Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Victoria Cross Company produces various types of candies. Several candies could be sold at the split-off point processed further and sold in a different form

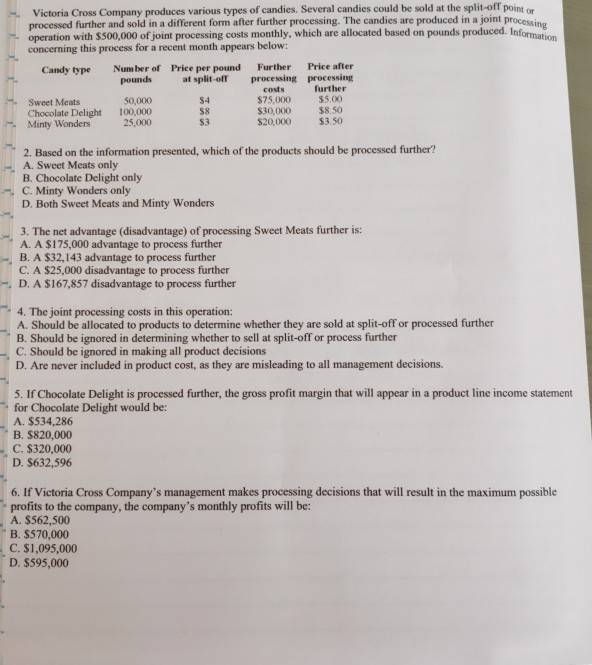

Victoria Cross Company produces various types of candies. Several candies could be sold at the split-off point processed further and sold in a different form after further processing. The candies are produced in a joint procese operation with $500,000 of joint processing costs monthly, which are allocated based on pounds produced. Inform concerning this process for a recent month appears below: Candy type Number of Price per pound Further Price after pounds afsplit-off processing processing costs further Sweet Meats 50,000 $75,000 $5.00 Chocolate Delight 100,000 58 $30,000 $8.50 Minty Wonders 25.000 $20,000 $3.50 S3 2. Based on the information presented, which of the products should be processed further? A. Sweet Meats only B. Chocolate Delight only C. Minty Wonders only D. Both Sweet Meats and Minty Wonders 3. The net advantage (disadvantage) of processing Sweet Meats further is: A. A $175,000 advantage to process further B. A $32,143 advantage to process further C. A $25,000 disadvantage to process further -. D. A $167,857 disadvantage to process further 4. The joint processing costs in this operation: A. Should be allocated to products to determine whether they are sold at split-off or processed further B. Should be ignored in determining whether to sell at split-off or process further C. Should be ignored in making all product decisions D. Are never included in product cost, as they are misleading to all management decisions. 5. If Chocolate Delight is processed further, the gross profit margin that will appear in a product line income statement for Chocolate Delight would be: A. $534,286 B. $820,000 C. $320,000 D. $632,596 6. If Victoria Cross Company's management makes processing decisions that will result in the maximum possible profits to the company, the company's monthly profits will be: A. $562,500 B. $570,000 C. $1,095,000 D. $595,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started