very longg and stressfull please help

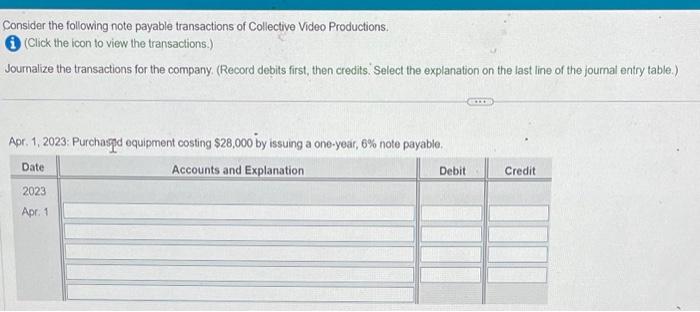

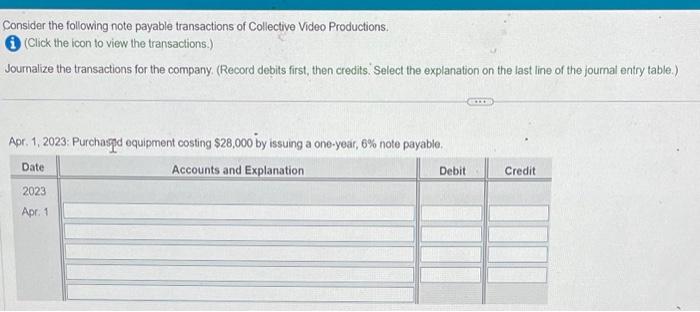

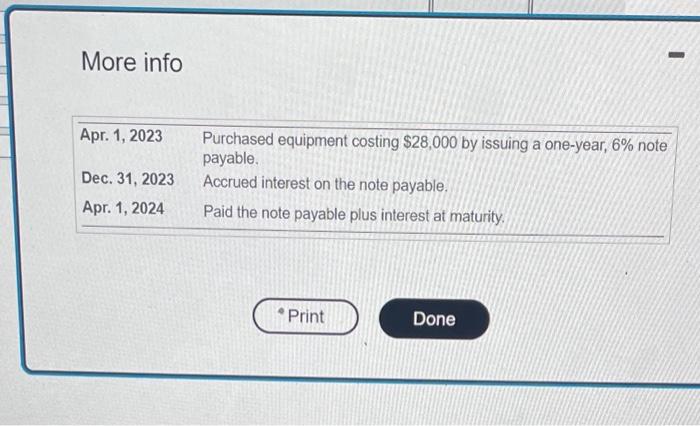

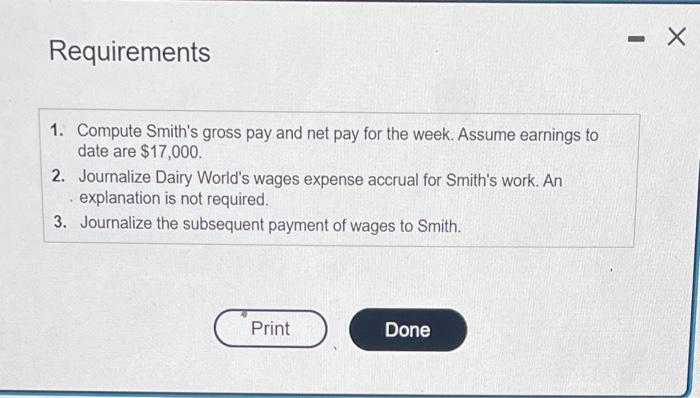

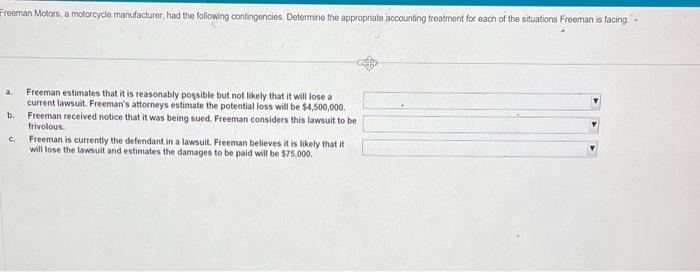

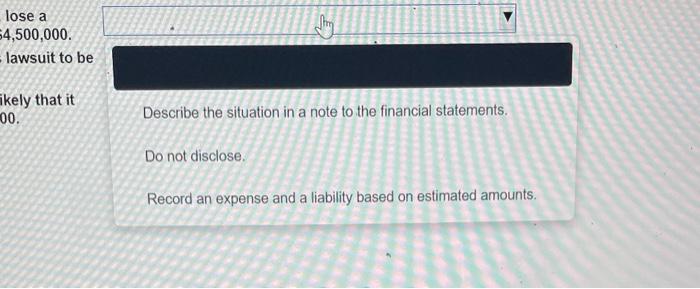

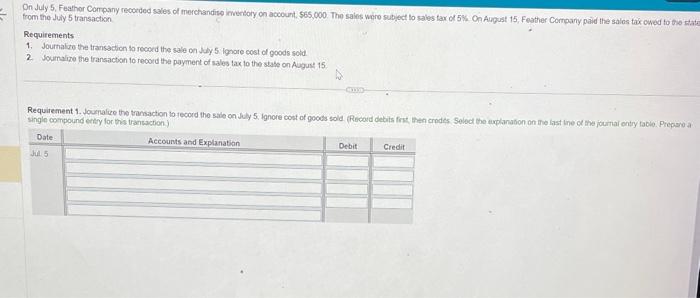

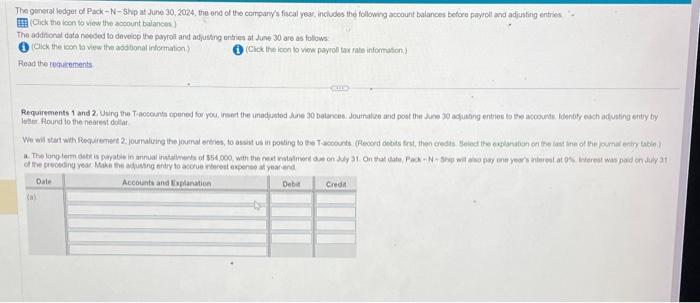

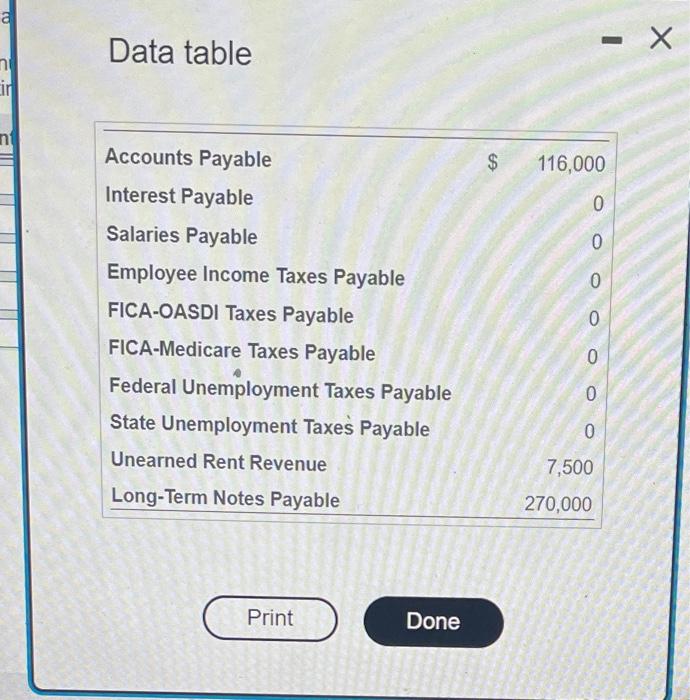

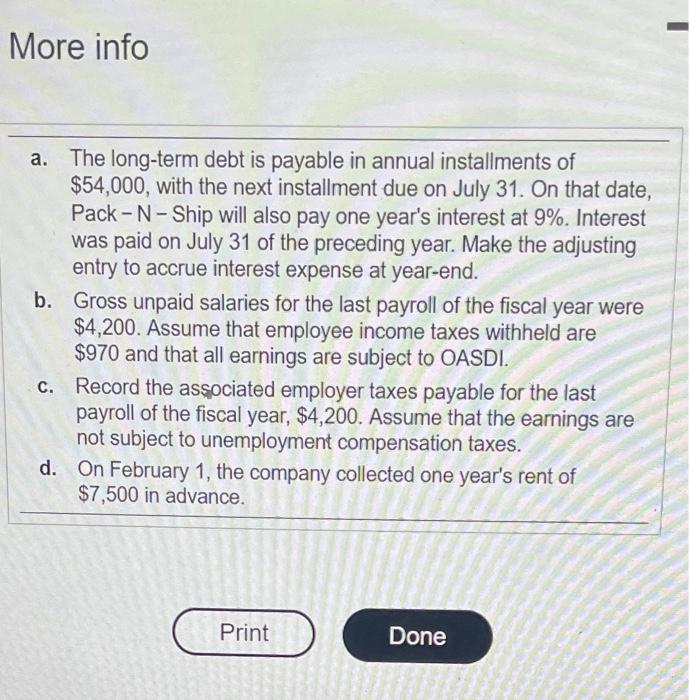

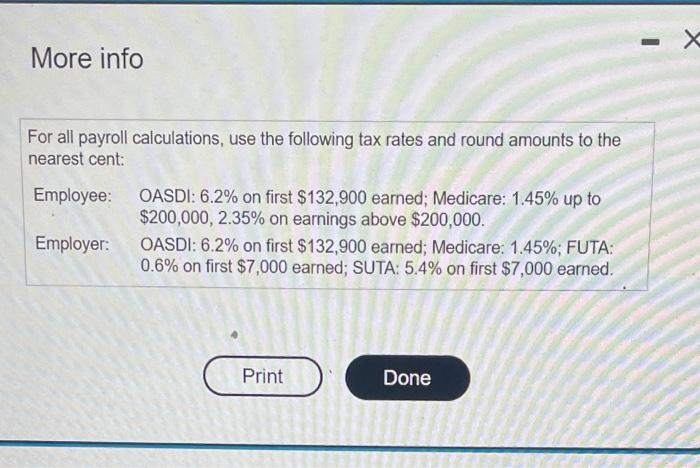

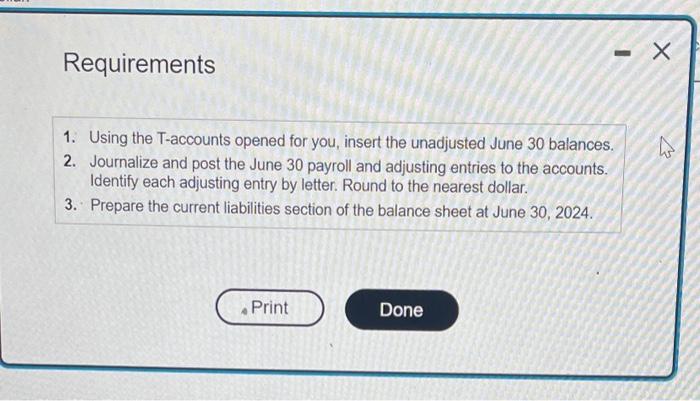

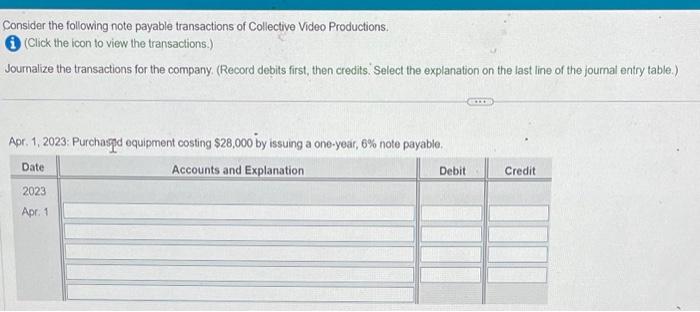

Consider the following note payable transactions of Collective Video Productions. (. (Click the icon to view the transactions.) Journalize the transactions for the company. (Record debits first, then credits. Select the explanation on the last line of the joumal entry table.) Apr. 1, 2023: Purchasfd equipment costing $28,000 by issuing a one-year, 6% note payable. More info FICA tax, and a wookly deduction of $11 for a chartable contribution to Unilod Way Smith woiked 5t hours during the wook. (i) (Cick the icon to view payrol tax rate informution) Rond the tequirements: Requirement 1. Compute Smith's goss pay and not pay for tho wook. Aswene earnings to date are 517,000 . ffound at amounts to the rieareit cont.) Bogin dy computng Smitis gross pay for the wook: Requirements 1. Compute Smith's gross pay and net pay for the week. Assume earnings to date are $17,000. 2. Journalize Dairy World's wages expense accrual for Smith's work. An explanation is not required. 3. Journalize the subsequent payment of wages to Smith. reeman Molors, a motorcyde manufacturer, had the following contingencies. Determine the appropriate accounting treatmont for each of the situations Freeman is facing a. Freeman estimates that it is reasonably possible but not likely that it will lose a current lawsuit. Freeman's attorneys estimate the potential loss will be $4,500,000. b. Freeman received notice that it was being sued. Freeman considers this lawsuit to be frivolous. c. Freeman is currently the defendant in a lawsuit. Freeman believes it is likely that it will lose the lawsuit and estimates the damages to be paid will be $75.000. losea4,500,000 lawsuit to be ikely that it 00. from the Juy 5 transaction Requirements 1. Journalive the transadion to recocd the sale on July 5 ignore cost of goods solid. 2. Sournaize the fransaction to record the payment of sales tax to the stabe on Aygust 15 . single compound enty for the trankiction) The goneral ledger of Pack-N-Ship at June 30,2024 , the ond of the company's fiscal year, inclubes the following account balances botoro payroll and adjusting entries ". (Cick the icen bo vew the acoount balances') The additional duta reseded to develop the payroil and adjusing ontries at June 30 are as follows: ( Cick the icon ta view tha addtonal irlormation) (Cick the ioon to viow payrol tax fate informason.) Read the Tequenements leber. Round lo the nearest doltar of the preobding year Make thit edusting entry to asouve nterest expeneo at year end Data table More info a. The long-term debt is payable in annual installments of $54,000, with the next installment due on July 31 . On that date, Pack N - Ship will also pay one year's interest at 9%. Interest was paid on July 31 of the preceding year. Make the adjusting entry to accrue interest expense at year-end. b. Gross unpaid salaries for the last payroll of the fiscal year were $4,200. Assume that employee income taxes withheld are $970 and that all earnings are subject to OASDI. c. Record the associated employer taxes payable for the last payroll of the fiscal year, $4,200. Assume that the earnings are not subject to unemployment compensation taxes. d. On February 1, the company collected one year's rent of $7,500 in advance. More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000,2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Requirements 1. Using the T-accounts opened for you, insert the unadjusted June 30 balances. 2. Journalize and post the June 30 payroll and adjusting entries to the accounts. Identify each adjusting entry by letter. Round to the nearest dollar. 3. Prepare the current liabilities section of the balance sheet at June 30, 2024