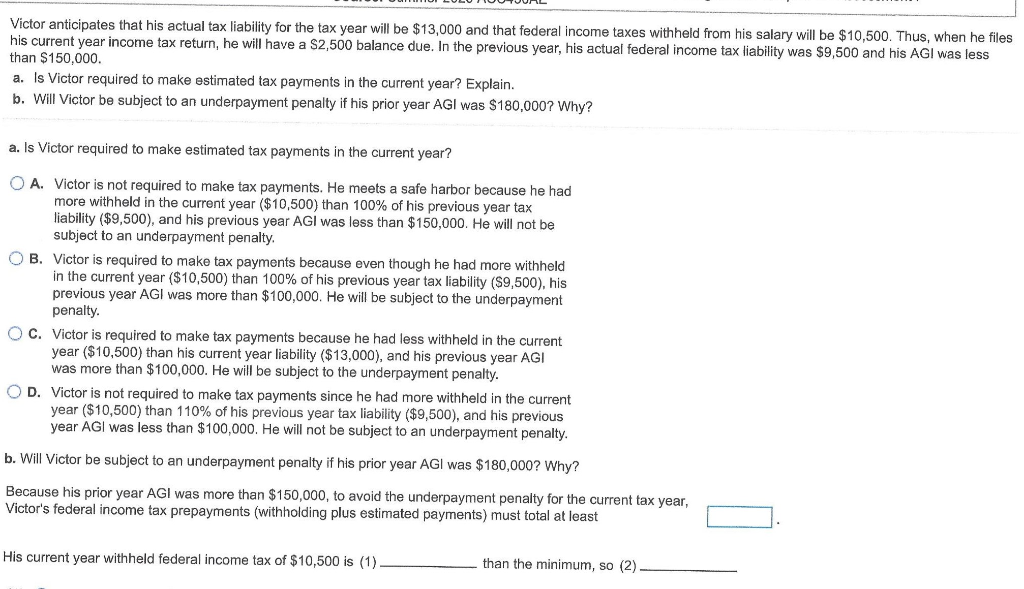

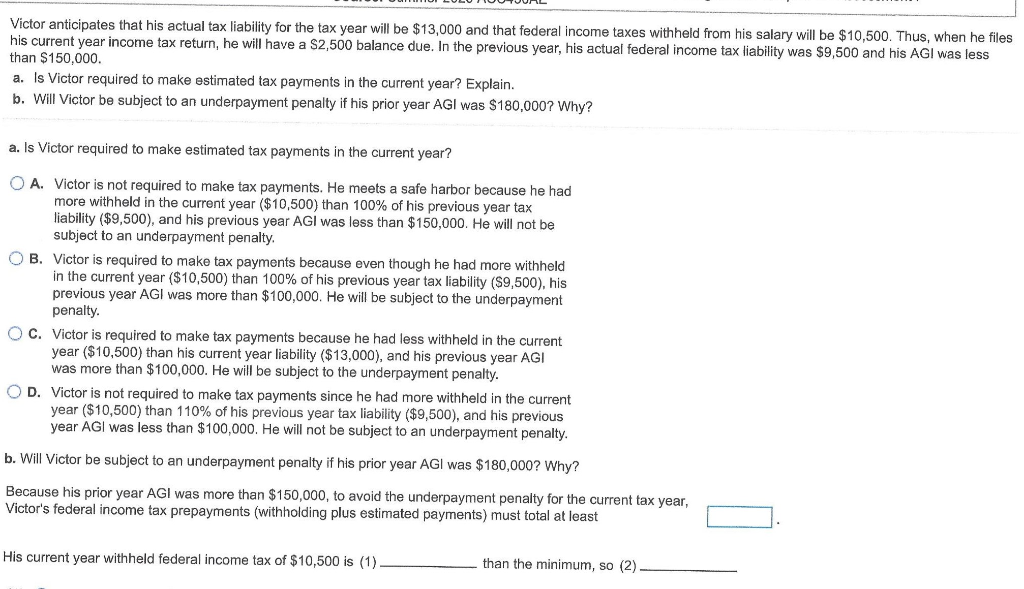

Victor anticipates that his actual tax liability for the tax year will be $13,000 and that federal income taxes withheld from his salary will be $10,500. Thus, when he files his current year income tax return, he will have a $2,500 balance due. In the previous year, his actual federal income tax liability was $9,500 and his AGI was less than $150,000. a. Is Victor required to make estimated tax payments in the current year? Explain. b. Will Victor be subject to an underpayment penalty if his prior year AGI was $180,000? Why? a. Is Victor required to make estimated tax payments in the current year? O A. Victor is not required to make tax payments. He meets a safe harbor because he had more withheld in the current year ($10,500) than 100% of his previous year tax liability ($9,500), and his previous year AGI was less than $150,000. He will not be subject to an underpayment penalty OB. Victor is required to make tax payments because even though he had more withheld in the current year ($10,500) than 100% of his previous year tax liability (9,500), his previous year AGI was more than $100,000. He will be subject to the underpayment penalty OC. Victor is required to make tax payments because he had less withheld in the current year ($10,500) than his current year liability ($13,000), and his previous year AGI was more than $100,000. He will be subject to the underpayment penalty. OD. Victor is not required to make tax payments since he had more withheld in the current year ($10,500) than 110% of his previous year tax liability ($9,500), and his previous year AGI was less than $100,000. He will not be subject to an underpayment penalty. b. Will Victor be subject to an underpayment penalty if his prior year AGI was $180,000? Why? Because his prior year AGI was more than $150,000, to avoid the underpayment penalty for the current tax year, Victor's federal income tax prepayments (withholding plus estimated payments) must total at least His current year withheld federal income tax of $10,500 is (1) than the minimum, so (2) Victor anticipates that his actual tax liability for the tax year will be $13,000 and that federal income taxes withheld from his salary will be $10,500. Thus, when he files his current year income tax return, he will have a $2,500 balance due. In the previous year, his actual federal income tax liability was $9,500 and his AGI was less than $150,000. a. Is Victor required to make estimated tax payments in the current year? Explain. b. Will Victor be subject to an underpayment penalty if his prior year AGI was $180,000? Why? a. Is Victor required to make estimated tax payments in the current year? O A. Victor is not required to make tax payments. He meets a safe harbor because he had more withheld in the current year ($10,500) than 100% of his previous year tax liability ($9,500), and his previous year AGI was less than $150,000. He will not be subject to an underpayment penalty OB. Victor is required to make tax payments because even though he had more withheld in the current year ($10,500) than 100% of his previous year tax liability (9,500), his previous year AGI was more than $100,000. He will be subject to the underpayment penalty OC. Victor is required to make tax payments because he had less withheld in the current year ($10,500) than his current year liability ($13,000), and his previous year AGI was more than $100,000. He will be subject to the underpayment penalty. OD. Victor is not required to make tax payments since he had more withheld in the current year ($10,500) than 110% of his previous year tax liability ($9,500), and his previous year AGI was less than $100,000. He will not be subject to an underpayment penalty. b. Will Victor be subject to an underpayment penalty if his prior year AGI was $180,000? Why? Because his prior year AGI was more than $150,000, to avoid the underpayment penalty for the current tax year, Victor's federal income tax prepayments (withholding plus estimated payments) must total at least His current year withheld federal income tax of $10,500 is (1) than the minimum, so (2)