Answered step by step

Verified Expert Solution

Question

1 Approved Answer

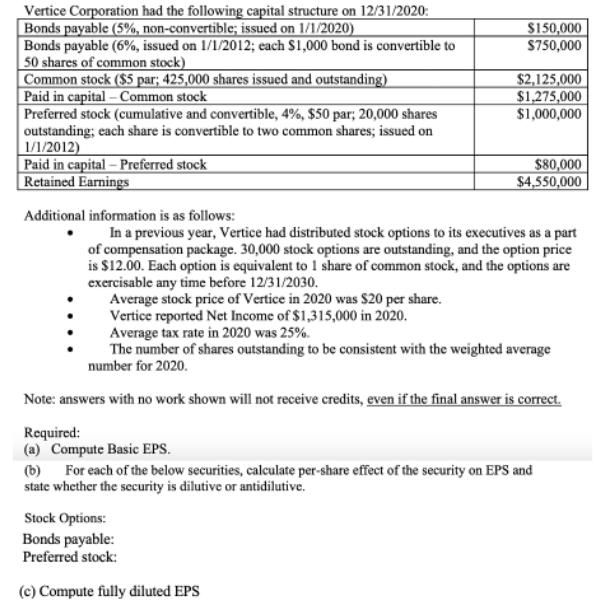

Vertice Corporation had the following capital structure on 12/31/2020: Bonds payable (5%, non-convertible; issued on 1/1/2020) Bonds payable (6%, issued on 1/1/2012; each S1,000

Vertice Corporation had the following capital structure on 12/31/2020: Bonds payable (5%, non-convertible; issued on 1/1/2020) Bonds payable (6%, issued on 1/1/2012; each S1,000 bond is convertible to 50 shares of common stock) Common stock ($5 par; 425,000 shares issued and outstanding) Paid in capital- Common stock Preferred stock (cumulative and convertible, 4%, $50 par; 20,000 shares outstanding; each share is convertible to two common shares; issued on 1/1/2012) Paid in capital Preferred stock Retained Earnings S150,000 S750,000 $2,125,000 $1,275,000 $1,000,000 $80,000 $4,550,000 Additional information is as follows: In a previous year, Vertice had distributed stock options to its executives as a part of compensation package. 30,000 stock options are outstanding, and the option price is $12.00. Each option is equivalent to 1 share of common stock, and the options are exercisable any time before 12/31/2030. Average stock price of Vertice in 2020 was $20 per share. Vertice reported Net Income of $1,315,000 in 2020. Average tax rate in 2020 was 25%. The number of shares outstanding to be consistent with the weighted average number for 2020. Note: answers with no work shown will not receive credits, even if the final answer is corect. Required: (a) Compute Basic EPS. (b) For each of the below securities, calculate per-share effect of the security on EPS and state whether the security is dilutive or antidilutive. Stock Options: Bonds payable: Preferred stock: (c) Compute fully diluted EPS

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Compute Basic EPS EPS Net Income Number of shares outstandi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started