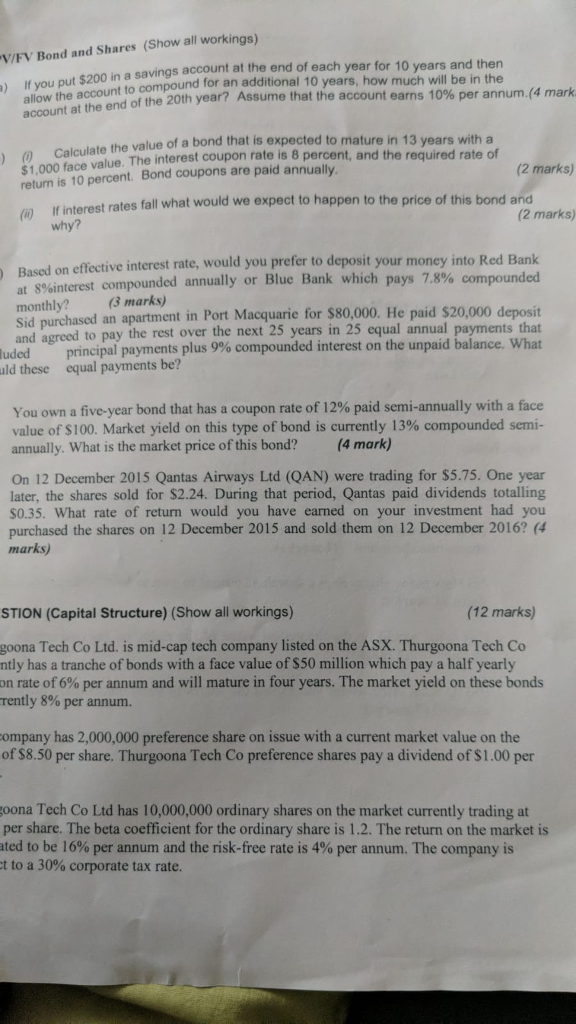

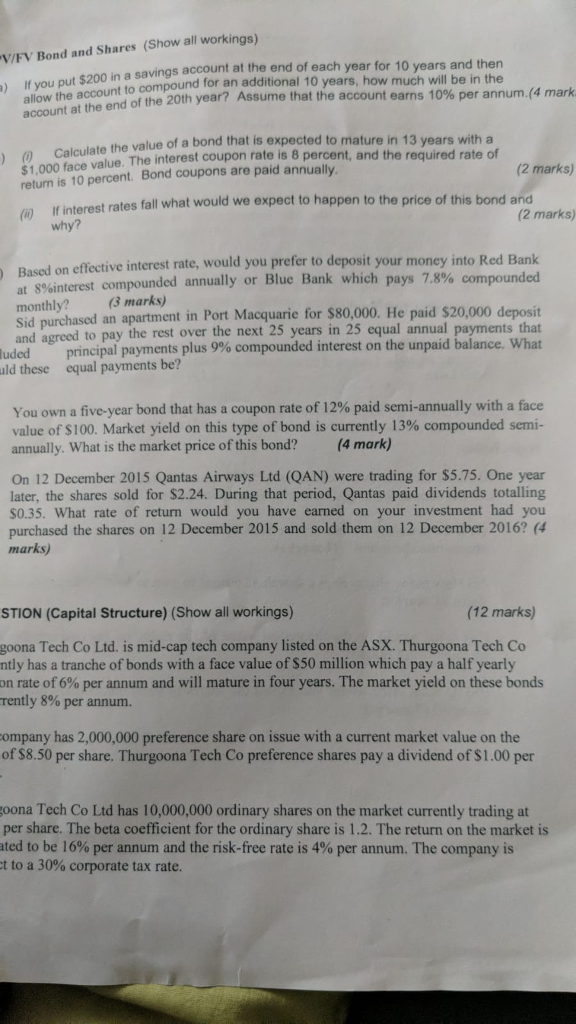

V/FV Bond and Shares (Show all workings) ) If you put $200 in a savings account at the end of each year for 10 years and then allow the account to compound for an additional 10 account at the end of the 20th year? Assume that the account earns 1 years, how much will be in the 0% per annum. (4 mark bond that is expected to mature in 13 years with a Calculate the value of a The interest coupon rate is 8 percent, and the required rate of retum is 10 percent. Bond coupons are paid annually (2 marks) rest rates fall what would we expect to happen to the price of this bond and If inte why? (2 marks) Based on effective interest rate, would you prefer to deposit your money into Red Bank at 8%interes monthly? (3 marks) Sid purchased and agreed to pay the rest over the next 25 years in 25 equal annual payments that t compounded annually or Blue Bank which pays 7.8% compounded an apartment in Port Macquarie for $80,000. He paid $20,000 deposit interest on the unpaid balance. What luded principal payments plus 9% compounded uld these equal payments be? You own a five-year bond that has a coupon rate of 12% paid semi-annually with a face value of S100. Market yield on this type of bond is currently 13% compounded semi- annually. What is the market price of this bond? (4 mark) On 12 December 2015 Qantas Airways Ltd (QAN) were trading for $5.75. One year later, the shares sold for $2.24. During that period, Qantas paid dividends totalling S0.35. What rate of return would you have earned on your investment had you purchased the shares on 12 December 2015 and sold them on 12 December 2016? (4 mar STION (Capital Structure) (Show all workings) (12 marks) goona Tech Co Ltd. is mid-cap tech company listed on the ASX. Thurgoona Tech Co ntly has a tranche of bonds with a face value of $50 million which pay a half yearly on rate of 6% per annum and will mature in four years. The market yield on these bonds rently 8% per annum. ompany has 2,000,000 preference share on issue with a current market value on the of $8.50 per share. Thurgoona Tech Co preference shares pay a dividend of $1.00 per oona Tech Co Ltd has 10,000,000 ordinary shares on the market currently trading at per share. The beta coefficient for the ordinary share is 1.2. The return on the market is ted to be 16% per annum and the risk-free rate is 4% per annum. The company is t to a 30% corporate tax rate