Answered step by step

Verified Expert Solution

Question

1 Approved Answer

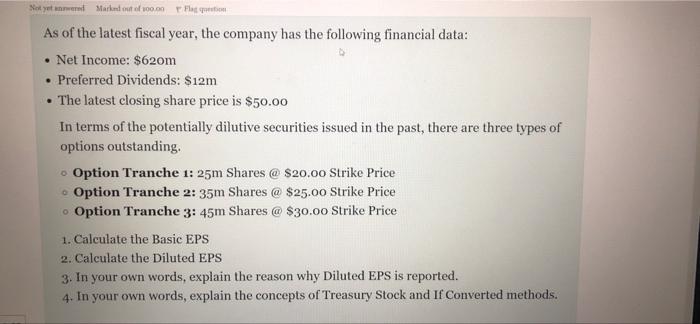

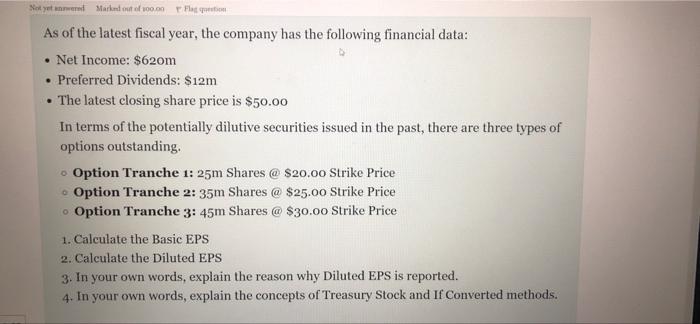

very urgent please Not yet Market of 100.00 Flat As of the latest fiscal year, the company has the following financial data: Net Income: $620m

very urgent please

Not yet Market of 100.00 Flat As of the latest fiscal year, the company has the following financial data: Net Income: $620m Preferred Dividends: $12m . The latest closing share price is $50.00 In terms of the potentially dilutive securities issued in the past, there are three types of options outstanding Option Tranche 1: 25m Shares @ $20.00 Strike Price Option Tranche 2: 35m Shares @ $25.00 Strike Price Option Tranche 3: 45m Shares @ $30.00 Strike Price 1. Calculate the Basic EPS 2. Calculate the Diluted EPS 3. In your own words, explain the reason why Diluted EPS is reported. 4. In your own words, explain the concepts of Treasury Stock and If Converted methods. Not yet Market of 100.00 Flat As of the latest fiscal year, the company has the following financial data: Net Income: $620m Preferred Dividends: $12m . The latest closing share price is $50.00 In terms of the potentially dilutive securities issued in the past, there are three types of options outstanding Option Tranche 1: 25m Shares @ $20.00 Strike Price Option Tranche 2: 35m Shares @ $25.00 Strike Price Option Tranche 3: 45m Shares @ $30.00 Strike Price 1. Calculate the Basic EPS 2. Calculate the Diluted EPS 3. In your own words, explain the reason why Diluted EPS is reported. 4. In your own words, explain the concepts of Treasury Stock and If Converted methods

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started