Answered step by step

Verified Expert Solution

Question

1 Approved Answer

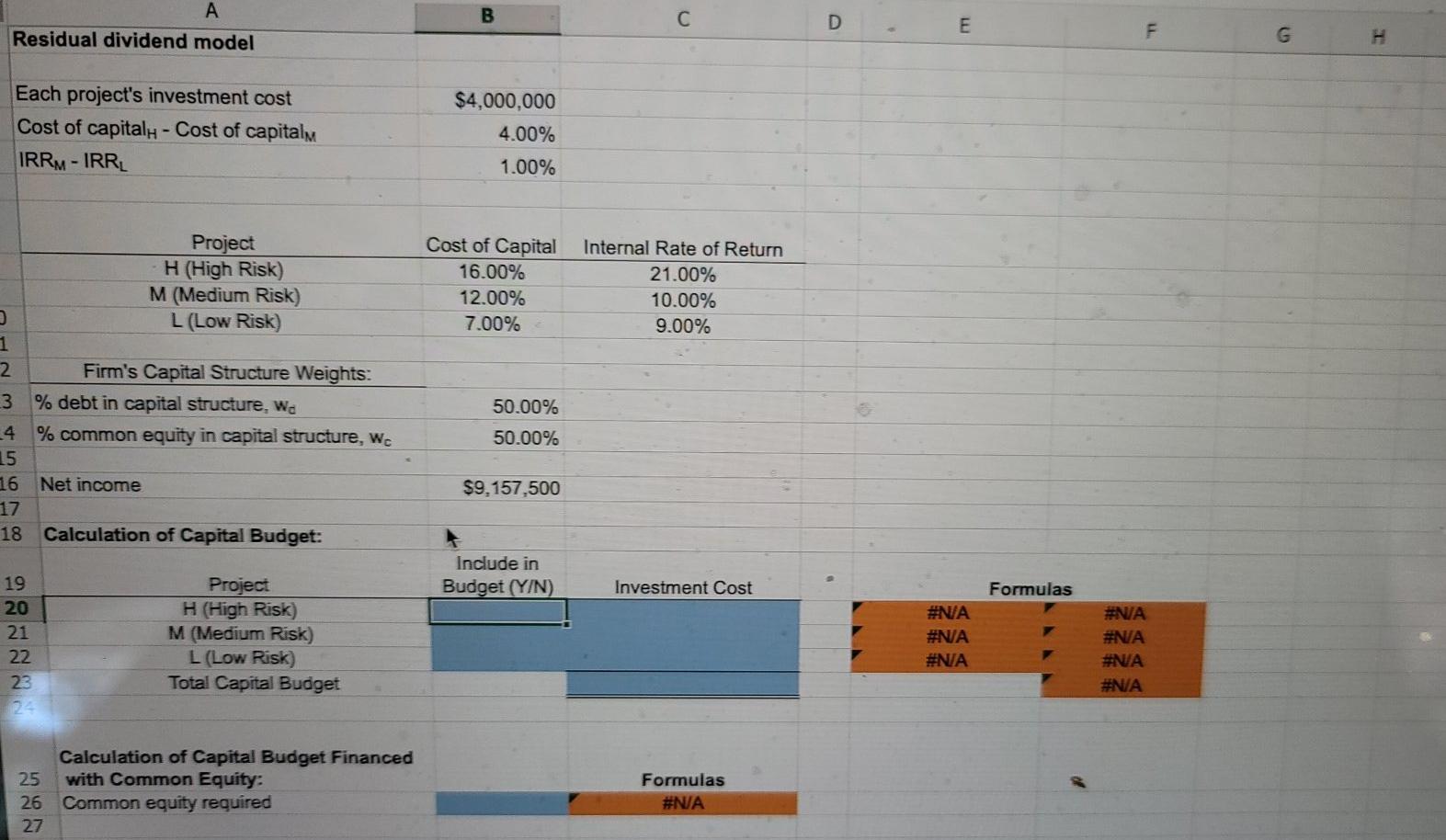

Video Excel Online Structured Activity: Residual dividend model Walsh Company is considering three independent projects, each of which requires a $4 million investment. The estimated

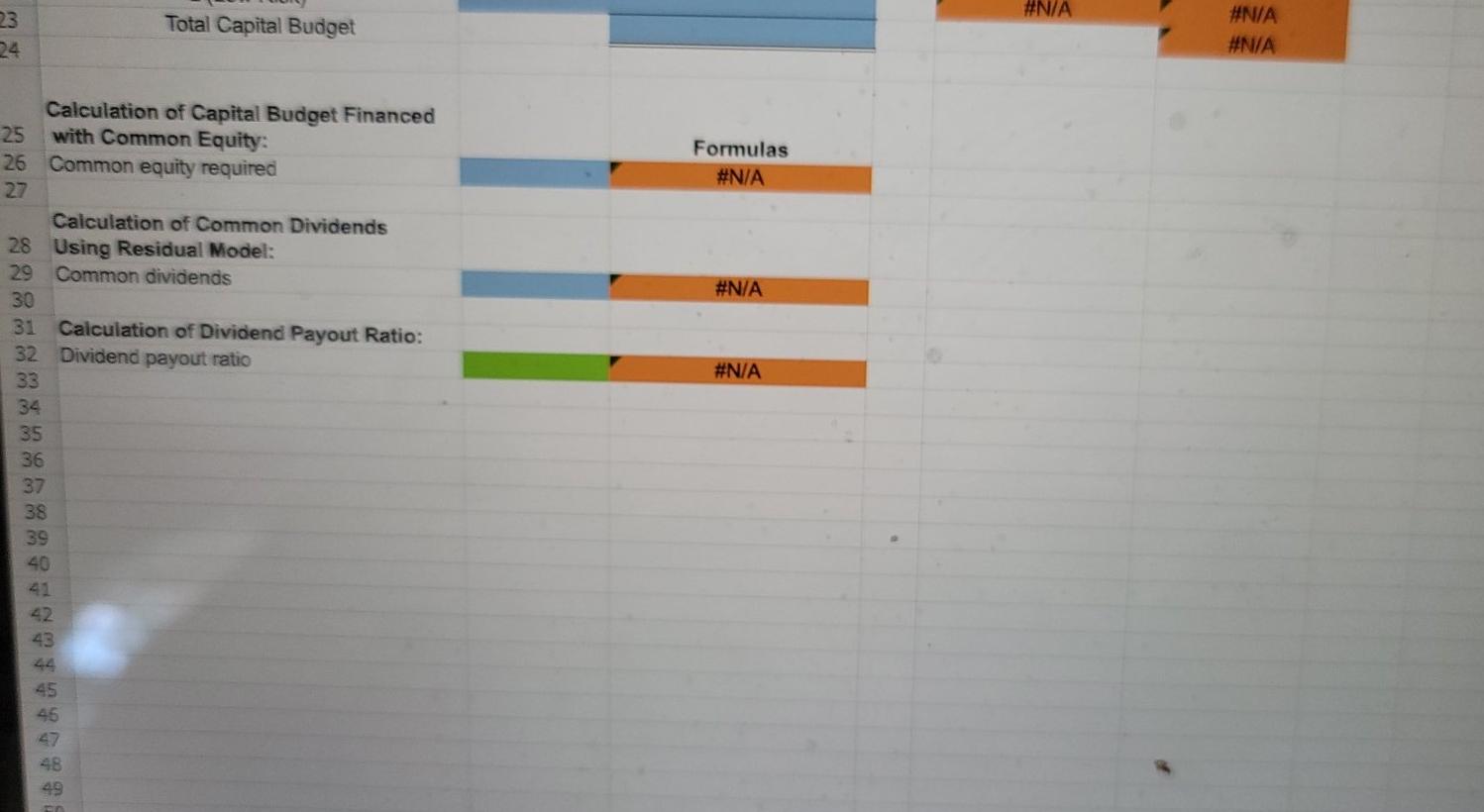

Video Excel Online Structured Activity: Residual dividend model Walsh Company is considering three independent projects, each of which requires a $4 million investment. The estimated internal rate of return (IRR) and cost of capital for these projects are presented below: Project H (High risk): Cost of capital = 16% IRR = 21% Project M (Medium risk): Cost of capital = 12% IRR = 10% Project L (Low risk): Cost of capital = 7% IRR = 9% Note that the projects' costs of capital vary because the projects have different levels of risk. The company's optimal capital structure calls for 50% debt and 50% common equity, and it expects to have net income of $9,157,500. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X TH Open spreadsheet If Walsh establishes its dividends from the residual dividend model, what will be its payout ratio? Round your answer to two decimal places. % Check My Work Reset Problem A B D E Residual dividend model F G H Each project's investment cost Cost of capitaly - Cost of capital IRR - IRRL $4,000,000 4.00% 1.00% Cost of Capital 16.00% 12.00% 7.00% Internal Rate of Return 21.00% 10.00% 9.00% Project H (High Risk) M (Medium Risk) L (Low Risk) 1 2 Firm's Capital Structure Weights: 3 % debt in capital structure. We 4 % common equity in capital structure, w 15 16 Net income 17 18 Calculation of Capital Budget: 50.00% 50.00% $9,157,500 Include in Budget (Y/N) Investment Cost Formulas 19 20 21 22 23 Project H (High Risk) M (Medium Risk) L (Low Risk) Total Capital Budget #NA #NA #NA #N/A #NA #NA #NA Calculation of Capital Budget Financed 25 with Common Equity: 26 Common equity required 27 Formulas #NA #N/A 23 24 Total Capital Budget #N/A #N/A Calculation of Capital Budget Financed 25 with Common Equity: 26 Common equity required Formulas #NA #N/A #N/A Calculation of Common Dividends 28 Using Residual Model: 29 Common dividends 30 31 Calculation of Dividend Payout Ratio: 32 Dividend payout ratio 33 34 35 36 37 38 39 40 42 43 45 46 48

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started