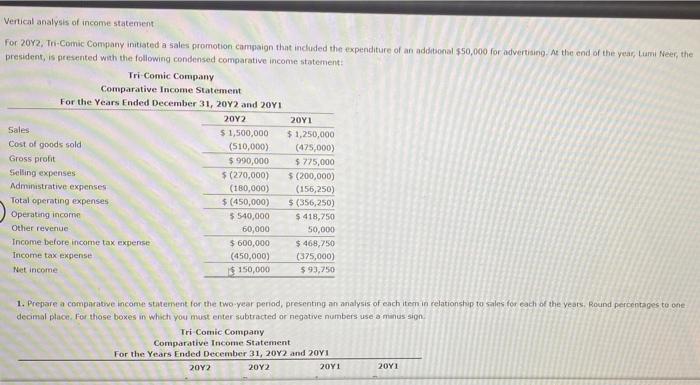

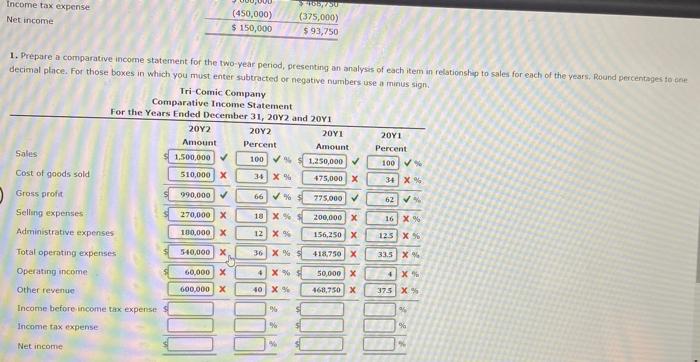

Vertical analysis of income statement For 2012, Tri-Comic Company initiated a sales promotion campaign that included the expenditure of an additional $50,000 for advertising. At the end of the year, Lumi Neer, the president, is presented with the following condensed comparative income statement Tri Comic Company Comparative Income Statement For the Years Ended December 31, 2012 and 20Y1 2012 2011 Sales $ 1,500,000 $1,250,000 Cost of goods sold (510,000) (475,000) Gross profit $ 990,000 5775,000 Selling expenses $(270,000) 5 (200,000) Administrative expenses (180,000) (156,250) Total operating expenses $ (450,000) $(356,250) Operating income 5 540,000 $ 418,750 Other revenue 60,000 50,000 Income before income tax expense $ 600,000 $ 468,750 Income tax expense (450,000) (375,000) Net income $150,000 $ 93,750 1. Prepare a comparative income statement for the two year period, presenting an analysis of each item in relationship to sales for each of the years. Round percentages to one decimal place. For those boxes in which you must enter subtracted or negative numbers use a minus sion Tri Comic Company Comparative Income Statement For the Years Ended December 31, 2012 and 2011 2012 2012 2011 2011 Income tax expense Net income (450,000) $ 150,000 SU (375,000) $ 93,750 1. Prepare a comparative income statement for the two-year period, presenting an analysis of each item in relationship to sales for each of the years. Round percentages to one decimal place. For those boxes in which you must enter subtracted or negative numbers use a minus sign Tri-Comic Company Comparative Income Statement For the Years Ended December 31, 2012 and 2041 2012 2012 2011 2011 Amount Percent Amount Percent Sales 1.500,000 100 1.250,000 100 % Cost of goods sold 510,000 X 36 X 475,000 X 34 X % Gross profit 90,00g . 66 % 775.000 62 Selling expenses 270,000 X 18 X % 200,000 X 16 X % Administrative expenses 100,000 X 12 X 156,250 X 125 X % Total operating expenses 540,000 X 36 X % 418.750 X 33.5 X % Operating income 60,000 X 4 X % 50,000 X 4 X Other revenue 600,000 X 40 X 90 468.750 X 375 X % Income before income tax expense 96 Income tax expense % Net income