Answered step by step

Verified Expert Solution

Question

1 Approved Answer

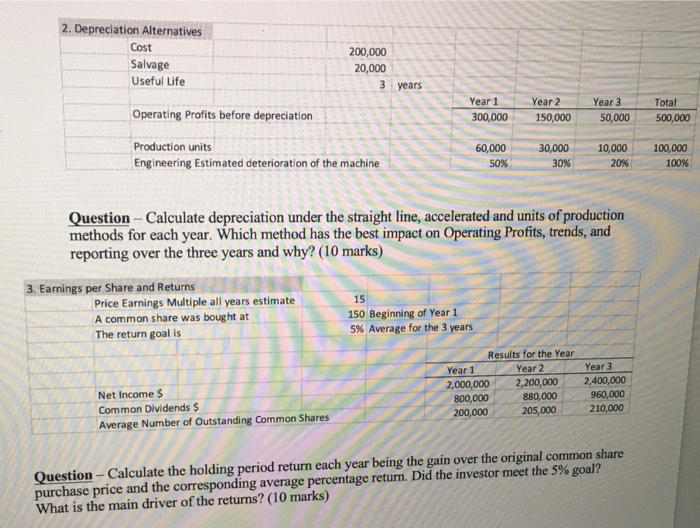

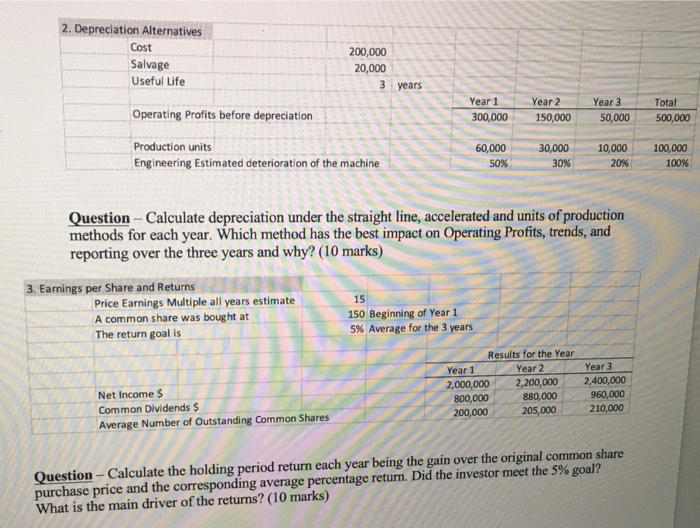

vgggggh 2. Depreciation Alternatives Cost Salvage Useful Life Operating Profits before depreciation Production units Engineering Estimated deterioration of the machine 3. Earnings per Share and

vgggggh

2. Depreciation Alternatives Cost Salvage Useful Life Operating Profits before depreciation Production units Engineering Estimated deterioration of the machine 3. Earnings per Share and Returns 200,000 20,000 Price Earnings Multiple all years estimate A common share was bought at The return goal is 3 years Net Income $ Common Dividends $ Average Number of Outstanding Common Shares Year 1 300,000 60,000 50% 15 150 Beginning of Year 1 5% Average for the 3 years Year 2 150,000 Question Calculate depreciation under the straight line, accelerated and units of production methods for each year. Which method has the best impact on Operating Profits, trends, and reporting over the three years and why? (10 marks) Year 1 2,000,000 800,000 200,000 30,000 30% Results for the Year Year 2 2,200,000 880,000 205,000 Year 3 50,000 10,000 20% Year 3 2,400,000 960,000 210,000 Question - Calculate the holding period return each year being the gain over the original common share purchase price and the corresponding average percentage return. Did the investor meet the 5% goal? What is the main driver of the returns? (10 marks) Total 500,000 100,000 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started