Question

Victor and Maria have decided to increase their contribution to their investment portfolio since Victor is now age 59 and thinking about retiring in five

Victor and Maria have decided to increase their contribution to their investment portfolio since Victor is now age 59 and thinking about retiring in five years. For years, they have followed a moderate-risk investment philosophy and put their money in suitable stocks, bonds, and mutual funds. The value of their portfolio is now $420,000, and this is in addition to their paid-for rental property, which is worth $300,000. They plan to invest about $8,000 every year for the next five years.

(a) Why should Victor and Maria consider buying common stock as an investment with the additional money? Why or why not?

(b) If Victor and Maria bought a stock with a market price of $50 and a beta value of 1.8, what would be the likely price of an $8,000 investment after one year if the general market for stocks rose 6 percent?

(c) What would the same investment be worth if the general market for stocks dropped 8 percent?

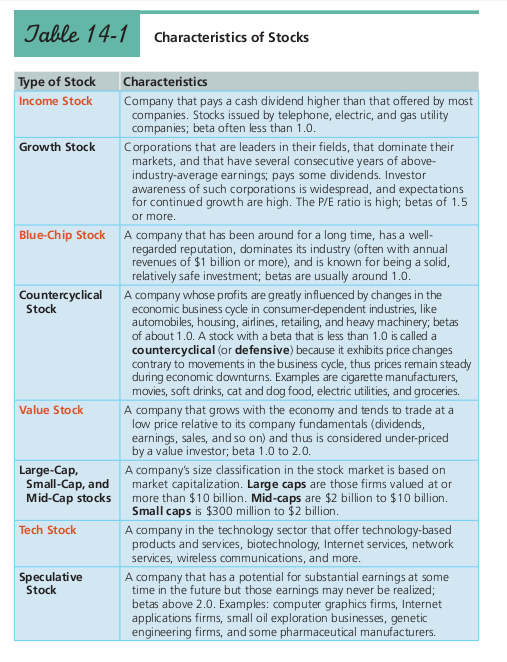

(d) Review the types of stocks in Table 14-1 on page 428 and select two that you think Victor and Maria might prefer as investments. Explain why.

(e) Discuss the positives and negatives of preferred stock for Victor and Maria.

Jable 14-1 Characteristics of Stocks Type of Stock Income Stock Characteristics Company that pays a cash dividend higher than that offered by most companies. Stocks issued by telephone, electric, and gas utility companies; beta often less than 1.0 Growth Stock Corporations that are leaders in their fields, that dominate their markets, and that have several consecutive years of above- industry- awareness of such corporations is widespread, and expectations for continued growth are high. The P/E ratio is high; betas of 1.5 or more average earnings; pays some dividends. In vestor Blue-Chip Stock A company that has been around for a long time, has a well regarded reputation, dominates its industry (often with annual revenues of $1 billion or more), and is known for being a solid relatively safe investment; betas are usually around 1.0 Countercyclical A company whose profits are greatly influenced by changes in the economic business cycle in consumer-dependent industries, like automobiles, housing, airlines, retailing, and heavy machinery, betas of about 1.0. A stock with a beta that is less than 1.0 is called a countercyclical (or defensive) because it exhibits price changes contrary to movements in the business cycle, thus prices remain steady during economic downturns. Examples are cigarette manufacturers, movies, soft drinks, cat and dog food, electric utilities, and groceries. Stock Value Stock A company that grows with the economy and tends to trade at a low price relative to its company fundamentals (dividends, earnings, sales, and so on) and thus is considered under-priced by a value investor; beta 1.0 to 2.0 Large-Cap, A company's size classification in the stock market is based on Small-Cap, and Mid-Cap stocks market capitalization. Large caps are those firms valued at or more than $10 billion. Mid-caps are $2 billion to $10 billion Small caps is $300 million to $2 billion Tech Stock A company in the technology sector that offer technology-based products and services, biotechnology, Internet services, network services, wireless communications, and more Speculative A company that has a potential for substantial earnings at some time in the future but those earnings may never be realized betas above 2.0. Examples: computer graphics firms, Internet applications firms, small oil exploration businesses, genetic engineering firms, and some pharmaceutical manufacturers. Stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started