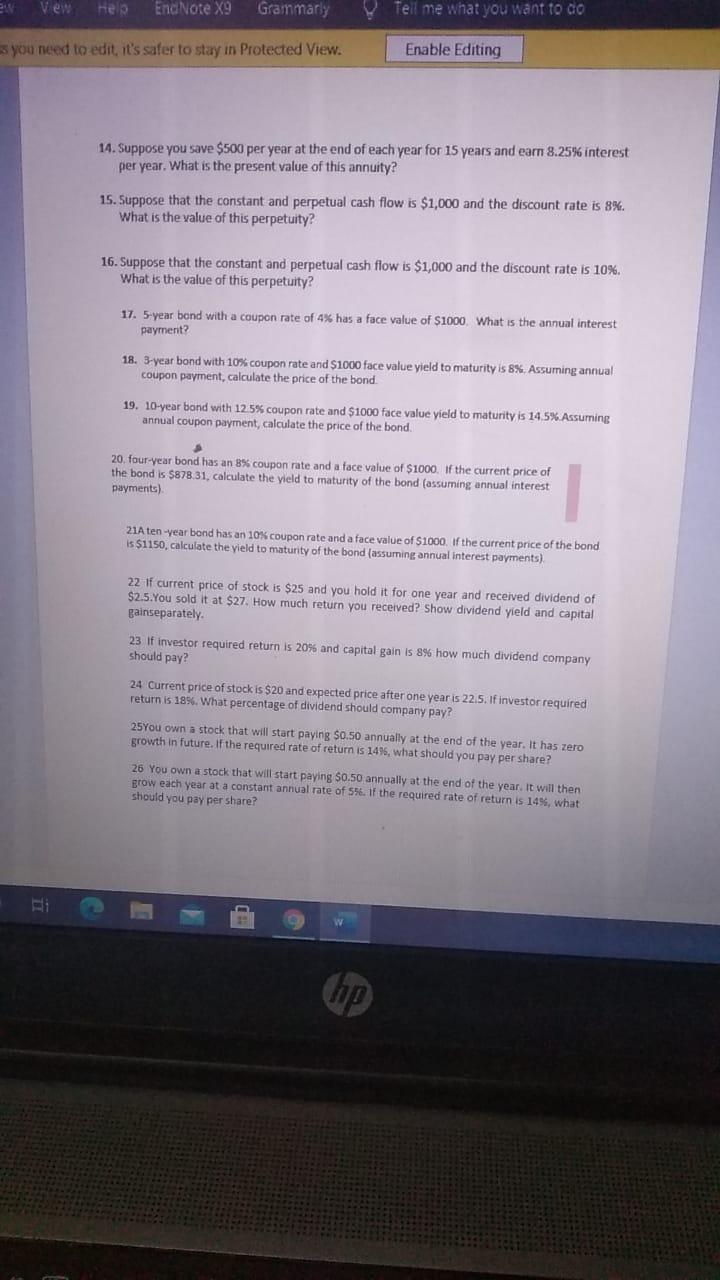

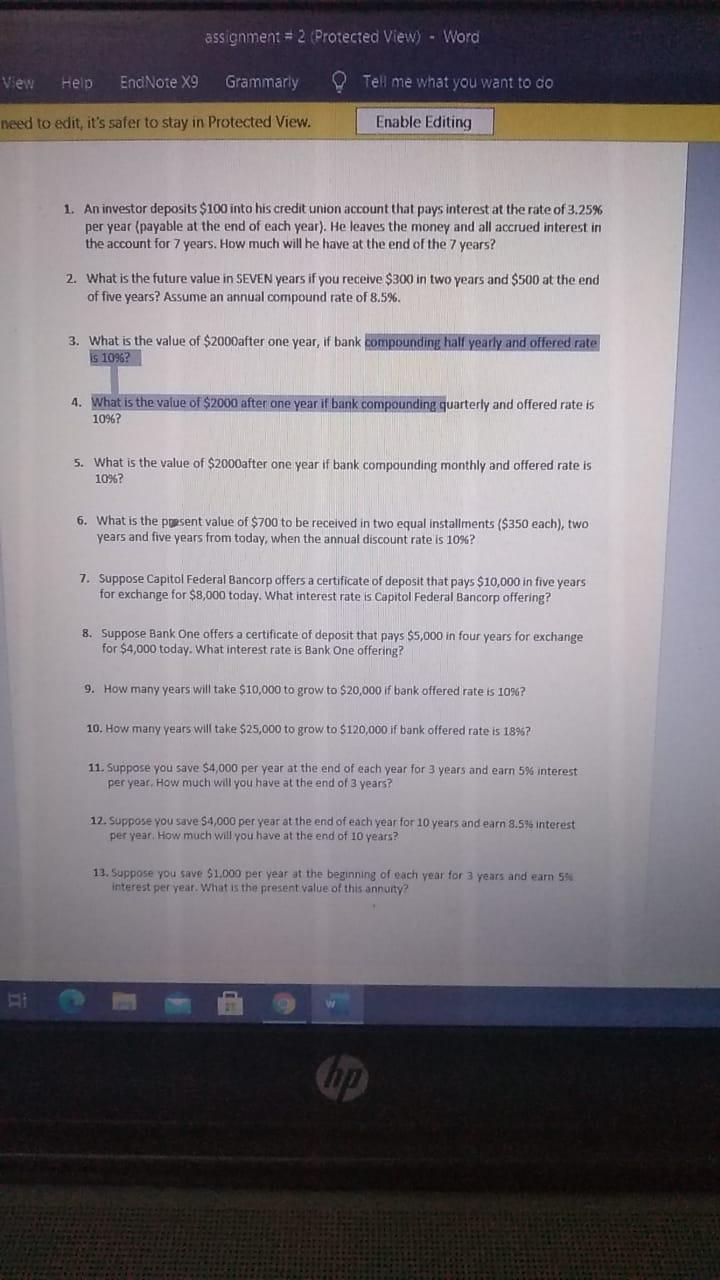

Vew Hels EndNote X9 Grammarly Tell me what you want to do s you need to edit, it's safer to stay in Protected View. Enable Editing 14. Suppose you save $500 per year at the end of each year for 15 years and earn 8.25% interest per year. What is the present value of this annuity? 15. Suppose that the constant and perpetual cash flow is $1,000 and the discount rate is 8%. What is the value of this perpetuity? 16. Suppose that the constant and perpetual cash flow is $1,000 and the discount rate is 10%. What is the value of this perpetuity? 17. 5-year bond with a coupon rate of 4% has a face value of $1000. What is the annual interest payment? 18. 3-year bond with 10% coupon rate and $1000 face value yield to maturity is 8%. Assuming annual coupon payment, calculate the price of the bond. 19. 10-year bond with 12.5% coupon rate and $1000 face value yield to maturity is 14.5%. Assuming annual coupon payment, calculate the price of the bond. 20. four-year bond has an 8% coupon rate and a face value of $1000. If the current price of the bond is $878.31, calculate the yield to maturity of the bond (assuming annual interest payments) 21A ten year bond has an 10% coupon rate and a face value of $1000, if the current price of the bond is $1150, calculate the yield to maturity of the bond (assuming annual interest payments) 22 If current price of stock is $25 and you hold it for one year and received dividend of $2.5.You sold it at $27. How much return you received? Show dividend yield and capital gainseparately. 23 If investor required return is 20% and capital gain is 8% how much dividend company should pay? 24 Current price of stock is $20 and expected price after one year is 22.5. If investor required return is 1896. What percentage of dividend should company pay? 25You own a stock that will start paying $0.50 annually at the end of the year. It has zero growth in future. If the required rate of return is 14%, what should you pay per share? 26 You own a stock that will start paying $0.50 annually at the end of the year. It will then grow each year at a constant annual rate of 55. If the required rate of return is 14%, what should you pay per share? Ap assignment= 2 Protected View) - Word View Help EndNote X9 Grammarly Tell me what you want to do need to edit, it's safer to stay in Protected View. Enable Editing 1. An investor deposits $100 into his credit union account that pays interest at the rate of 3.25% per year (payable at the end of each year). He leaves the money and all accrued interest in the account for 7 years. How much will he have at the end of the 7 years? 2. What is the future value in SEVEN years if you receive $300 in two years and $500 at the end of five years? Assume an annual compound rate of 8.5%. 3. What is the value of $2000 after one year, if bank compounding half yearly and offered rate is 1096? 4. What is the value of $2000 after one year if bank compounding quarterly and offered rate is 1096? What is the value of $2000after one year if bank compounding monthly and offered rate is 1096? 6. What is the present value of $700 to be received in two equal installments ($350 each), two years and five years from today, when the annual discount rate is 10%? 7. Suppose Capitol Federal Bancorp offers a certificate of deposit that pays $10,000 in five years for exchange for $8,000 today. What interest rate is Capitol Federal Bancorp offering? 8. Suppose Bank One offers a certificate of deposit that pays $5,000 in four years for exchange for $4,000 today. What interest rate is Bank One offering? 9. How many years will take $10,000 to grow to $20,000 if bank offered rate is 10%? 10. How many years will take $25,000 to grow to $120,000 if bank offered rate is 18967 11. Suppose you save $4,000 per year at the end of each year for 3 years and earn 5% interest per year. How much will you have at the end of 3 years? 12. Suppose you save $4,000 per year at the end of each year for 10 years and earn 8.5% interest per year. How much will you have at the end of 10 years? 13. Suppose you save $1,000 ear at the beginning of each year for 3 years and earn 5 interest per year. What is the present value of this annuity