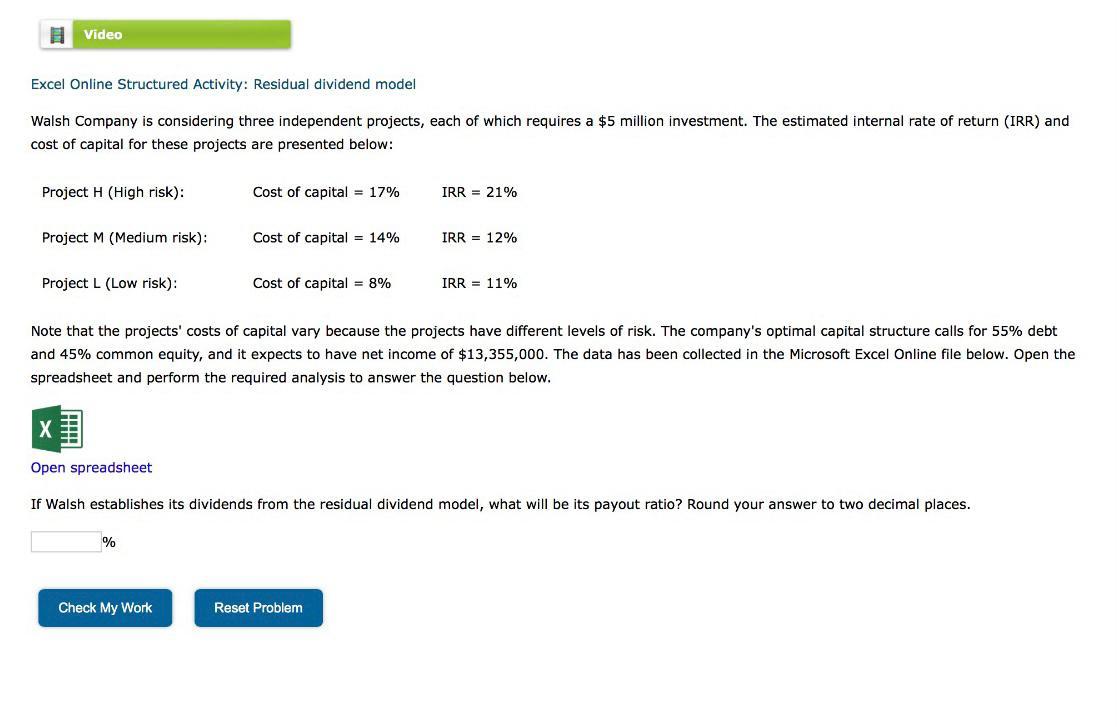

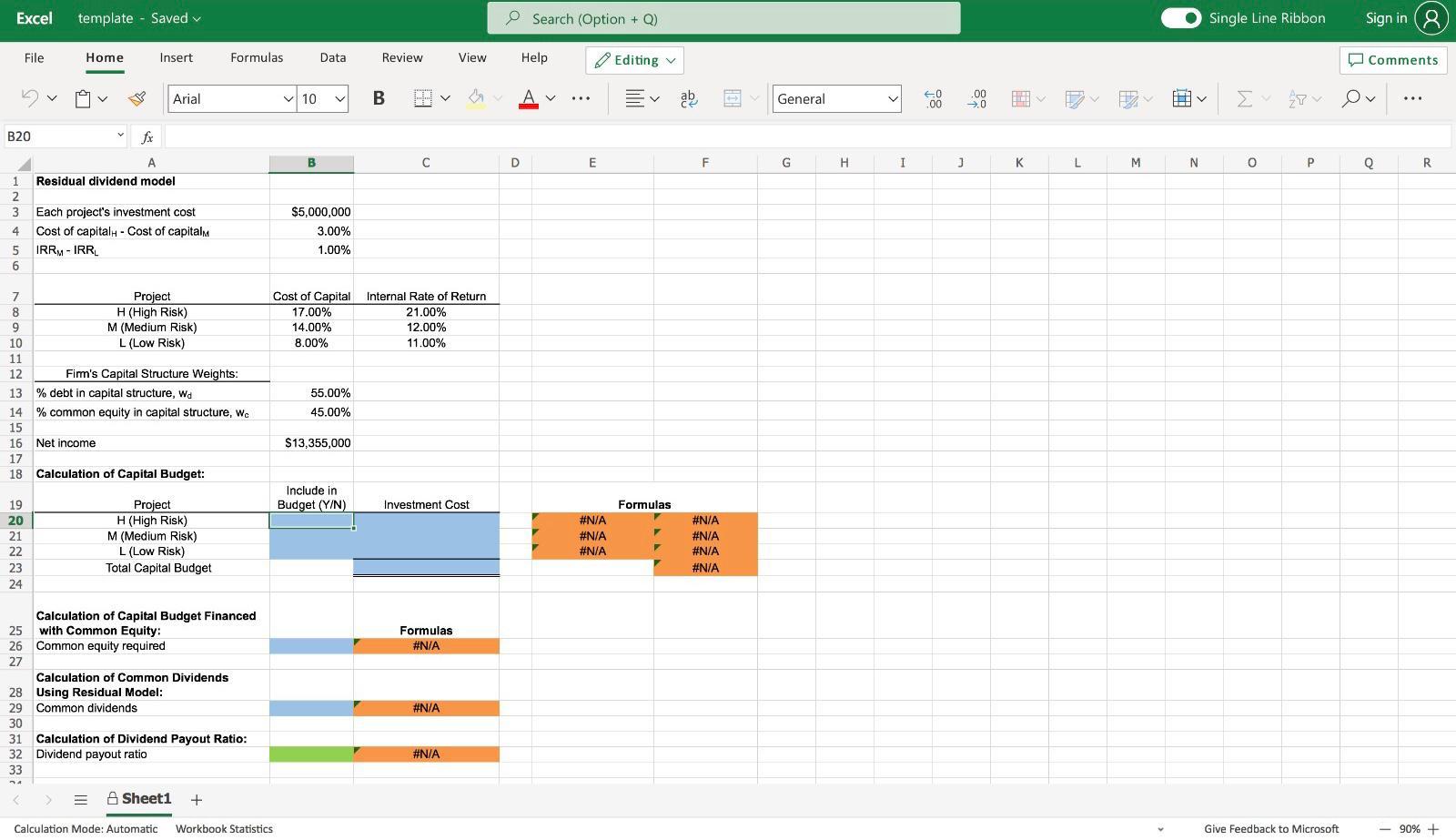

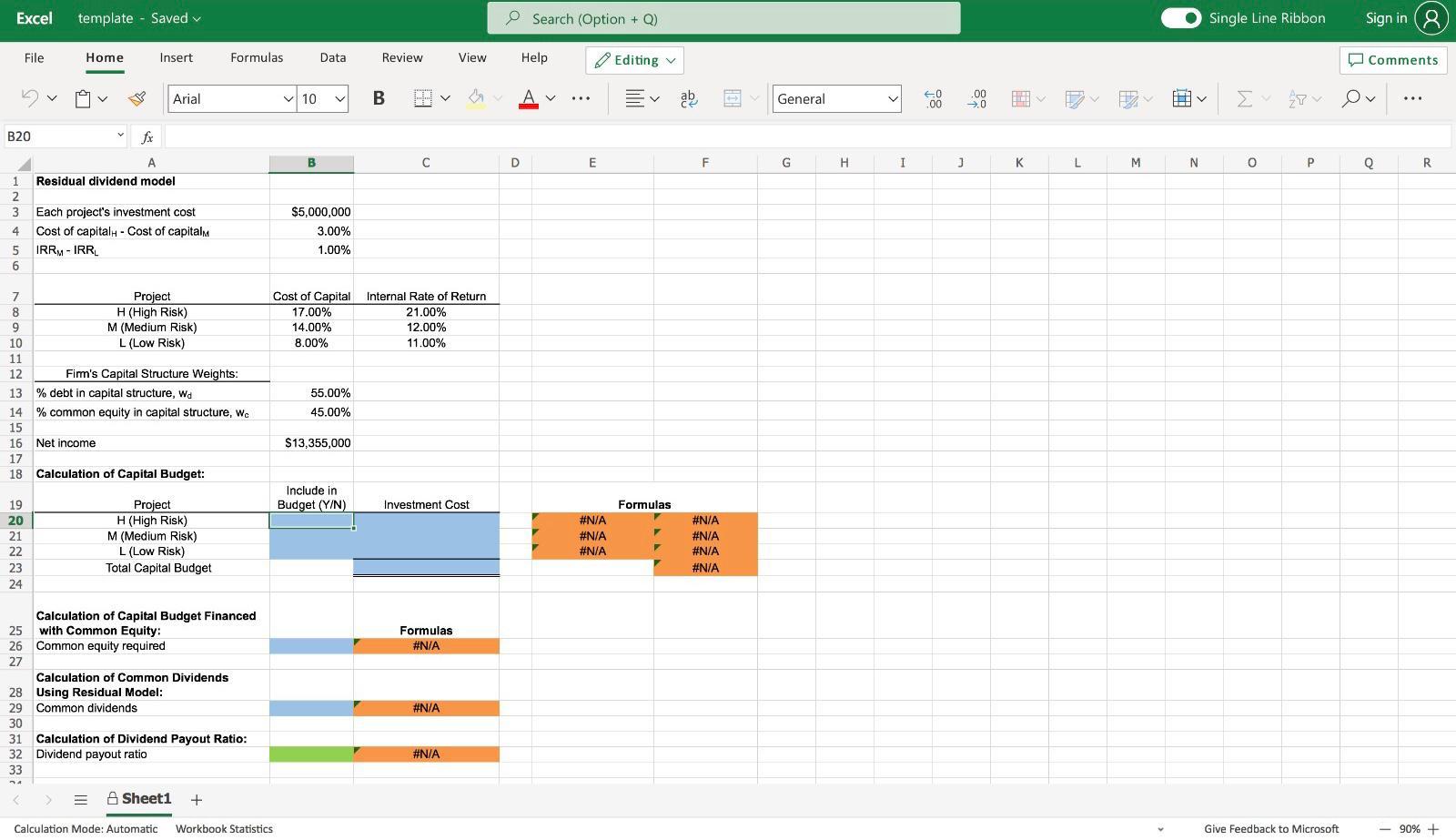

Video Excel Online Structured Activity: Residual dividend model Walsh Company is considering three independent projects, each of which requires a $5 million investment. The estimated internal rate of return (IRR) and cost of capital for these projects are presented below: Project H (High risk): Cost of capital = 17% IRR = 21% Project M (Medium risk): Cost of capital = 14% IRR = 12% Project L (Low risk): Cost of capital = 8% IRR = 11% Note that the projects' costs of capital vary because the projects have different levels of risk. The company's optimal capital structure calls for 55% debt and 45% common equity, and it expects to have net income of $13,355,000. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet If Walsh establishes its dividends from the residual dividend model, what will be its payout ratio? Round your answer to two decimal places. % Check My Work Reset Problem Excel template - Saved v Search (Option +Q Single Line Ribbon Sign in 8 File Home Insert Formulas Data Review View Help Editing Comments Arial V 10 B 7 Av General 60 .00 .00 0 B20 B D E F G H 1 J L M N o P Q R Residual dividend model 1 2 3 4 Each project's investment cost Cost of capital - Cost of capital IRR - IRRL $5,000,000 3.00% 1.00% 5 6 Cost of Capital 17.00% 14.00% 8.00% Internal Rate of Return 21.00% 12.00% 11.00% 7 Project 8 H (High Risk) 9 M (Medium Risk) 10 L (Low Risk) 11 12 Fimm's Capital Structure Weights: 13 % debt in capital structure, Wa 14 % common equity in capital structure, Wa 15 16 Net income 17 18 Calculation of Capital Budget: 55.00% 45.00% $13,355,000 Include in Budget (Y/N) Investment Cost Formulas 19 20 21 22 23 24 Project H (High Risk) M (Medium Risk) L (Low Risk) Total Capital Budget #N/A #N/A #N/A #N/A #N/A #N/A #N/A Formulas #N/A Calculation of Capital Budget Financed 25 with Common Equity: 26 Common equity required 27 Calculation of Common Dividends 28 Using Residual Model: 29 Common dividends 30 31 Calculation of Dividend Payout Ratio: 32 Dividend payout ratio 33 #N/A #N/A A Sheet1 + Calculation Mode: Automatic Workbook Statistics Give Feedback to Microsoft - 90% +