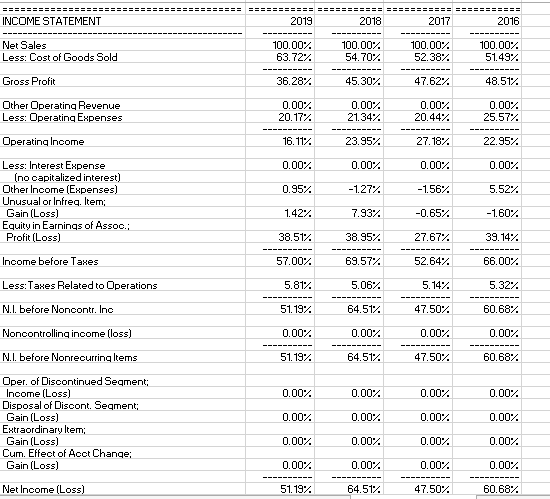

vertical i/s

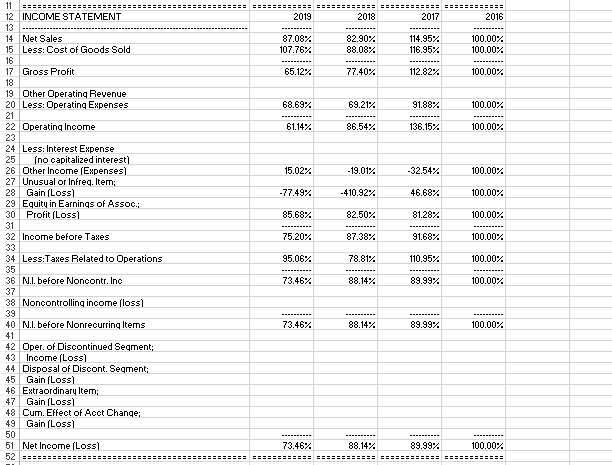

horizental i\s

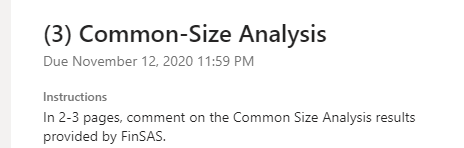

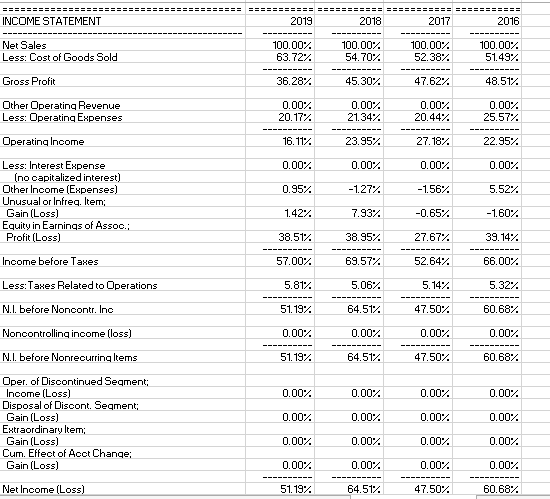

(3) Common-Size Analysis Due November 12, 2020 11:59 PM Instructions In 2-3 pages, comment on the Common Size Analysis results provided by FinSAS. INCOME STATEMENT 2019 2018 2017 2016 Net Sales Less: Cost of Goods Sold 100.00% 63.72% 100.00% 54.70%. 100.00% 52.38% 100.00% 51.49% Gross Profit 36.28% 45.30% 47.62% 48.51% Other Operating Revenue Less: Operating Expenses 0.00% 20.17% 0.00% 21.34% 0.00% 20.44% 0.00% 25.57% Operating Income 16.11% 23.95% 27.187. 22.95% 0.00% 0.00% 0.00% 0.00% 0.95% -1.27% -1.56% 5.52%. Less: Interest Expense (no capitalized interest) Other Income (Expenses) Unusual or Infreq. Item; Gain (Loss) Equity in Earnings of Assoc.; Profit (Loss) 1.42% 7.93% -0.65% -1.607 38.51% 38.95% 27.67% 39.14% Income before Taxes 57.00% 69.57% 52.64% 66.00% Less:Taxes Related to Operations 5.812 5.06% 5.14% 5.32% N.I. before Noncontr. Ino 51.192 64.517 47.50% 60.68% Noncontrolling income (loss) 0.00% 0.00% 0.00% 0.00% N.I. before Nonrecurring Items 51.19%. 64.517 47.507 60.68% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Oper. of Discontinued Segment; Income (Loss) Disposal of Discont. Segment; Gain (Loss) Extraordinary ltem; Gain (Loss) Cum. Effect of Acct Change: Gain (Loss) 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Net Income (Loss) 51. 19% 64.51% 47.50% 60.687 2019 2018 2017 2016 87.08% 107.76% 82.90% 88.08% 114.95% 116.95% 100.00% 100.00% 65.12% 77.40% 112.82% 100.00% 68.69% 69.217 91.88% 100.00% 61.14% 86.54% 136.15% 100.00% 15.02% - 19.01% -32.54% 100.00% -77.49% -410.92% 46.68% 100.00% 85.68% 82.50% 81.28% 100.00% 11 12 INCOME STATEMENT 13 14 Net Sales 15 Less: Cost of Goods Sold 16 17 Gross Profit 18 19 Other Operating Revenue 20 Less: Operating Expenses 21 22 Operating Income 23 24 Less: Interest Expense 25 (no capitalized interest 26 Other Income (Expenses 27 Unusual or Infreq. Item; 28 Gain (Lossl 29 Equity in Earnings of Assoc.; 30 Profit (Loss 31 32 Income before Taxes 33 34 Less:Taxes Related to Operations 35 36 N.I. before Noncontr. Inc 37 38 Noncontrolling income loss 39 40 N.I. before Nonrecurring Items 41 42 Oper. of Discontinued Segment; 43 Income (Loss 44 Disposal of Discont. Segment; 45 Gain (Loss 46 Extraordinary Item; 47 Gain (Loss 48 Cum. Effect of Acct Change; 49 Gain (Loss 50 51 Net Income (Loss) 52 75.20% 87.38% 91.68% 100.00% 95.06% 78.81% 110.95% 100.00% 73.46% 88.14% 89.99% 100.00% 73.46% 88.14% 89.99% 100.00% 73.46% 88.14% 89.99% 100.00%