Answered step by step

Verified Expert Solution

Question

1 Approved Answer

very very urgent Question 2 (10 points) A company develops innovative inventory management solutions and has two investment centre divisions, Division 1 and Division 2.

very very urgent

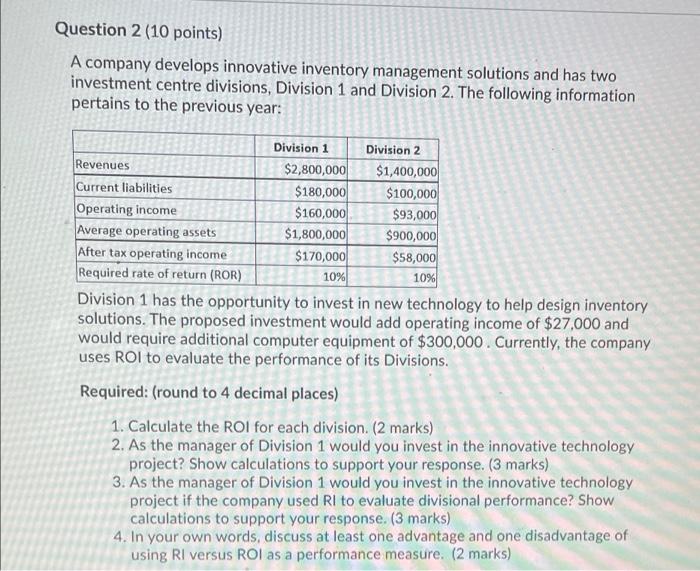

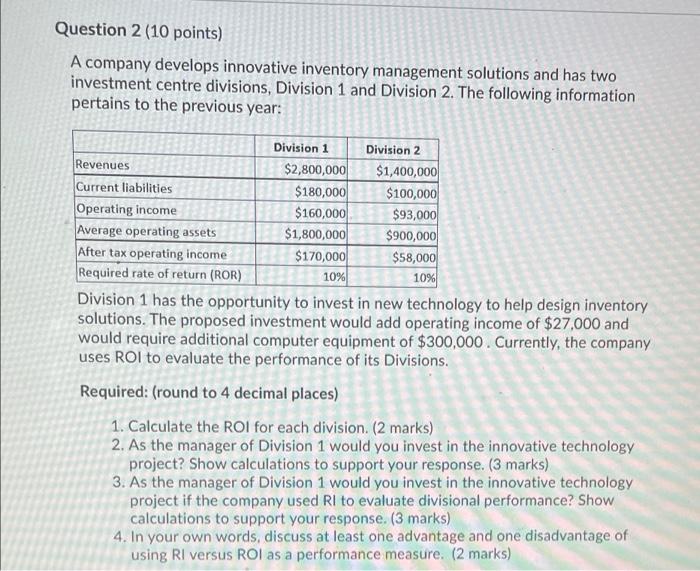

Question 2 (10 points) A company develops innovative inventory management solutions and has two investment centre divisions, Division 1 and Division 2. The following information pertains to the previous year: Division 1 Division 2 Revenues $2,800,000 $1,400,000 Current liabilities $180,000 $100,000 Operating income $160,000 $93,000 Average operating assets $1,800,000 $900,000 After tax operating income $170,000 $58,000 Required rate of return (ROR) 10% 10% Division 1 has the opportunity to invest in new technology to help design inventory solutions. The proposed investment would add operating income of $27,000 and would require additional computer equipment of $300,000. Currently, the company uses ROI to evaluate the performance of its Divisions. Required: (round to 4 decimal places) 1. Calculate the ROI for each division. (2 marks) 2. As the manager of Division 1 would you invest in the innovative technology project? Show calculations to support your response. (3 marks) 3. As the manager of Division 1 would you invest in the innovative technology project if the company used RI to evaluate divisional performance? Show calculations to support your response. (3 marks) 4. In your own words, discuss at least one advantage and one disadvantage of using RI versus ROI as a performance measure. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started