Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Viable Enterprises, Inc. is seeking to float a new bond to pay for an expansion of the firm into the Midwest. However, some directors fear

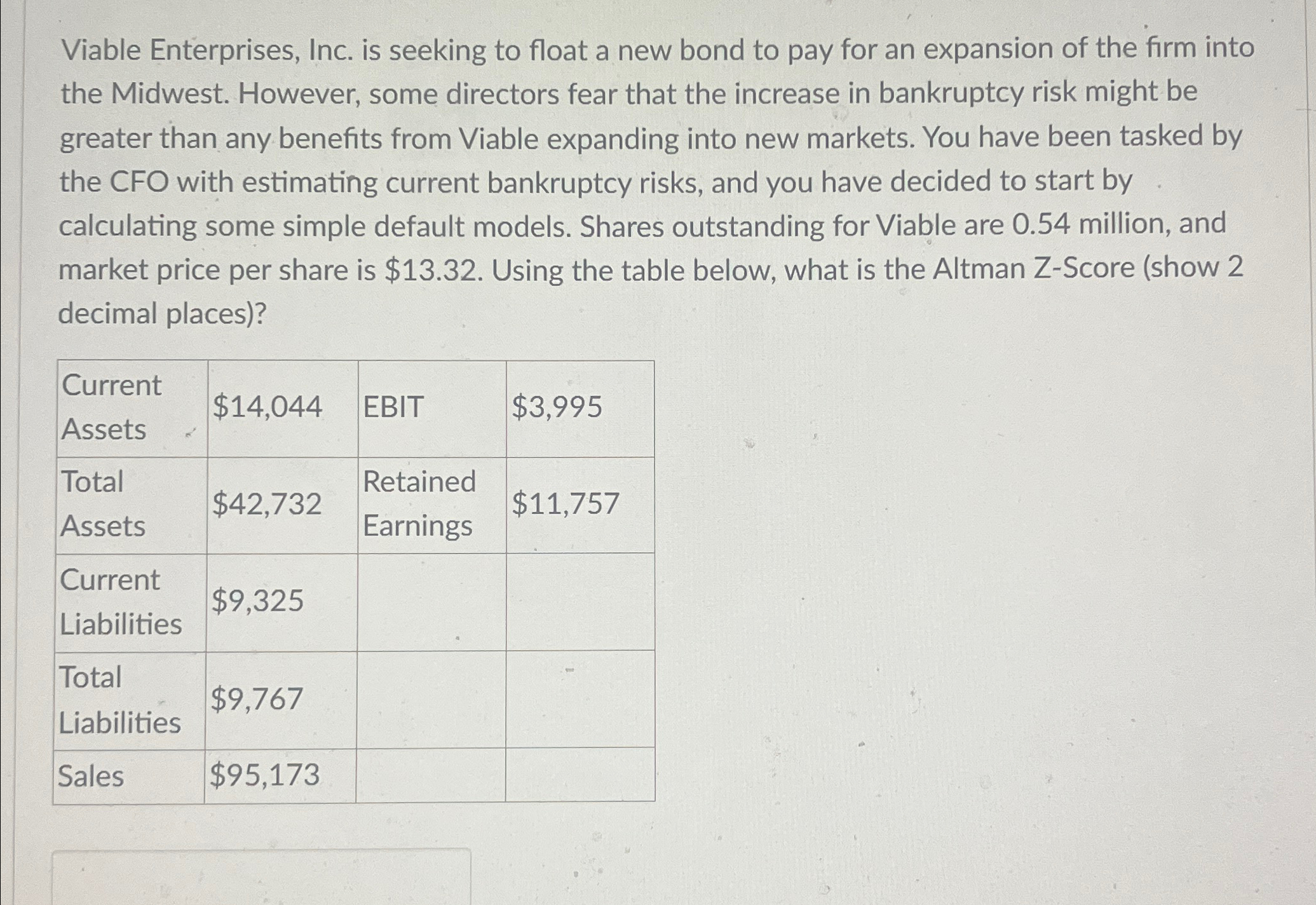

Viable Enterprises, Inc. is seeking to float a new bond to pay for an expansion of the firm into the Midwest. However, some directors fear that the increase in bankruptcy risk might be greater than any benefits from Viable expanding into new markets. You have been tasked by the CFO with estimating current bankruptcy risks, and you have decided to start by calculating some simple default models. Shares outstanding for Viable are million, and market price per share is $ Using the table below, what is the Altman ZScore show decimal places

tabletableCurrentAssets$EBIT,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started