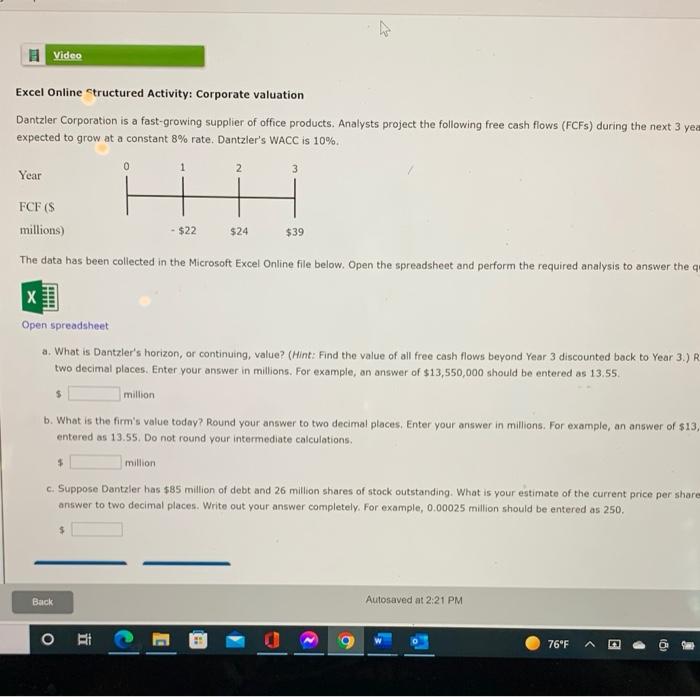

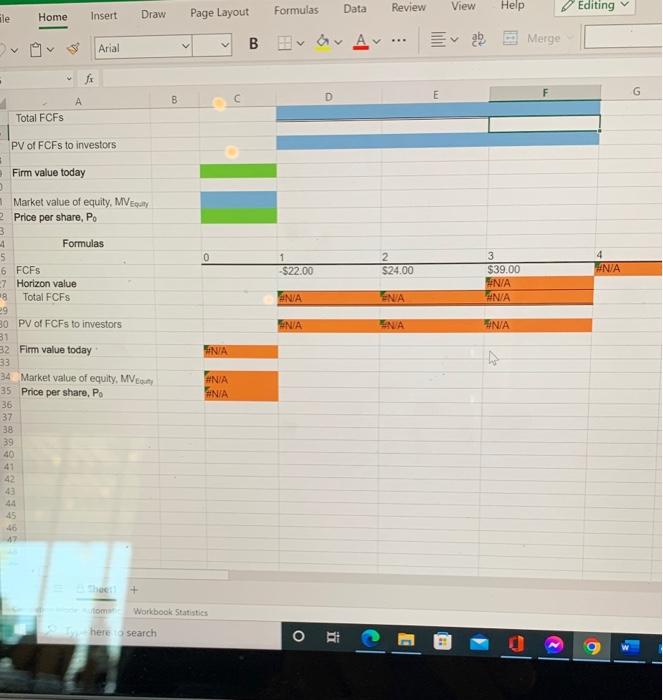

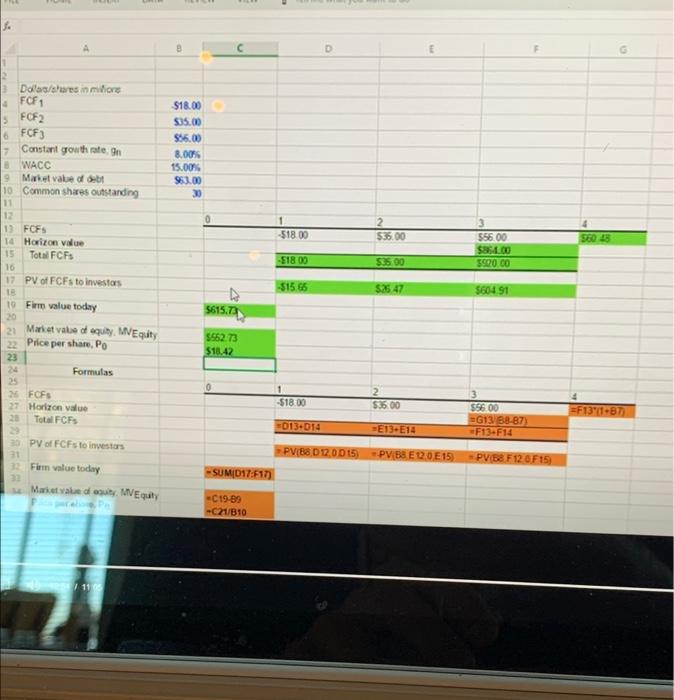

- Video Excel Online Structured Activity: Corporate valuation Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 yea expected to grow at a constant 8% rate. Dantzler's WACC is 10%. Year FCF (S millions) - $22 $2 $39 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the q $ X Open spreadsheet a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) R two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. million b. What is the firm's value today? Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13, entered as 13.55. Do not round your intermediate calculations million c. Suppose Dantzler has $85 million of debt and 26 million shares of stock outstanding. What is your estimate of the current price per share answer to two decimal places. Write out your answer completely. For example, 0.00025 million should be entered as 250, $ Back Autosaved at 2:21 PM O 76F A Review Formulas Data View Help Sle Editing Home Insert Draw Page Layout V B Eva A Arial Merge - fo E G A B Total FCFs PV of FCFs to investors Firm value today 0 1 $22.00 2 $24.00 WANJA 3 $39.00 ANA #N/A N/A ANA NA ENA #N/A Market value of equity, MV Equity 2 Price per share, P. 3 4 Formulas 5 6 FCFS 7 Horizon value 8 Total FCFS 29 BO PV of FCFs to investors 31 32 Firm value today 33 34 Market value of equity, MV 35 Price per share. Po 36 37 38 39 40 41 NA #NIA NA 44 45 46 47 tom Workbook Statistics here search O RI e D E $18.00 $35.00 $56.00 8.00% 15.00 563.00 30 0 1 -$18.00 2 $35.00 56013 Dolls/es in milione 4 FCF 5 FCF2 FCF3 Constant growth raten BWACC Market value of 10 Common shares outstanding 11 12 13 FCFS 14 Horizon value 15 Total FCF 16 17 PV of FCFs to investors 18 19 Firm value today 20 21 Maret valse taquily. WEquity of 22 Pilce per share, Po 23 24 Formulas 25 26 FCFS 27 Horizon value 20 Total FCF 556.00 $850.00 5920.00 -$1800 $35.00 51566 $25 47 $604 91 5615.73 $562.73 $18.42 0 -$18.00 2 $36.00 3 59600 -G13B8-87) F13-F14 =F1301-87 013+014 -E13-E14 PV/E8.0 12.00 15) PV B8 E 12.0 E 15) PV(88F12 F15 30 PV of FCFs to investors 31 Firm value today 2 Market value du MEquity -SUMD17:F17) C19-89 -C21/B10 110