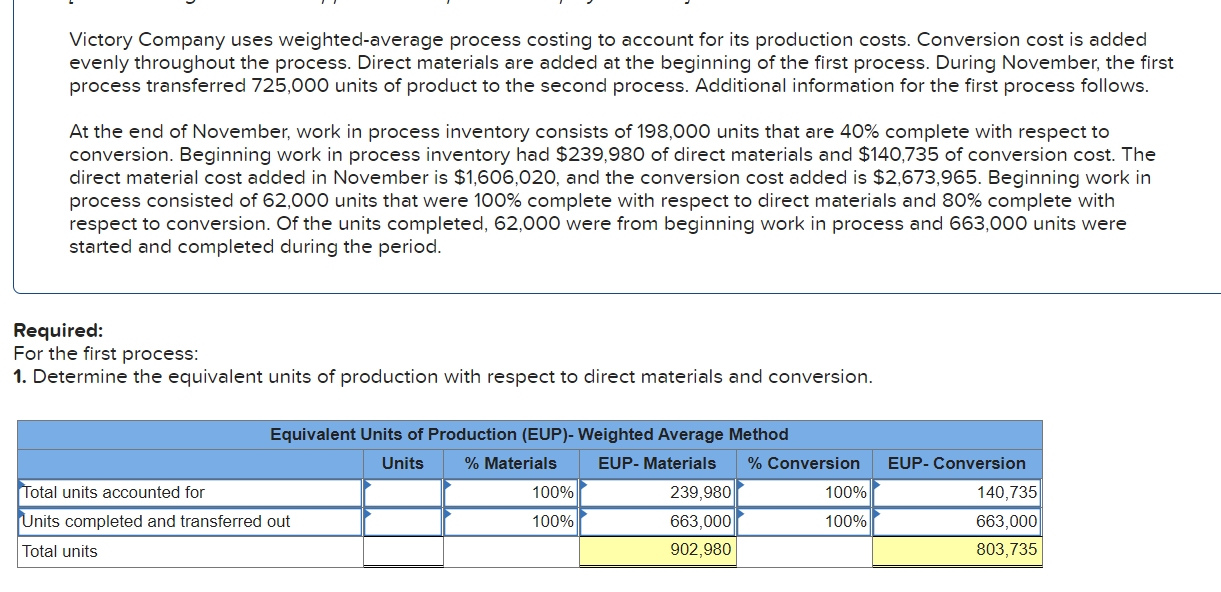

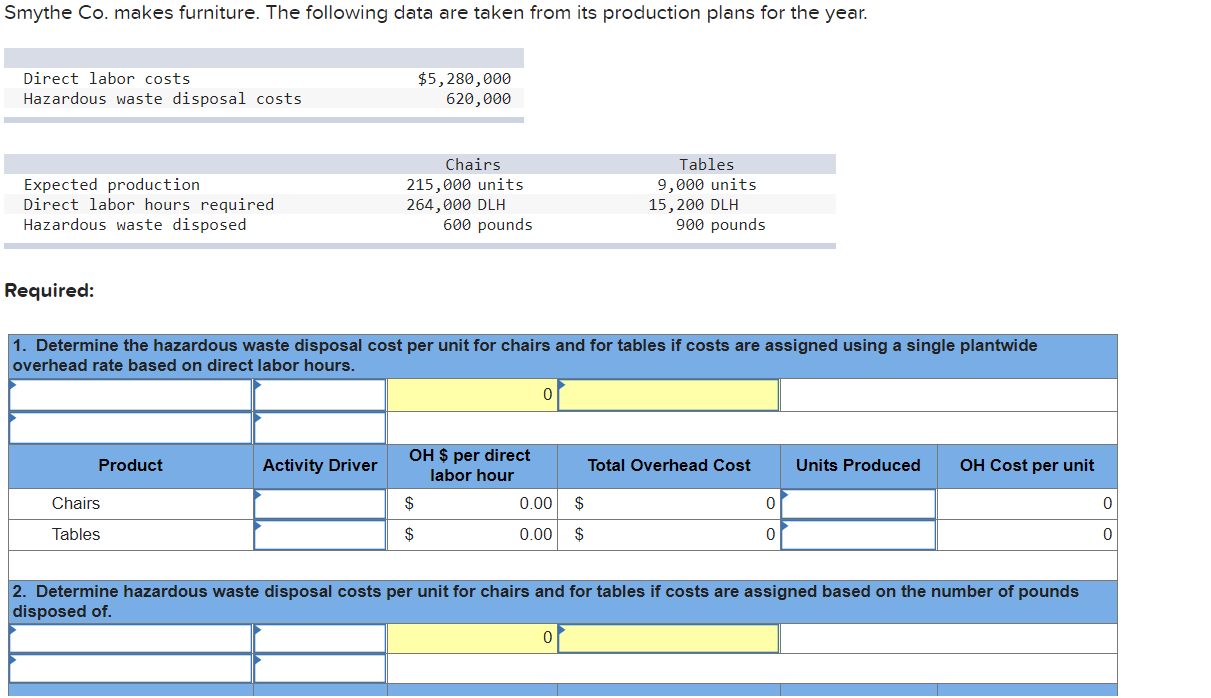

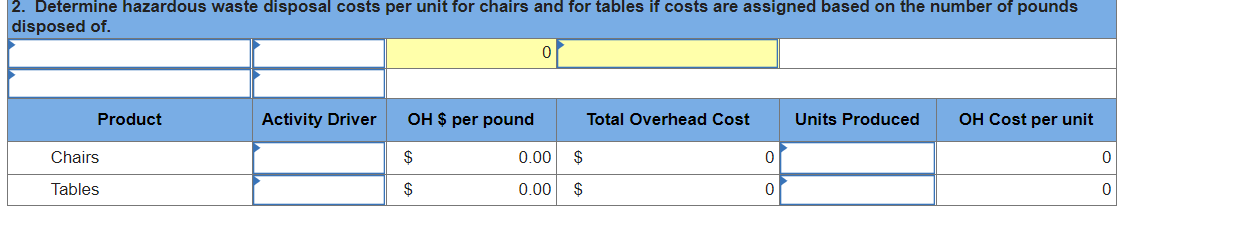

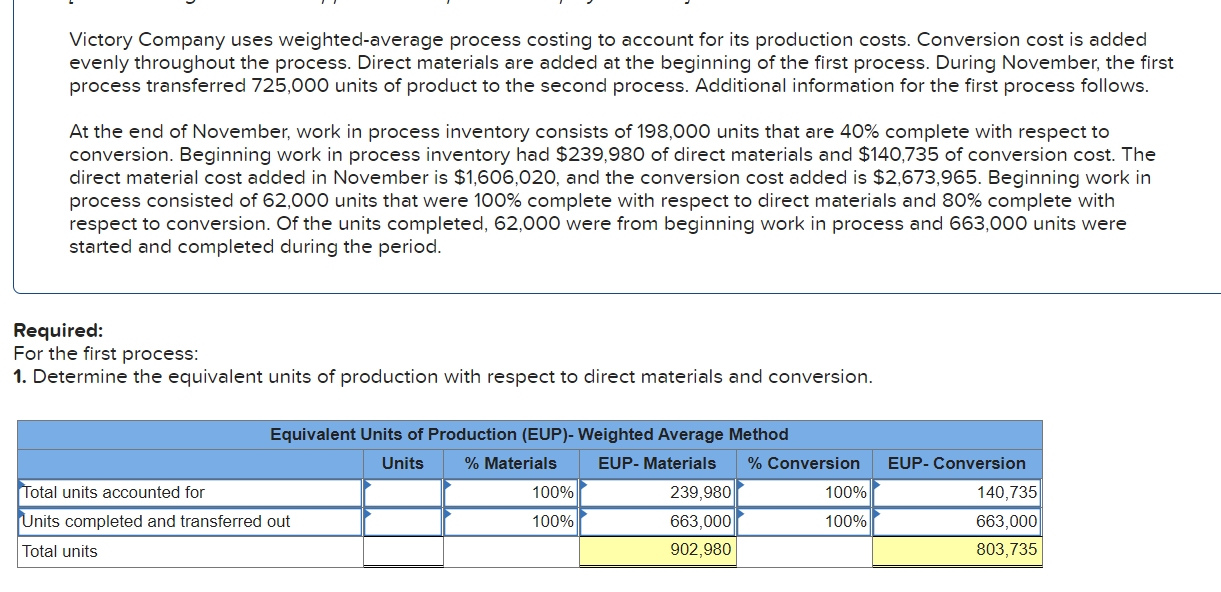

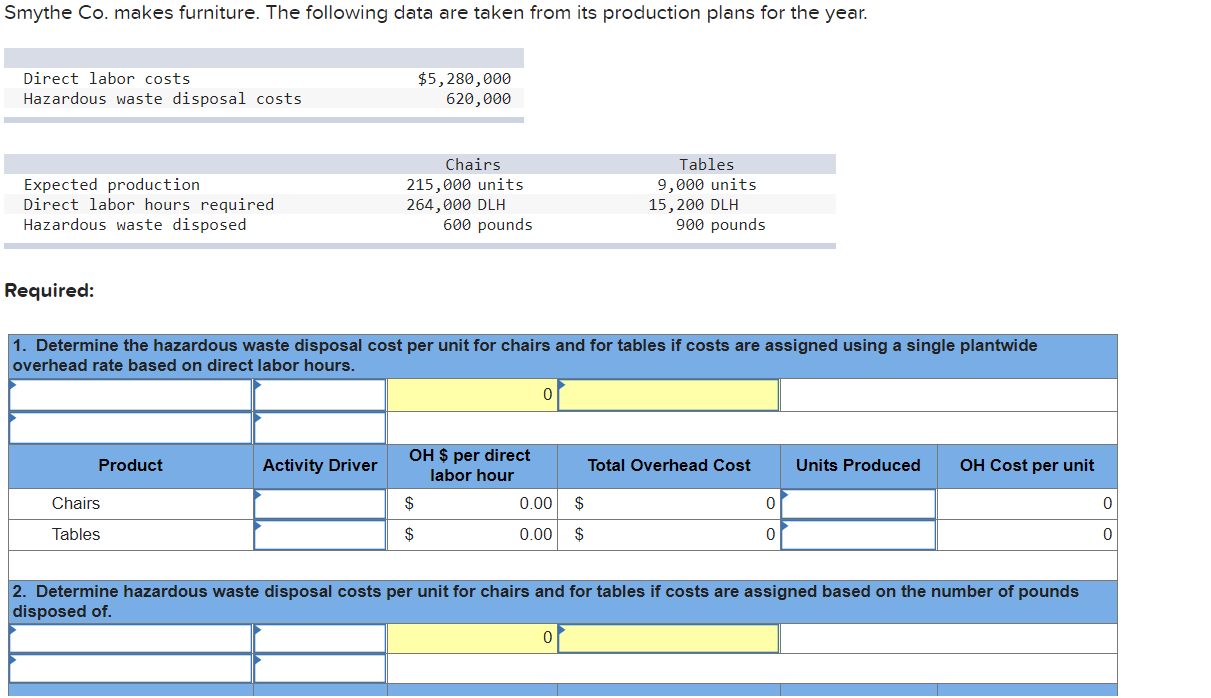

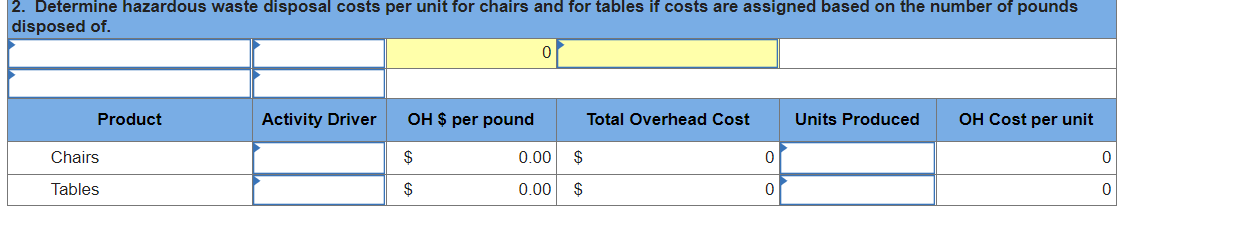

Victory Company uses weighted-average process costing to account for its production costs. Conversion cost is added evenly throughout the process. Direct materials are added at the beginning of the first process. During November, the first process transferred 725,000 units of product to the second process. Additional information for the first process follows. At the end of November, work in process inventory consists of 198,000 units that are 40% complete with respect to conversion. Beginning work in process inventory had $239,980 of direct materials and $140,735 of conversion cost. The direct material cost added in November is $1,606,020, and the conversion cost added is $2,673,965. Beginning work in process consisted of 62,000 units that were 100% complete with respect to direct materials and 80% complete with respect to conversion. Of the units completed, 62,000 were from beginning work in process and 663,000 units were started and completed during the period. Required: For the first process: 1. Determine the equivalent units of production with respect to direct materials and conversion. Equivalent Units of Production (EUP)-Weighted Average Method Units % Materials EUP- Materials % Conversi Total units accounted for 100% 239,980 100% Units completed and transferred out 100% 663,000 100% Total units 902,980 EUP- Conversion 140,735 663,000 803,735 Smythe Co. makes furniture. The following data are taken from its production plans for the year. Direct labor costs Hazardous waste disposal costs $5,280,000 620,000 Expected production Direct labor hours required Hazardous waste disposed Chairs 215,000 units 264,000 DLH 600 pounds Tables 9,000 units 15,200 DLH 900 pounds Required: 1. Determine the hazardous waste disposal cost per unit for chairs and for tables if costs are assigned using a single plantwide overhead rate based on direct labor hours. 0 Product Activity Driver OH $ per direct labor hour Total Overhead Cost Units Produced OH Cost per unit Chairs $ 0.00 $ 0 0 Tables $ 0.00 $ 0 0 2. Determine hazardous waste disposal costs per unit for chairs and for tables if costs are assigned based on the number of pounds disposed of. 2. Determine hazardous waste disposal costs per unit for chairs and for tables if costs are assigned based on the number of pounds disposed of. 0 Product Activity Driver OH $ per pound Total Overhead Cost Units Produced OH Cost per unit Chairs $ 0.00 $ 0 0 Tables $ 0.00 $ 0 0