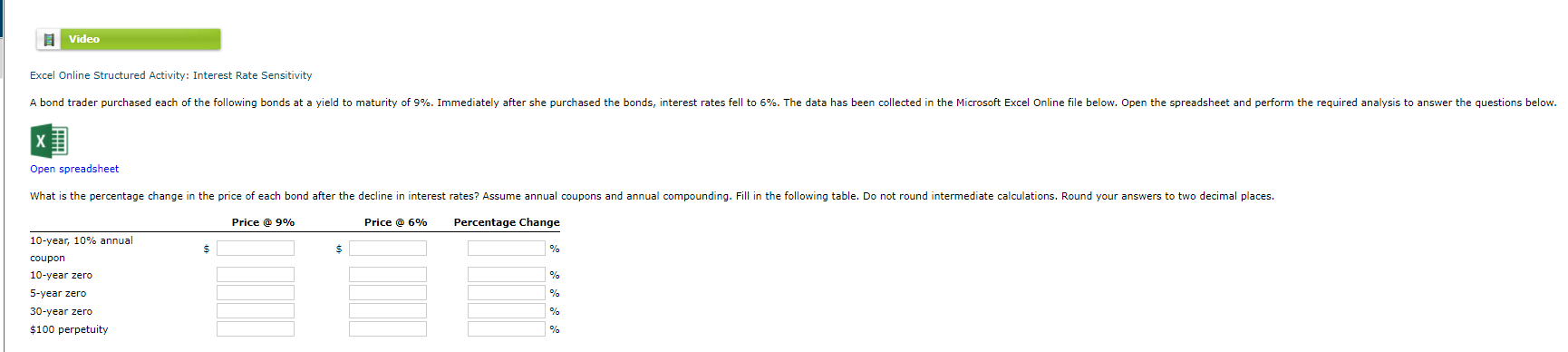

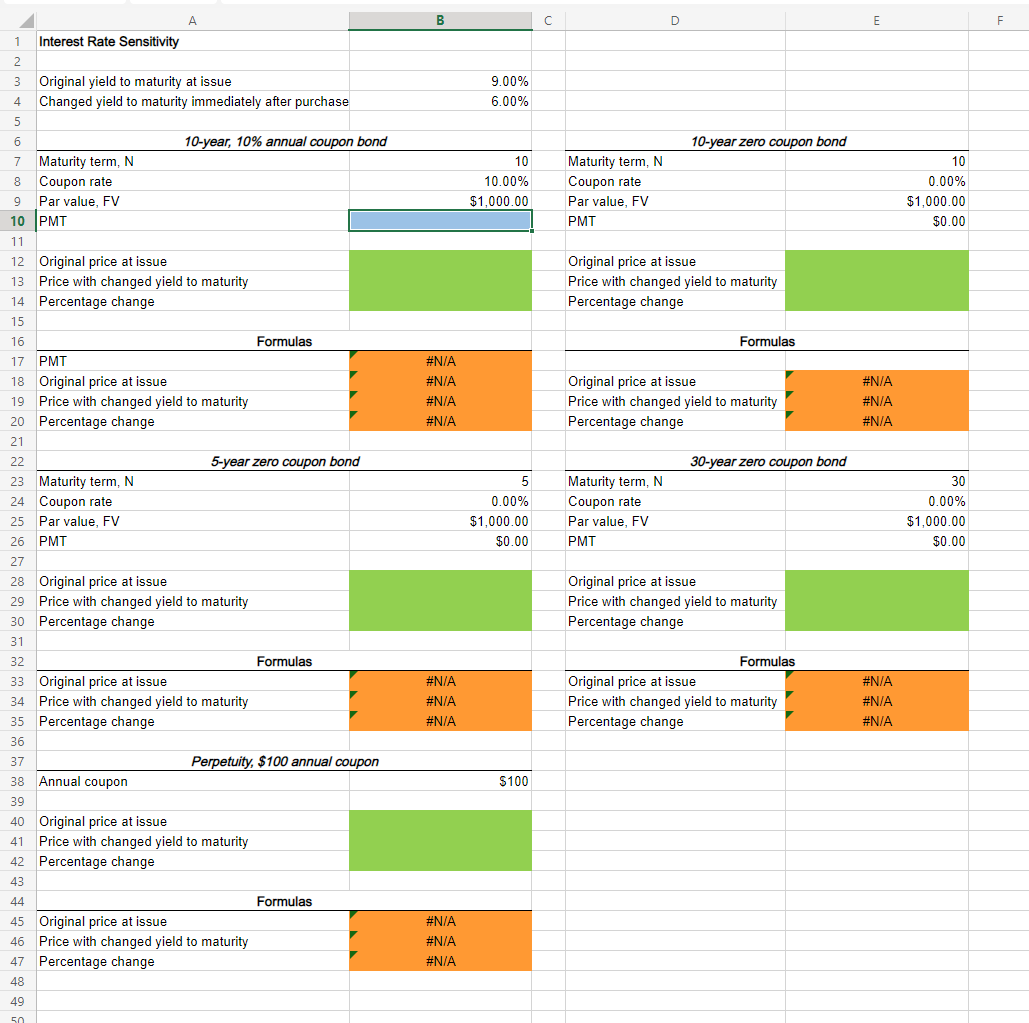

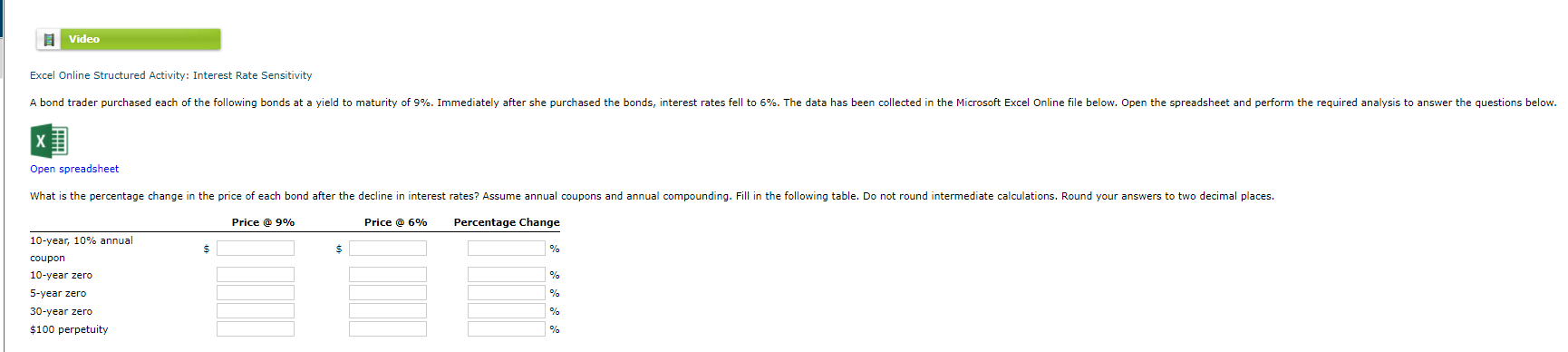

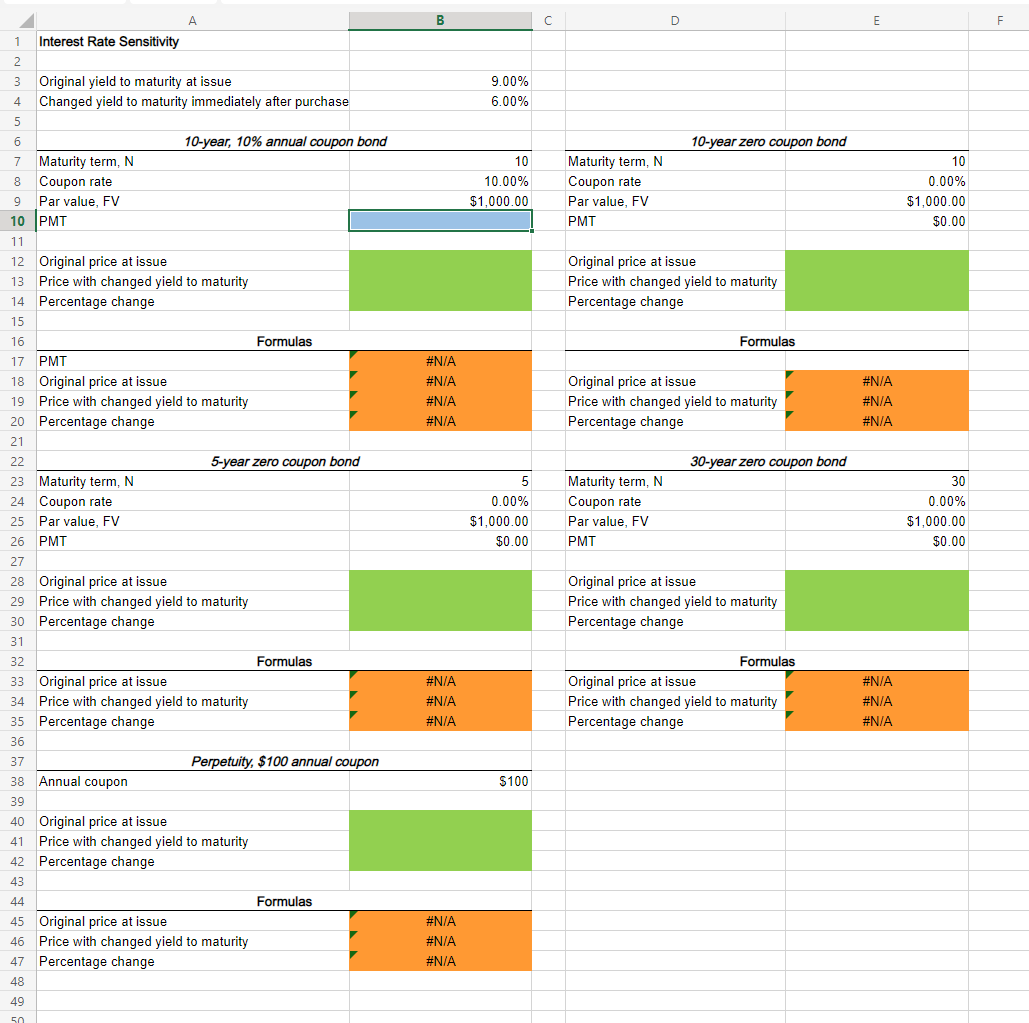

Video Excel Online Structured Activity: Interest Rate Sensitivity A bond trader purchased each of the following bonds at a yield to maturity of 9%. Immediately after she purchased the bonds, interest rates fell to 6%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet What is the percentage change in the price of each bond after the decline in interest rates? Assume annual coupons and annual compounding. Fill in the following table. Do not round intermediate calculations. Round your answers to two decimal places. Price @ 9% Price @ 6% Percentage Change $ % % 10-year, 10% annual coupon 10-year zero 5-year zero 30-year zero $100 perpetuity % MINE % % D E F 9.00% 6.00% 10-year zero coupon bond 10 10.00% $1,000.00 Maturity term, N Coupon rate Par value, FV PMT 10 0.00% $1,000.00 $0.00 Original price at issue Price with changed yield to maturity Percentage change Formulas #N/A #N/A #N/A #N/A #N/A Original price at issue Price with changed yield to maturity Percentage change #N/A #N/A 30-year zero coupon bond A 1 Interest Rate Sensitivity 2 3 Original yield to maturity at issue 4 Changed yield to maturity immediately after purchase 5 6 10-year, 10% annual coupon bond 7 Maturity term, N 8 Coupon rate 9 Par value, FV 10 PMT 11 12 Original price at issue 13 Price with changed yield to maturity 14 Percentage change 15 16 Formulas 17 PMT 18 Original price at issue 19 Price with changed yield to maturity 20 Percentage change 21 22 5-year zero coupon bond 23 Maturity term, N 24 Coupon rate 25 Par value, FV 26 PMT 27 28 Original price at issue 29 Price with changed yield to maturity 30 Percentage change 31 32 Formulas 33 Original price at issue 34 Price with changed yield to maturity 35 Percentage change 36 37 Perpetuity, $100 annual coupon 38 Annual coupon 39 40 Original price at issue 41 Price with changed yield to maturity 42 Percentage change 43 44 Formulas 45 Original price at issue 46 Price with changed yield to maturity 47 Percentage change 48 49 50 5 0.00% $1,000.00 $0.00 Maturity term, N Coupon rate Par value, FV PMT 30 0.00% $1,000.00 $0.00 Original price at issue Price with changed yield to maturity Percentage change #N/A #N/A Formulas Original price at issue Price with changed yield to maturity Percentage change #N/A #N/A #N/A #N/A $100 #N/A #N/A #N/A