Answered step by step

Verified Expert Solution

Question

1 Approved Answer

VI . Accounting Principles and Assumptions. Answer the following questions. Identify the accounting principles or assumptions that are applied, and briefly explain. ( 6 %

VI Accounting Principles and Assumptions. Answer the following questions. Identify the

accounting principles or assumptions that are applied, and briefly explain.

On December Spring, a sole trader, extended an offer of $ for land that had been

priced for sale at $ Two weeks later, Spring accepted the seller's counteroffer of

$ On December the land was assessed at a value of $ for property tax

purposes. On December a national retail chain offered Spring $ for the land. At

what value should the land be recorded in Spring's accounting records?

On December Summer plc signed a $ contract with a client to provide

legal services in the following year. In which year should the legal fees revenue be recorded?

IV Adjusting accounts.

For the year ending December Autumn Co mistakenly omitted adjusting entries for $

of unearned revenue that was earned, earned revenue of $ that was not billed, and accrued

wages of $ Indicate the combined effect of the errors on a revenues, b expenses, and c net

income for the year ended December

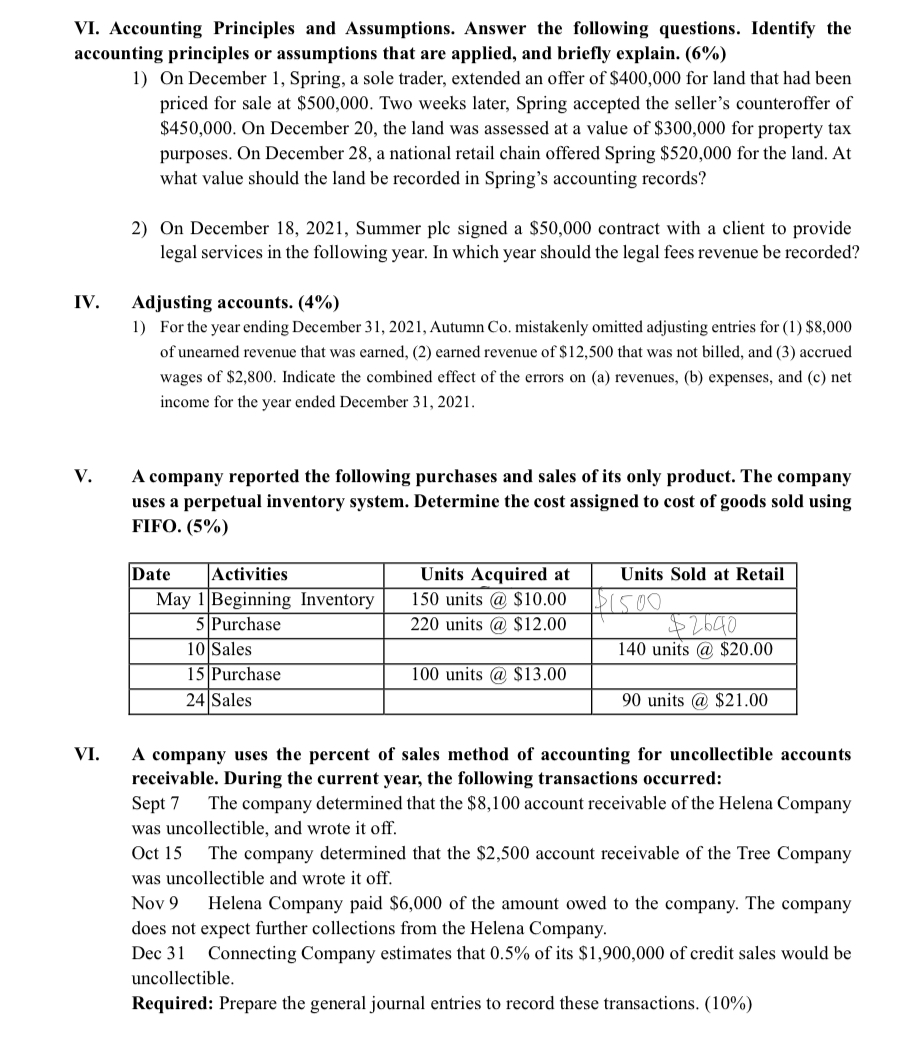

V A company reported the following purchases and sales of its only product. The company

uses a perpetual inventory system. Determine the cost assigned to cost of goods sold using

FIFO.

VI A company uses the percent of sales method of accounting for uncollectible accounts

receivable. During the current year, the following transactions occurred:

Sept The company determined that the $ account receivable of the Helena Company

was uncollectible, and wrote it off.

Oct The company determined that the $ account receivable of the Tree Company

was uncollectible and wrote it off.

Nov Helena Company paid $ of the amount owed to the company. The company

does not expect further collections from the Helena Company.

Dec Connecting Company estimates that of its $ of credit sales would be

uncollectible.

Required: Prepare the general journal entries to record these transactions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started