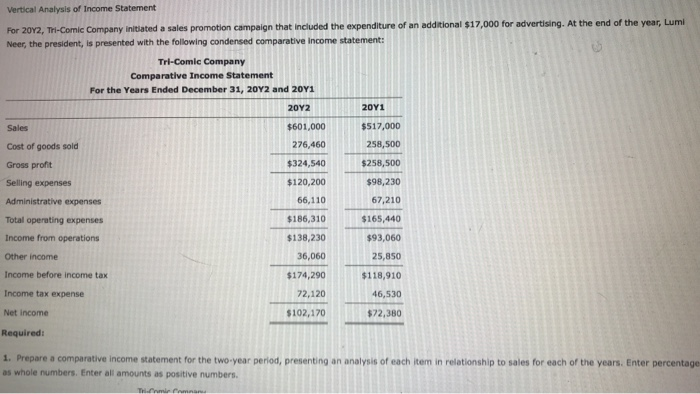

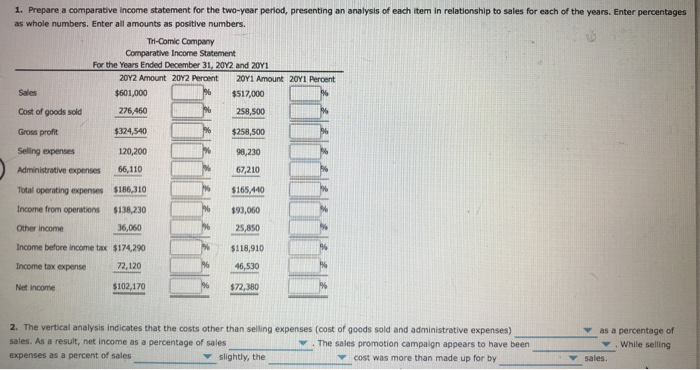

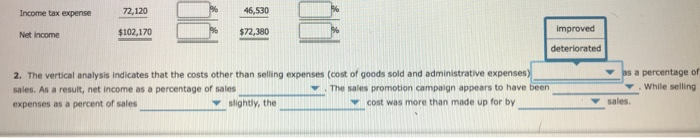

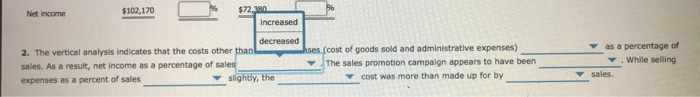

Vertical Analysis of Income Statement For 2012, TH-Comic Company initiated a sales promotion campaign that included the expenditure of an additional $17,000 for advertising. At the end of the year, Lumi Neer, the president, is presented with the following condensed comparative Income statement: Tri-Comic Company Comparative Income Statement For the Years Ended December 31, 2012 and 2041 Sales $601.000 $517.000 276.460 258,500 $324,540 $258,500 $98,230 $120,200 66,110 67,210 Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Income from operations Other income Income before income tax $186,310 $138.230 $165.440 $93,060 25,850 36,060 $174.290 Income tax expense Net income $118,910 46,530 72,120 $102,170 $72,380 Required: 1. Prepare a comparative Income statement for the two-year period, presenting an analysis of each item in relationship to sales for each of the years. Enter percentage as whole numbers. Enter all amounts as positive numbers 1. Prepare a comparative income statement for the two-year period, presenting an analysis of each item in relationship to sales for each of the years. Enter percentages as whole numbers. Enter all amounts as positive numbers TH-Comic Company Comparative Income Statement For the Years Ended December 31, 2012 and 2041 2012 Amount 2072 Percent 20Y1 Amount 20Y1 Percent Sales $601,000 $517,000 Cost of goods sold 226.460 259.500 Gross profit $324,540 $258,500 Selling expenses 120,200 98,230 67,210 Administrative expenses 66,110 Total operating expenses $186,310 $165.440 193,060 25,850 Income from operations $138,230 Other income 36,050 Income before income tax $174,290 Income tax expense 72,120 $118,910 Net income $102,170 $72,380 2. The vertical analysis indicates that the costs other than selling expenses (cost of goods sold and administrative expenses) sales. As a result, net income as a percentage of sales The sales promotion campaign appears to have been expenses as a percent of sales slightly, the cost was more than made up for by as a percentage of . While selling Income tax expense 72,120 46.530 Net income $102,170 $72.18 improved deteriorated s 2. The vertical analysis indicates that the costs other than selling expenses (cost of goods sold and administrative expenses) sales. As a result, net income as a percentage of sales The sales promotion campaign appears to have been expenses as a percent of sales slightly, the cost was more than made up for by a percentage of . While selling sales Net Income $102,170 Increased decreased 2. The vertical analysis indicates that the costs other than hses (cost of goods sold and administrative expenses) sales. As a result, net income as a percentage of sales The sales promotion campaign appears to have been expenses as a percent of sales slightly, the cost was more than made up for by as a percentage of . While selling Net Income $102,170 $72 380 successful unsuccessful 2. The vertical analysis indicates that the costs other than selling expenses (cost of goods sold and administrative expenses) sales. As a result, net income as a percentage of sales The sales promotion campaign appears to have been expenses as a percent of sales slightly, the cost was more than made up for by a percentage of While selling 2. The vertical analysis indicates sales. As a result, net income as a expenses as a percent of sales decreased other than selling expenses (cost of goods sold and administrative expenses) sales The sales promotion campaign appears to have been slightly, the cost was more than made up for by as a percentage of . While selling increased 2. The vertical analysis indicates that the costs other than selling ex decreased lof goods sold and administrative expenses) sales. As a result, net income as a percentage of sales sales promotion campaign appears to have been expenses as a percent of sales slightly, the cost was more than made up for by as a percentage of . While selling sales Income increased decreased 2. The vertical analysis indicates that the costs other than selling expenses (cost of goods sold and administrative expenses) sales. As a result, net income as a percentage of sales The sales promotion campaign appears to have expenses as a percent of sales slightly, the cost was more than made up for by as a percentage of . While selling