Answered step by step

Verified Expert Solution

Question

1 Approved Answer

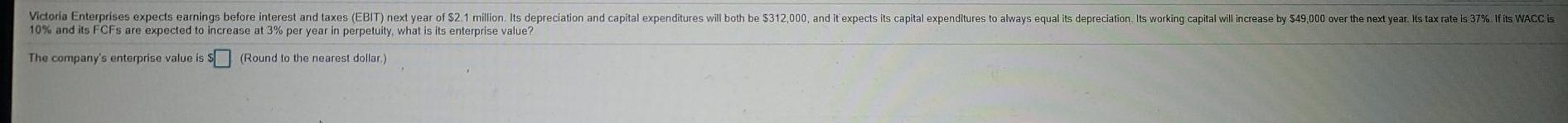

Victoria Enterprises expects earnings before interest and taxes (EBIT) next year of $2.1 million. Its depreciation and capital expenditures will both be 5312,000, and it

Victoria Enterprises expects earnings before interest and taxes (EBIT) next year of $2.1 million. Its depreciation and capital expenditures will both be 5312,000, and it expects its capital expenditures to always equal its depreciation. Its working capital will increase by 549,000 over the next year. Is tax rate is 37% If its WACC is 10% and its FCFs are expected to increase at 3% per year in perpetuity, what is its enterprise value? The company's enterprise value is $ (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started