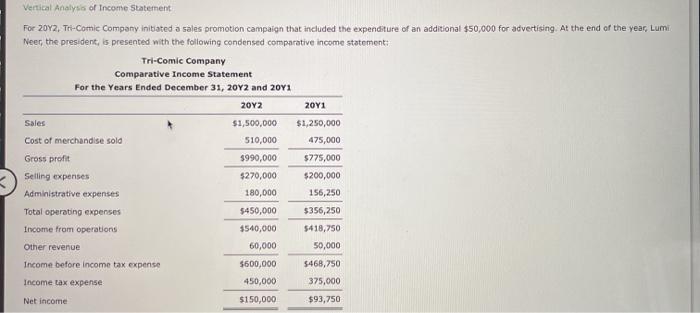

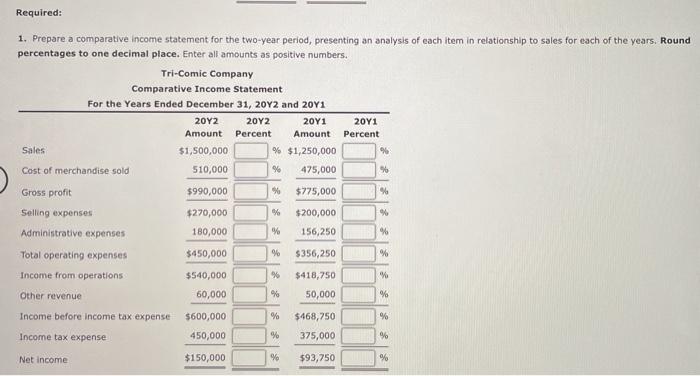

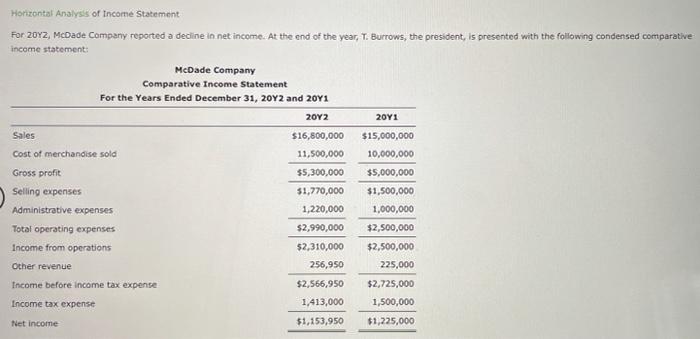

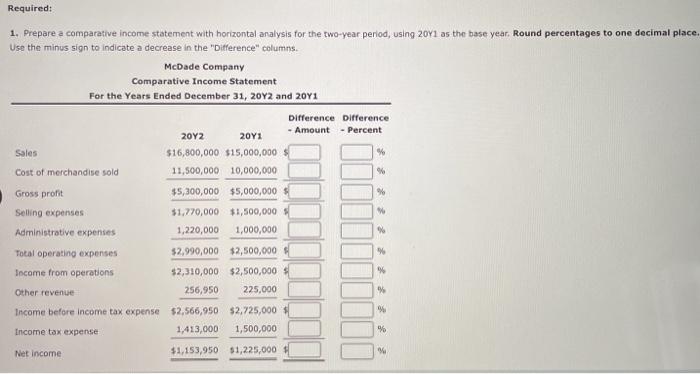

Vertical Analysis of Income Statement For 2072. Tri-Comic Company initiated a sales promotion campaign that included the expenditure of an additional $50,000 for advertising. At the end of the year, Lumi Neer, the president, is presented with the following condensed comparative income statement: Tri-Comic Company Comparative Income Statement For the Years Ended December 31, 2012 and 2041 2012 20Y1 Sales $1,500,000 $1,250,000 Cost of merchandise sold 510,000 475,000 Gross profit $990,000 $775,000 Selling expenses $270,000 $200,000 Administrative expenses 180,000 156,250 Total operating expenses $450,000 $356,250 Income from operations $540,000 5418,750 Other revenue 60,000 50,000 Income before income tax expense $600,000 5468,750 Income tax expense 450,000 375,000 Net Income $150,000 $93,750 Required: 1. Prepare a comparative income statement for the two-year period, presenting an analysis of each item in relationship to sales for each of the years. Round percentages to one decimal place. Enter all amounts as positive numbers. Tri-Comic Company Comparative Income Statement For the Years Ended December 31, 2012 and 2041 2012 2012 20Y1 2011 Amount Percent Amount Percent Sales $1,500,000 % $1,250,000 Cost of merchandise sold 510,000 % 475,000 % 9 Gross profit $990,000 % $775,000 % Selling expenses Administrative expenses $270,000 180,000 $200,000 156,250 % % $450,000 Total operating expenses % $356,250 % Income from operations 96 $540,000 60,000 $418,750 50,000 % % Other revenue % Income before income tax expense $600,000 % % $468,750 375,000 Income tax expense 450,000 % % Net income $150,000 % $93,750 % Horizontal Analysis of Income Statement For 20x2, McDade Company reported a decline in net income. At the end of the year, T. Burrows, the president, is presented with the following condensed comparative income statement: McDade Company Comparative Income Statement For the Years Ended December 31, 2012 and 20Y1 2012 2011 Sales $16,800,000 $15,000,000 Cost of merchandise sold 11,500,000 10,000,000 Gross profit $5,300,000 $5,000,000 Selling expenses $1,770,000 $1,500,000 Administrative expenses 1,220,000 1,000,000 Total operating expenses $2,990,000 $2,500,000 Income from operations $2,310,000 $2,500,000 Other revenue 256,950 225,000 Income before income tax expense $2,566,950 $2,725,000 Income tax expense 1,413,000 1,500,000 Net income $1,153,950 $1,225,000 Required: 1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 2071 as the base year. Round percentages to one decimal place Use the minus sign to indicate a decrease in the "Difference" columns McDade Company Comparative Income Statement For the Years Ended December 31, 20Y2 and 2041 Difference Difference 20Y2 Amount - Percent 2011 Sales $16,800,000 $15,000,000 % Cost of merchandise sold 11,500,000 10,000,000 Gross profit $5,300,000 $5,000,000 % Selling expenses $1,770,000 $1,500,000 Administrative expenses 1,220,000 1,000,000 Total operating expenses $2,990,000 $2,500,000 Income from operations $2,310,000 $2,500,000 Other revenue 256,950 225,000 Income before income tax expense $2,566,950 $2,725,000 Income tax expense 1,413,000 1,500,000 % Net income $1,153,950 $1,225,000