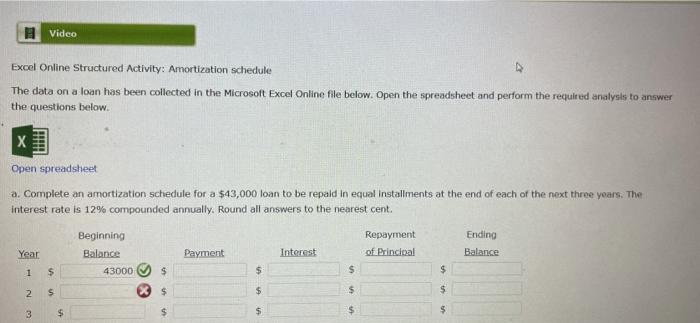

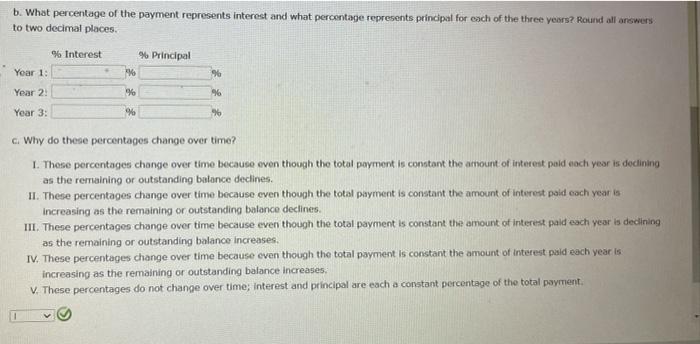

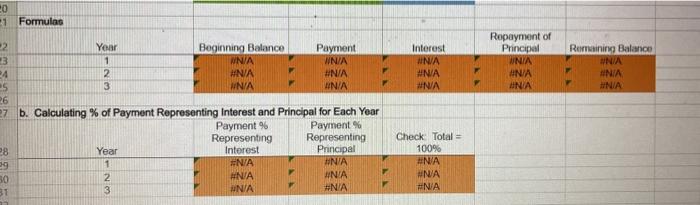

Video Excel Online Structured Activity: Amortization schedule The data on a loan has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. Complete an amortization schedule for a $43,000 loan to be repaid in equal installments at the end of each of the next three years. The interest rate is 12% compounded annually. Round all answers to the nearest cent. Beginning Balance 43000 Repayment of Principal Ending Balance Year Payment Interest 1 $ $ $ $ $ 2 $ $ $ $ $ 3 $ $ $ $ $ b. What percentage of the payment represents interest and what percentage represents principal for each of the three years? Round all answers to two decimal places 96 Interest % Principal % Year 1: 96 Year 2 % 96 Year 3: % c. Why do these percentages change over time? 1. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or outstanding balance declines. II. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or outstanding balance declines. III. These percentages change over time because even though the total payment is constant the amount of interest paid each year is dedining as the remaining or outstanding balance increases IV. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or outstanding balance increases, V. These percentages do not change over time; interest and principal are each a constant percentage of the total payment 1 E F H Amortizabon schedule 1 2 3 Loan amount to be repaid (PV) Interest rato (1) Length of loan (in years) $43.000.00 12.00% 5 G 7 8 9 Formula a. Setting up amortization table Calculation of loan payment INA Ropayment of Principal Interest Romaining Balance 10 Year Be Banos Payment 1 12 2 13 3 14 15 b. Calculating % of Payment Representing Interest and Principal for Each Year Payment Payment Representing Representing 16 Year Interest Principal 17 1 18 2 19 3 20 21 Formulas Check Total 100% 22 23 24 Year 1 2 Beginning Balance UA NA Payment NA ENA Interest NA Ropayment of Principal INA NA Romain Balance ENA ENIA 20 1 Formulas Interest UNA #N/A WNA Repayment of Principal WNIA UNA Remaining Balance WNIA ANIA #N/A 2 Year Beginning Balance Payment 3 1 WNIA WNIA 4 2 NA #N/A 5 3 WNA N/A 26 27 b. Calculating % of Payment Representing Interest and Principal for Each Year Payment % Payment Representing Representing 28 Year Interest Principal 59 1 #N/A 30 2 #N/A 31 3 #N/A #N/A Check Total 100% #NA #NA F