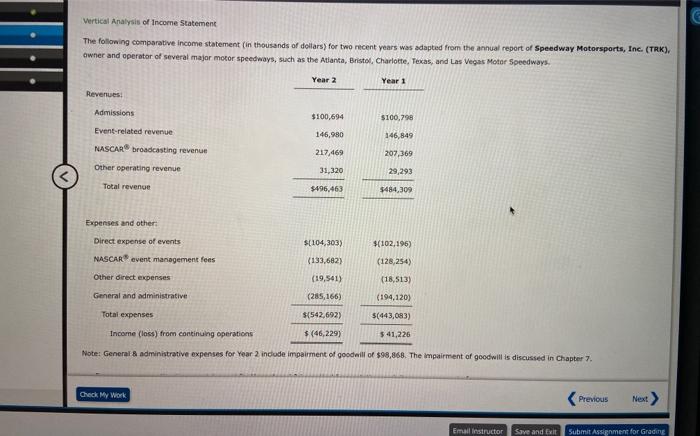

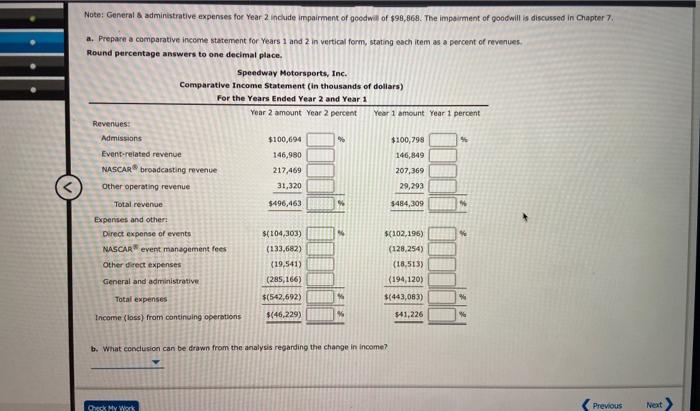

Vertical Analysis of Income Statement The following comparative Income statement (in thousands of dollars) for two recent years was adapted from the annual report of Speedway Motorsports, Inc. (TRK), owner and operator of several major motor speedways, such as the Atlanta, Bristol, Charlotte, Texas, and Las Vegas Motor Speedways Year 2 Year 1 Revenues Admissions $100,694 $100,798 Event-related revenue 146,980 146,849 NASCAR broadcasting revenue 217,469 207,369 Other operating revenue 31,320 29,293 Total revenue $496,463 $484,309 Expenses and other Direct expense of events $[104,303) $(102,196) NASCAR event management fees (133,682) (128,254) (18,513) Other direct expenses (19,541) General and administrative (285,166) (194,120) Total expenses ${542,692) $(443,083) Income (less) from continuing operations $(46,229) 5 41,226 Note: General administrative expenses for Year 2 include impairment of goodwill of $98,868. The Impairment of goodwill is discussed in Chapter 7. Check My Work Previous Next Email Instructor Save and Exit Submit Assignment for Grading Note: General administrative expenses for Year 2 include impairment of goodwill of $98,868. The impairment of goodwill is discussed in Chapter 7. a. Prepare a comparative income statement for Years 1 and 2 in vertical form, stating each item as a percent of revenues Round percentage answers to one decimal place. Speedway Motorsports, Inc. Comparative Income Statement (in thousands of dollars) For the Years Ended Year 2 and Year 1 Year 2 amount Year 2 percent Year 1 amount Year 1 percent Revenues: Admissions $100,694 $100,798 Event-related revenue 146,980 146,849 NASCAR broadcasting revenue 217.469 207,369 Other operating revenue 31,320 29,293 Total revenue $496,463 $484,309 Expenses and other Direct expense of events ${104,303) $(102,196) NASCAR event management fees (133,682) (128,254) Other direct expenses (19,541) (18,513) General and administrative (285,166) (194,120) Total expenses $(542,692) $(443,083) Income (loss) from continuing operations ${46,229) 341,226 % b. What conclusion can be drawn from the analysis regarding the change in income? Previous Next Check My Work