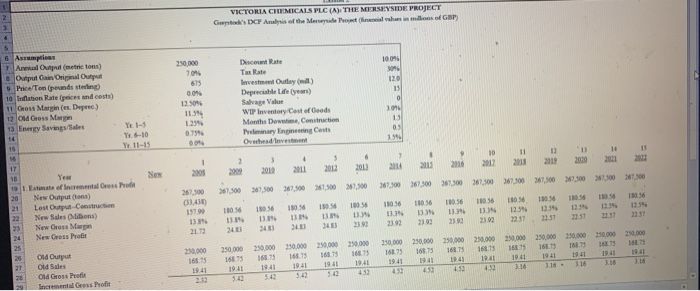

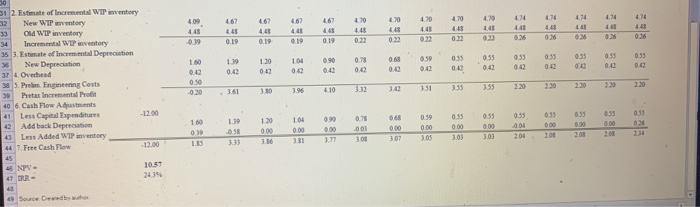

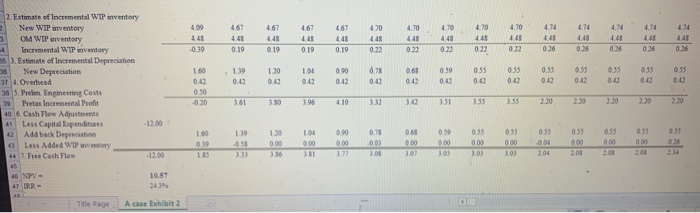

Victoria Chemicals (A) Posted on: Tuesday, March 3, 2020 95102 AM EST We will begin Victoria Chemicals Thursday. I have posted the spreadsheets in the Course Documents area Consider these questions: 1. What changes, if any, should Lucy Morris ask Frank Greystock to make in his discounted cash flow (DCF) analysis? Why? What should Morris be prepared to say to the Transport Dision, the director of sales, her assistant plant manager and the analyst from the Treasury Stat? 2. How attractive is the Merseyside project? By what criteria? 3. Should Morris continue to promote the project for funding? VICTORIA CHEMICALS PLC (A) THE MERMEYSIDE PROJECT Gawk 'DCF nis of the Mar v is moms of GSP 6 Assumpties 7 A p ul metre tons) Out On On Out 10046 250.000 7.016 10 Intan Rates and costs) 11 Cross Marin (es. Depree) 12 OMG Mer 00 50 11.5 125 14 Tas Rate Oy) Depechy ) Salve Value WIP Inventory Cast of Goods Mes De Costa Play En Cats Overhead Investment Y 6-10 Y 11-15 10 111 115 2 2 2018 1.500 67.00 361.00 1.00 1,500 6700 67.00 367.300 67.00 1.00 37.500 0 0 . 0 1. Estate of incrementales et New Output ) Lost .Com New Sales C ons) New Cross Me New Oress Profit 267.00 (34) 151 13 156 15 1856 1856 185 0510036 1856 1856 1010056 345 3433 341 48 339 239 232 232 233 234 231 2321311231 35000 1 OM O Old Sales Old Gross Profile e ta Greus Profi 0 689 1941 0 0 160 1941 0 0 0 210.000 25000 165 166 167 1942 1941 1940 1941 9452 453 25000 168 1940 25000 25000 10000 167 165 1941 1942 1941 453116 35000 350.00 50.000 164 165 1941 1940 118 118 194 118 3 5 4.09 4.67 4.20 4 67 470 471 467 470 470 474 470 022 022 023 026 0 0 0 0.78 0.55 0.55 0.55 012 00 $12. Estimate of increment WIP inventory 32 New WIP inventory 33 O WIP inventory 34 Incremental WIP inventory 35 3. Estimate of incremental Depreciation 3 New Depreciation 37 4. Overhead 38 5. Pre Engineering Costs 39 Preta incremental Profit 40 6. Cash Flow Au nts 41 Less Capital Expenditures -12.00 42 Add back Depreciation 43 Less Added WI ventory 44 7. Free Cash Flow 030 3 81 380 19 110 112 0.02 331 10 33 355 220 220 230 220 230 05 0.5 0.35 160 120 130 1.04 0.00 3 0.90 0.78 0.00 001 372308 0.68 000 302 0.59 000 303 0.35 000 303 0.35 0.00 0.04 3020 300 201 208 333 336 18 NPV- 4T ER 34394 49 Source Gewedby Exhibit VICTORIA CHEMICALS PLC (A) THE MERSEYSIDE PROJECT DCF Am of the Midd le of GSP G 250 000 100% so Assumpties Am Out ) Output an Original Output Price/Ton (pounds stering inflation Rate (prices and costs) Gross Marpan (n. Depene) Ou Gress Marin Energy Savings Sales Data Tus Rate Investment Outly ) Deprecia) Savage war WIP Inventory Cost of Goods Month Dow Contacto 115 109 Yr 1-5 Y10 Ye 11-15 0 Overhead Yew 1 Estate of incr e ase New Ourens) Lost Contact 367,500 1300 7.50 7.500 367.500 3.500 3700 37.50367300 7.500 7.500 7.500 7.500 7.500 7.500 1979 13 136 13 11 1 56 13 NON New Gross Pratt 10 13 11 10 13 2 100 55 56 13 1921 56 13 396 192 101 125 257 1 124 357 0 6 15 125 121 12:51 3257 2 257 3 O . OLC Sara 230.000 1685 1941 250.000 200.000 250.000 250.000 1685 1685 1685 1685 1940 1941 1941 1942 5050 250.000 1685 1941 250.000 250.000 250.000 1685 1685 1685 1941 1941 1942 250.000 1685 1941 250.000 250.000 250.000 1685 165 16 1942 1941 250.000 6 1940 250.000 1675 1941 Profit Gross Pro Title Page Achse Ehibit 2 467 467 4.67 470 4.70 4.70 4.70 474 4.74 4.74 414 4.45 -0.39 0.19 0.36 150 2 Estimate of Incremental WTP inventory New WIP inventory OM WIP inventory Incremental WIP inventory 15 3. Estimate of incremental Depreciation 38 New Depreciation 37 4. Overhead 30 5. Prelim. Engineering Costs 39 Pretax incremental Profit 406 Cash Flow Adjustments 41 Less Capital Expenditures 42 Ada back Depreciation 43 Less Added WIP inventory 44 Free Cash Flow 1.39 0.42 -0.20 103,51 335 33 2.20 220 230 0.42 220 230 0.90 0.68 0.5 0.55 0.5 0.5 0.5 0. 0.3 0.33 1201 04 0.00 0.00 356 381 -12.00 372 303 302 303 0 201 202 203 204 2:34 1057 45 47 - - 2433 Tale Page A case Exhibit 2 Victoria Chemicals (A) Posted on: Tuesday, March 3, 2020 95102 AM EST We will begin Victoria Chemicals Thursday. I have posted the spreadsheets in the Course Documents area Consider these questions: 1. What changes, if any, should Lucy Morris ask Frank Greystock to make in his discounted cash flow (DCF) analysis? Why? What should Morris be prepared to say to the Transport Dision, the director of sales, her assistant plant manager and the analyst from the Treasury Stat? 2. How attractive is the Merseyside project? By what criteria? 3. Should Morris continue to promote the project for funding? VICTORIA CHEMICALS PLC (A) THE MERMEYSIDE PROJECT Gawk 'DCF nis of the Mar v is moms of GSP 6 Assumpties 7 A p ul metre tons) Out On On Out 10046 250.000 7.016 10 Intan Rates and costs) 11 Cross Marin (es. Depree) 12 OMG Mer 00 50 11.5 125 14 Tas Rate Oy) Depechy ) Salve Value WIP Inventory Cast of Goods Mes De Costa Play En Cats Overhead Investment Y 6-10 Y 11-15 10 111 115 2 2 2018 1.500 67.00 361.00 1.00 1,500 6700 67.00 367.300 67.00 1.00 37.500 0 0 . 0 1. Estate of incrementales et New Output ) Lost .Com New Sales C ons) New Cross Me New Oress Profit 267.00 (34) 151 13 156 15 1856 1856 185 0510036 1856 1856 1010056 345 3433 341 48 339 239 232 232 233 234 231 2321311231 35000 1 OM O Old Sales Old Gross Profile e ta Greus Profi 0 689 1941 0 0 160 1941 0 0 0 210.000 25000 165 166 167 1942 1941 1940 1941 9452 453 25000 168 1940 25000 25000 10000 167 165 1941 1942 1941 453116 35000 350.00 50.000 164 165 1941 1940 118 118 194 118 3 5 4.09 4.67 4.20 4 67 470 471 467 470 470 474 470 022 022 023 026 0 0 0 0.78 0.55 0.55 0.55 012 00 $12. Estimate of increment WIP inventory 32 New WIP inventory 33 O WIP inventory 34 Incremental WIP inventory 35 3. Estimate of incremental Depreciation 3 New Depreciation 37 4. Overhead 38 5. Pre Engineering Costs 39 Preta incremental Profit 40 6. Cash Flow Au nts 41 Less Capital Expenditures -12.00 42 Add back Depreciation 43 Less Added WI ventory 44 7. Free Cash Flow 030 3 81 380 19 110 112 0.02 331 10 33 355 220 220 230 220 230 05 0.5 0.35 160 120 130 1.04 0.00 3 0.90 0.78 0.00 001 372308 0.68 000 302 0.59 000 303 0.35 000 303 0.35 0.00 0.04 3020 300 201 208 333 336 18 NPV- 4T ER 34394 49 Source Gewedby Exhibit VICTORIA CHEMICALS PLC (A) THE MERSEYSIDE PROJECT DCF Am of the Midd le of GSP G 250 000 100% so Assumpties Am Out ) Output an Original Output Price/Ton (pounds stering inflation Rate (prices and costs) Gross Marpan (n. Depene) Ou Gress Marin Energy Savings Sales Data Tus Rate Investment Outly ) Deprecia) Savage war WIP Inventory Cost of Goods Month Dow Contacto 115 109 Yr 1-5 Y10 Ye 11-15 0 Overhead Yew 1 Estate of incr e ase New Ourens) Lost Contact 367,500 1300 7.50 7.500 367.500 3.500 3700 37.50367300 7.500 7.500 7.500 7.500 7.500 7.500 1979 13 136 13 11 1 56 13 NON New Gross Pratt 10 13 11 10 13 2 100 55 56 13 1921 56 13 396 192 101 125 257 1 124 357 0 6 15 125 121 12:51 3257 2 257 3 O . OLC Sara 230.000 1685 1941 250.000 200.000 250.000 250.000 1685 1685 1685 1685 1940 1941 1941 1942 5050 250.000 1685 1941 250.000 250.000 250.000 1685 1685 1685 1941 1941 1942 250.000 1685 1941 250.000 250.000 250.000 1685 165 16 1942 1941 250.000 6 1940 250.000 1675 1941 Profit Gross Pro Title Page Achse Ehibit 2 467 467 4.67 470 4.70 4.70 4.70 474 4.74 4.74 414 4.45 -0.39 0.19 0.36 150 2 Estimate of Incremental WTP inventory New WIP inventory OM WIP inventory Incremental WIP inventory 15 3. Estimate of incremental Depreciation 38 New Depreciation 37 4. Overhead 30 5. Prelim. Engineering Costs 39 Pretax incremental Profit 406 Cash Flow Adjustments 41 Less Capital Expenditures 42 Ada back Depreciation 43 Less Added WIP inventory 44 Free Cash Flow 1.39 0.42 -0.20 103,51 335 33 2.20 220 230 0.42 220 230 0.90 0.68 0.5 0.55 0.5 0.5 0.5 0. 0.3 0.33 1201 04 0.00 0.00 356 381 -12.00 372 303 302 303 0 201 202 203 204 2:34 1057 45 47 - - 2433 Tale Page A case Exhibit 2