Answered step by step

Verified Expert Solution

Question

1 Approved Answer

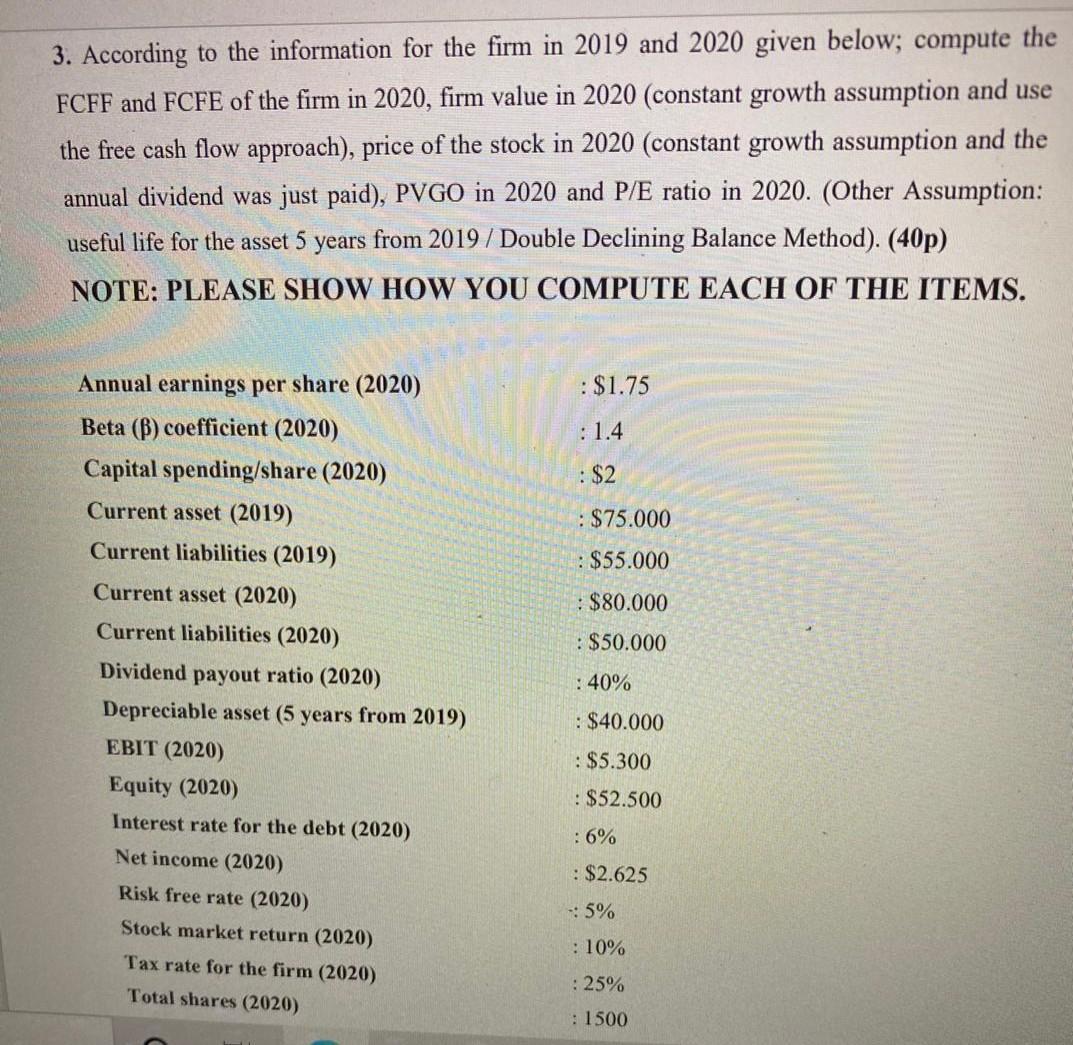

very quickly please 3. According to the information for the firm in 2019 and 2020 given below; compute the FCFF and FCFE of the firm

very quickly please

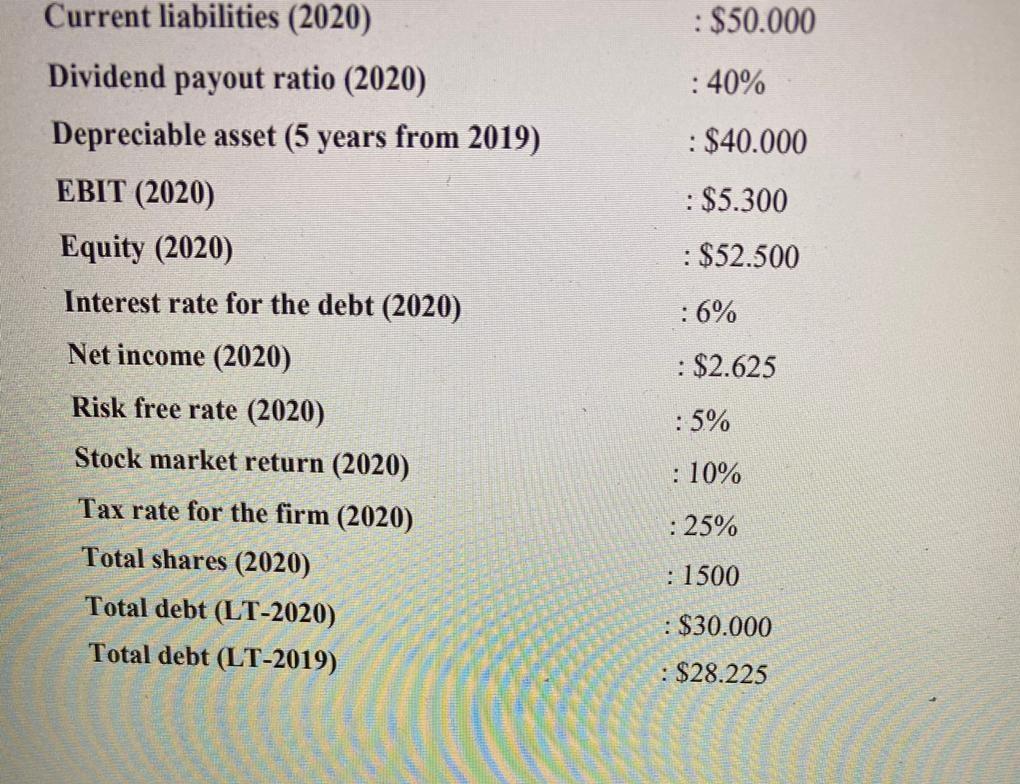

3. According to the information for the firm in 2019 and 2020 given below; compute the FCFF and FCFE of the firm in 2020, firm value in 2020 (constant growth assumption and use the free cash flow approach), price of the stock in 2020 (constant growth assumption and the annual dividend was just paid), PVGO in 2020 and P/E ratio in 2020. (Other Assumption: useful life for the asset 5 years from 2019 / Double Declining Balance Method). (40p) NOTE: PLEASE SHOW HOW YOU COMPUTE EACH OF THE ITEMS. : $1.75 : 1.4 : $2 : $75.000 : $55.000 $80.000 : $50.000 Annual earnings per share (2020) Beta () coefficient (2020) Capital spending/share (2020) Current asset (2019) Current liabilities (2019) Current asset (2020) Current liabilities (2020) Dividend payout ratio (2020) Depreciable asset (5 years from 2019) EBIT (2020) Equity (2020) Interest rate for the debt (2020) Net income (2020) Risk free rate (2020) Stock market return (2020) Tax rate for the firm (2020) Total shares (2020) : 40% : $40.000 : $5.300 : $52.500 :6% : $2.625 : 5% : 10% : 25% : 1500 : $50.000 : 40% : $40.000 : $5.300 : $52.500 :6% Current liabilities (2020) Dividend payout ratio (2020) Depreciable asset (5 years from 2019) EBIT (2020) Equity (2020) Interest rate for the debt (2020) Net income (2020) Risk free rate (2020) Stock market return (2020) Tax rate for the firm (2020) Total shares (2020) Total debt (LT-2020) Total debt (LT-2019) : $2.625 : 5% : 10% :25% : 1500 : $30.000 : $28.225Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started