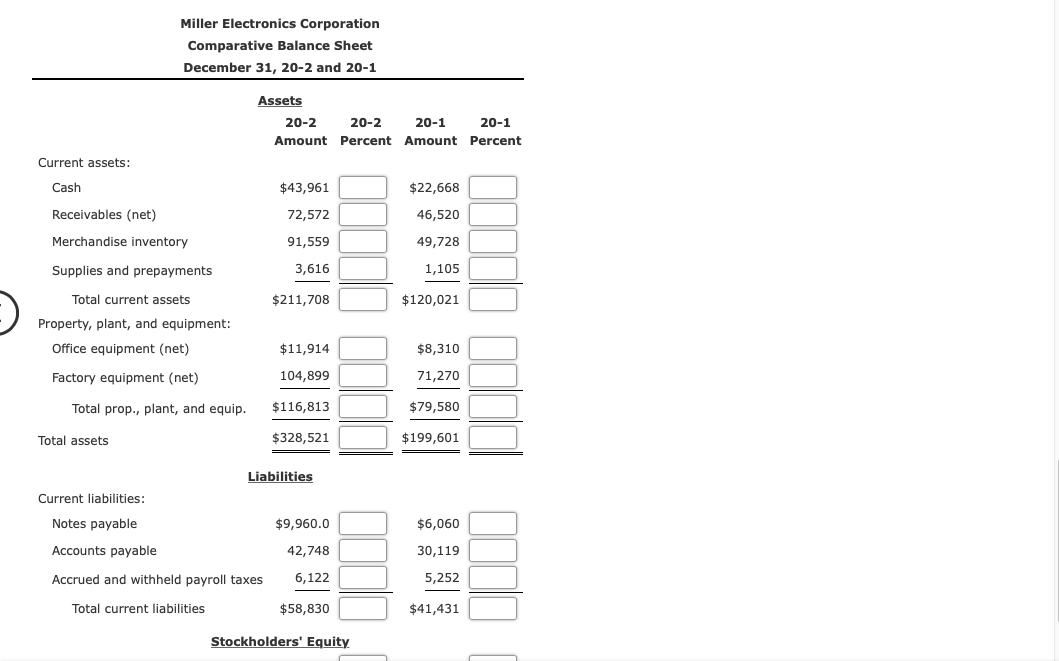

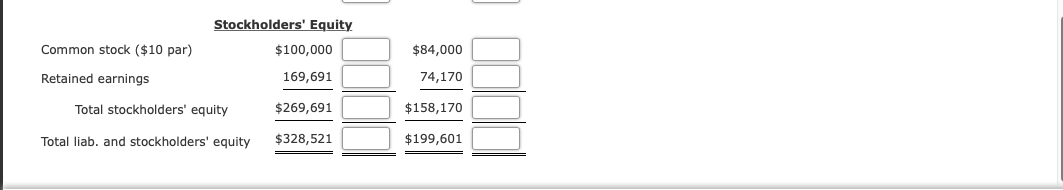

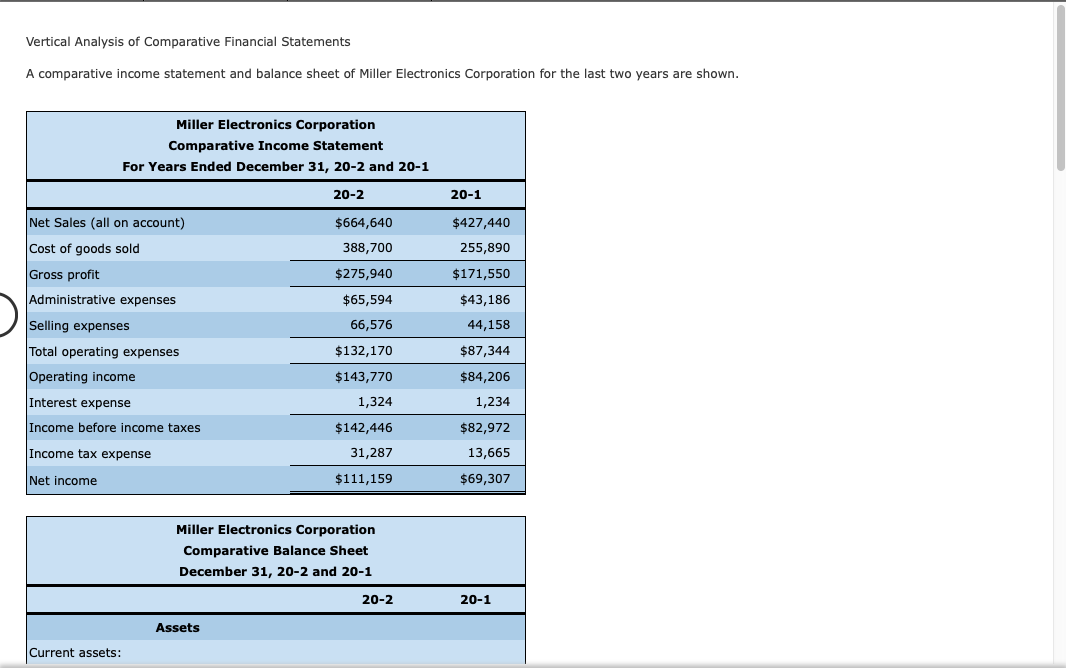

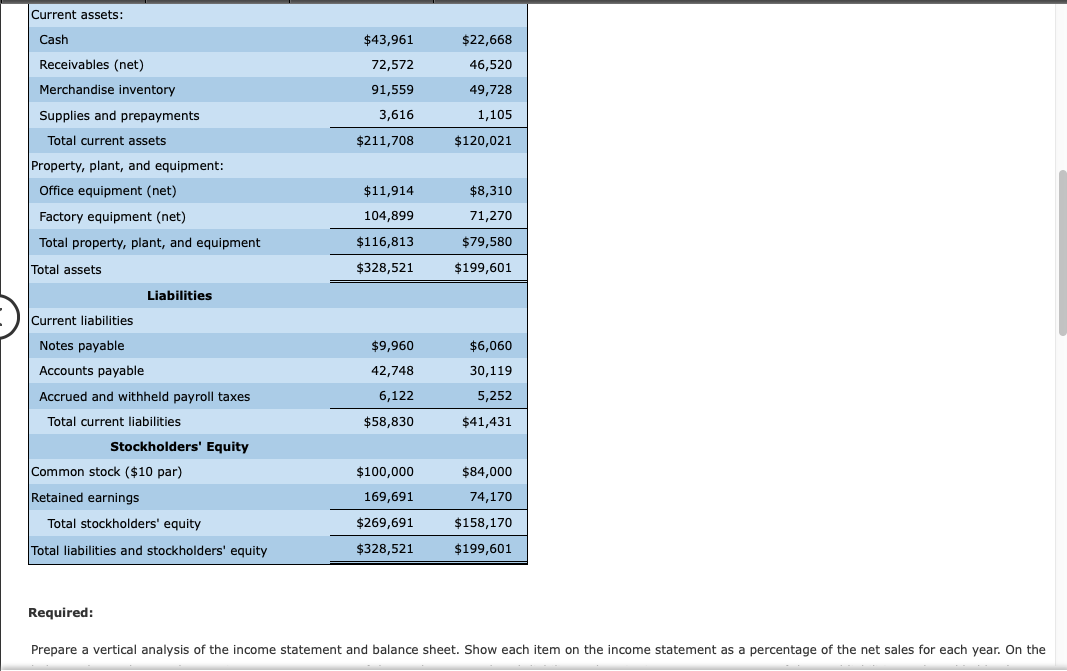

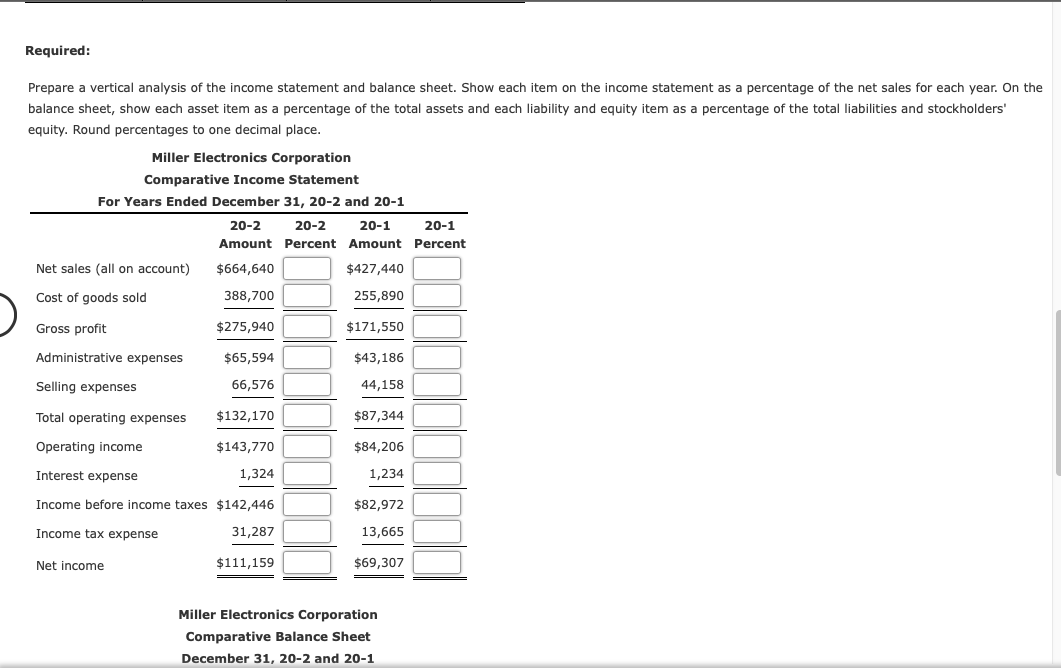

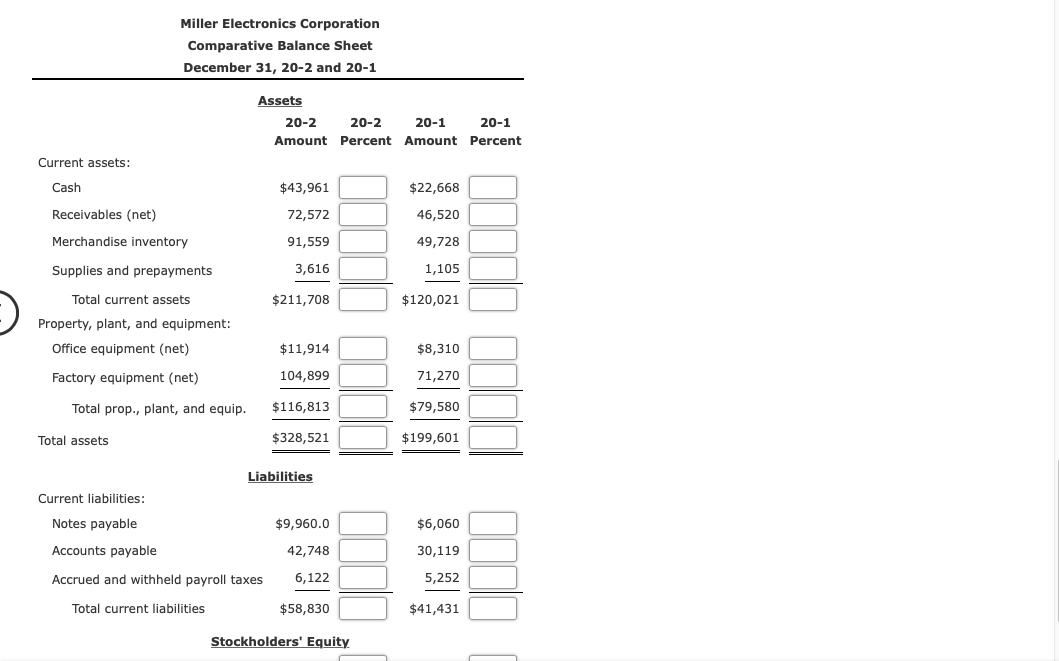

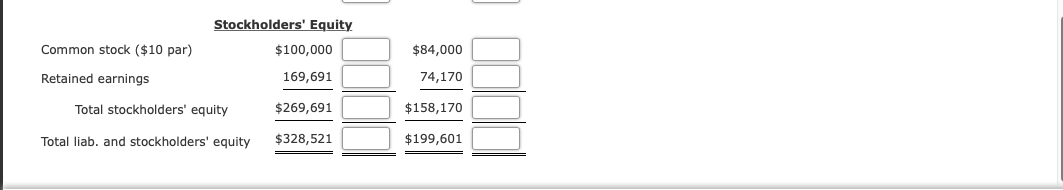

Vertical Analysis of Comparative Financial Statements A comparative income statement and balance sheet of Miller Electronics Corporation for the last two years are shown. Miller Electronics Corporation Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 20-2 20-1 Net Sales (all on account) Cost of goods sold $664,640 388,700 $275,940 $427,440 255,890 $171,550 Gross profit Administrative expenses $65,594 $43,186 66,576 44,158 Selling expenses Total operating expenses Operating income $87,344 $132,170 $143,770 1,324 $84,206 1,234 Interest expense Income before income taxes $142,446 31,287 $82,972 13,665 Income tax expense Net income $111,159 $69,307 Miller Electronics Corporation Comparative Balance Sheet December 31, 20-2 and 20-1 20-2 20-1 Assets Current assets: Current assets: Cash $43,961 72,572 $22,668 46,520 Receivables (net) Merchandise inventory Supplies and prepayments 91,559 3,616 49,728 1,105 $211,708 $120,021 Total current assets Property, plant, and equipment: Office equipment (net) Factory equipment (net) Total property, plant, and equipment $11,914 $8,310 104,899 $116,813 71,270 $79,580 Total assets $328,521 $199,601 Liabilities $9,960 $6,060 30,119 Current liabilities Notes payable Accounts payable Accrued and withheld payroll taxes Total current liabilities Stockholders' Equity Common stock ($10 par) 42,748 6,122 5,252 $58,830 $41,431 $100,000 169,691 $84,000 74,170 Retained earnings Total stockholders' equity $269,691 $158,170 $199,601 Total liabilities and stockholders' equity $328,521 Required: Prepare a vertical analysis of the income statement and balance sheet. Show each item on the income statement as a percentage of the net sales for each year. On the Required: Prepare a vertical analysis of the income statement and balance sheet. Show each item on the income statement as a percentage of the net sales for each year. On the balance sheet, show each asset item as a percentage of the total assets and each liability and equity item as a percentage of the total liabilities and stockholders' equity. Round percentages to one decimal place. Miller Electronics Corporation Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 20-2 20-2 20-1 20-1 Amount Percent Amount Percent Net sales (all on account) $664,640 $427,440 Cost of goods sold 388,700 255,890 Gross profit $275,940 $171,550 Administrative expenses $65,594 $43,186 Selling expenses 66,576 44,158 Total operating expenses $132,170 $87,344 Operating income $143,770 $84,206 Interest expense 1,324 1,234 Income before income taxes $142,446 $82,972 Income tax expense 31,287 13,665 Net income $111,159 $69,307 Miller Electronics Corporation Comparative Balance Sheet December 31, 20-2 and 20-1 Miller Electronics Corporation Comparative Balance Sheet December 31, 20-2 and 20-1 Assets 20-2 20-2 20-1 20-1 Amount Percent Amount Percent Current assets: Cash $43,961 $22,668 72,572 46,520 Receivables (net) Merchandise inventory 91,559 49,728 Supplies and prepayments 3,616 1,105 Total current assets $211,708 $120,021 Property, plant, and equipment: Office equipment (net) $11,914 $8,310 Factory equipment (net) 104,899 71,270 Total prop., plant, and equip. $116,813 $79,580 Total assets $328,521 $199,601 Liabilities Current liabilities: Notes payable $9,960.0 $6,060 Accounts payable 42,748 30,119 Accrued and withheld payroll taxes 6,122 5,252 Total current liabilities $58,830 $41,431 Stockholders' Equity Stockholders' Equity $100,000 Common stock ($10 par) $84,000 Retained earnings 169,691 74,170 Total stockholders' equity $269,691 $ 158,170 Total liab. and stockholders' equity $328,521 $199,601