Answered step by step

Verified Expert Solution

Question

1 Approved Answer

very lost! please help can upvote thank you! :) 13 WACC-Book wroights and market welghts Webster Company has complled the information shown in the following

very lost! please help can upvote thank you! :)

13

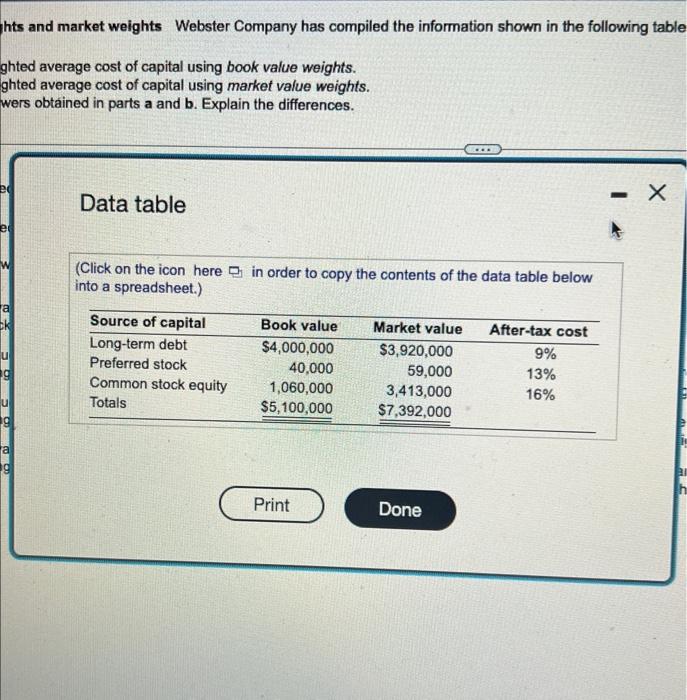

WACC-Book wroights and market welghts Webster Company has complled the information shown in the following table: a. Calculate the weighted average cost of capital using book value woights. b. Calculate the weighted average cost of capital using markot value weights. c. Compare the answers obtainod in ports a and b. Explain the diflerences. a. The firm's weighted average cost of capital using book value weights is K. (Round to two docimal places) b. The firm's weighted average cost of capital using market value weights is \%. (Round to two decimal places.) c. Compare the answers oblained in parts a and b. Explain the diflerences. (Select the bent answer below.) A. The market value appraach yiolds a higher cont of capital because the costs of the components of the capilal structure are calculated iaing the prevaling market pnices. Since the common stock is seling at a higher value than is book value, the cost of capial is much higher when using the market value weights. B. The book value appeoach yields a higher cost of capital because the costs of the componerts of the captal structure are calculated uaing the prevaling market prices. Since the comman slock is seling at a lower value than its market value, the cost of capital is much higher wher using the book value weights C. The book value approach yields a loaer cost of capital because the cost of the components of the capital structuce are caloulated using the prevaling inaket prices. Since the cormon 6. The market value approach yields a lower cost of capital because the costs of the comconerts of the cusvel structure are calculaved uning the prevaling market prices. Since the common block is solng at a lower vave than its book value, the cost of captal is much lower when using the macket value weights. hts and market weights Webster Company has compiled the information shown in the following table hhted average cost of capital using book value weights. ghted average cost of capital using market value weights. vers obtained in parts a and b. Explain the differences. Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started