Answered step by step

Verified Expert Solution

Question

1 Approved Answer

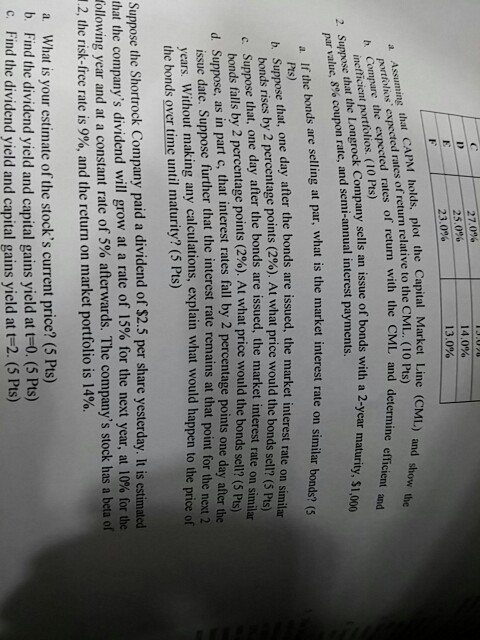

very urgent!!!! question 2 25. 0% 230% 14.0% 13.0% Capital Market Line (CML) and show the with the CML and determine efficient and s that

very urgent!!!! question 2

25. 0% 230% 14.0% 13.0% Capital Market Line (CML) and show the with the CML and determine efficient and s that CAPM holds, plot the Assuming n nded rates ofreturn relative to the CML. (10 Pts) inefticient portfolios. (10 Pts) value,8% coupon rate, and semi-annual interest payments. the expected rates of return hat the Longrock Company sells an issue of bonds with a 2-year 2 Suppose bonds are selling at par, what is the market interest rate on similar bonds? (S Pts) e that, one day after the bonds are issued, the market interest rate on similar b. Suppose bonds rises by 2 percentage points c. Suppose that, one day after the bonds are (2%). At what price would the bonds sell? (5 Pts) issued, the market interest bonds falls by 2 percentage points (2%). At what price would the b rate on similar d. Suppose, as in part c, that interest rates fall by 2 percentage points one day after the onds sell?( iss years. Without making any calculations, explai the bonds over time until maturity? (5 Pts) ue date. Suppose further that the interest rate remains at that point for the ne 5 Pts) what would happen to the price Suppose the Shortrock Company paid a dividend of $2.5 per share yesterday. It is estimated that the company's dividend will grow at a rate of 15% for the next year, at 10% for the following year and at a constant rate of 5% afterwards. The company's stock has ab 12, the risk-free rate is 9%, and the return on market portfolio is 14%. a. What is your estimate of the stock's current price? (5 Pts) b. Find the dividend yield and capital gains yield at t-0. (5 Pts) c. Find the dividend yield and capital gains yield at t-2. (5 Pts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started