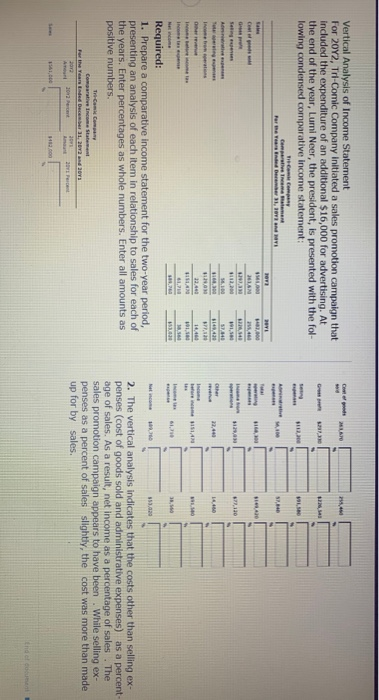

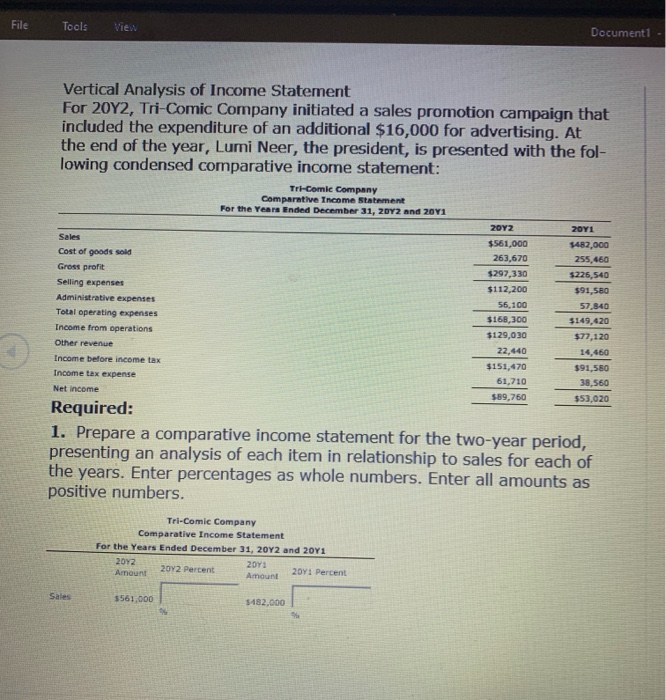

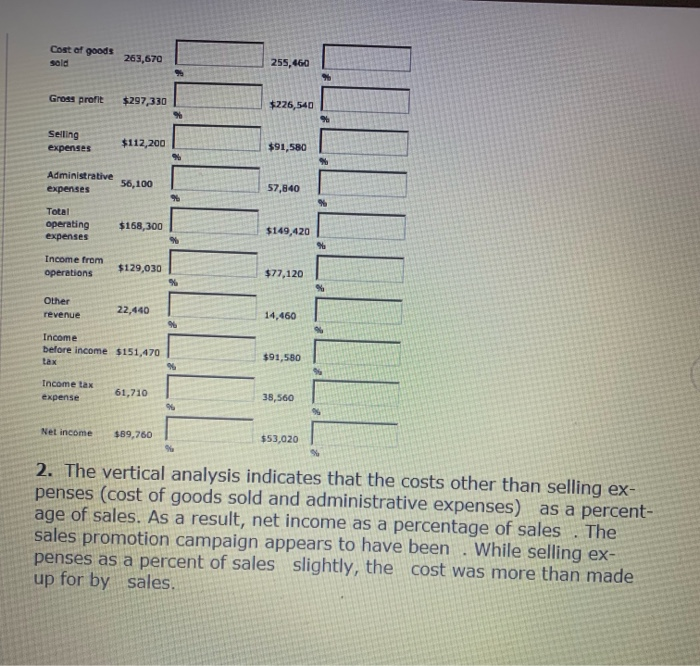

Vertical Analysis of Income Statement For 20Y2, Tri-Comic Company Initiated a sales promotion campaign that included the expenditure of an additional $16,000 for advertising. At the end of the year, Lumi Neer, the president, is presented with the fol- lowing condensed comparative Income statement: USA Comparte em man For the Year End Der 1. MY 57, 16,00 2016 113200 HAN 7130 . S4 , . HAN 14 . 151 Income . 353.020 Required: 1. Prepare a comparative income statement for the two-year period, presenting an analysis of each item in relationship to sales for each of the years. Enter percentages as whole numbers. Enter all amounts as positive numbers. 2. The vertical analysis indicates that the costs other than selling ex- penses (cost of goods sold and administrative expenses) as a percent age of sales. As a result, net income as a percentage of sales. The sales promotion campaign appears to have been. While selling ex- penses as a percent of sales slightly, the cost was more than made up for by sales. T-Com Comotive Income Statement For the Year Ended December 31, 2012 and 2013 2017 A 2011 12.000 tid File Tools Document1 - Vertical Analysis of Income Statement For 20Y2, Tri-Comic Company initiated a sales promotion campaign that included the expenditure of an additional $16,000 for advertising. At the end of the year, Lumi Neer, the president, is presented with the fol- lowing condensed comparative income statement: Tri-Comic Company Comparative Income Statement For the Year Ended December 31, 20Y2 and 2011 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Income from operations Other revenue Income before income tax Income tax expense Net income 2012 $561,000 263,670 $297,330 $112,200 56,100 $168,300 $129,030 22,440 $151,670 61,710 $89,750 2011 $482,000 255,460 $226,540 $91,580 57,840 $149,420 $77,120 14,460 $91,580 38,560 $53,020 Required: 1. Prepare a comparative income statement for the two-year period, presenting an analysis of each item in relationship to sales for each of the years. Enter percentages as whole numbers. Enter all amounts as positive numbers. Tri-Comic Company Comparative Income Statement For the Years Ended December 31, 2012 and 2011 2012 Amount 20Y: 2012 Percent 2011 Percent Amount Sales $561,000 1182.000 Cost of goods sala 263,670 255,460 Groes profit $297,330 $226,540 Selling expenses $112,200 $91,580 Administrative expenses 56,100 57,840 % Total operating expenses $168,300 $149,420 Income from operations $129,030 $77,120 % % Other revenue 22,440 14,460 Income before income $151,470 tax $91,580 IL Income tax expense 61,710 38,560 Net income $89,760 $53,020 % 2. The vertical analysis indicates that the costs other than selling ex- penses (cost of goods sold and administrative expenses) as a percent- age of sales. As a result, net income as a percentage of sales . The sales promotion campaign appears to have been . While selling ex- penses as a percent of sales slightly, the cost was more than made up for by sales