The following are selected transactions for Medley Company for the year 2020. Jan. 1 Issued 60,000 shares of $4 par value common stock for

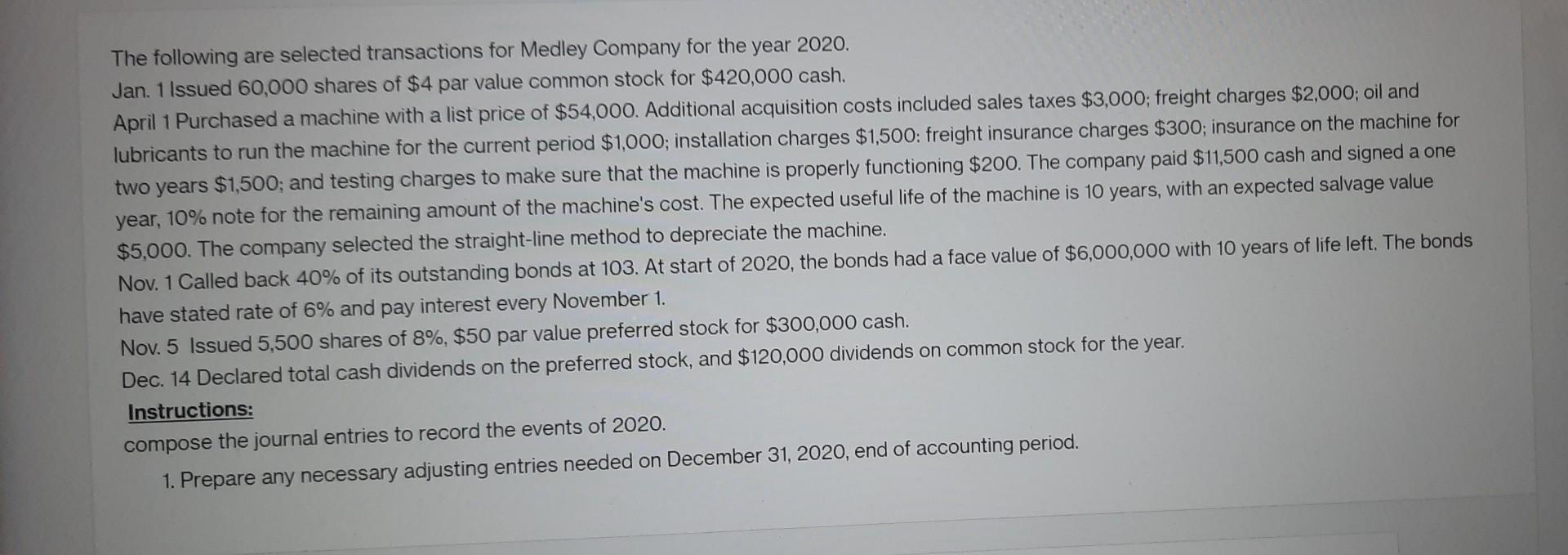

The following are selected transactions for Medley Company for the year 2020. Jan. 1 Issued 60,000 shares of $4 par value common stock for $420,000 cash. April 1 Purchased a machine with a list price of $54,000. Additional acquisition costs included sales taxes $3,000; freight charges $2,000; oil and lubricants to run the machine for the current period $1,000; installation charges $1,500: freight insurance charges $300; insurance on the machine for two years $1,500; and testing charges to make sure that the machine is properly functioning $200. The company paid $11,500 cash and signed a one year, 10% note for the remaining amount of the machine's cost. The expected useful life of the machine is 10 years, with an expected salvage value $5,000. The company selected the straight-line method to depreciate the machine. Nov. 1 Called back 40% of its outstanding bonds at 103. At start of 2020, the bonds had a face value of $6,000,000 with 10 years of life left. The bonds have stated rate of 6% and pay interest every November 1. Nov. 5 Issued 5,500 shares of 8%, $50 par value preferred stock for $300,000 cash. Dec. 14 Declared total cash dividends on the preferred stock, and $120,000 dividends on common stock for the year. Instructions: compose the journal entries to record the events of 2020. 1. Prepare any necessary adjusting entries needed on December 31, 2020, end of accounting period.

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Adjusting entry for depreciation on mac... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards