Answered step by step

Verified Expert Solution

Question

1 Approved Answer

> View Assessment Case Study Company X Financ Case Study - Company X Financ New Tab Log In | Course Hero C File C:/Users/jhawk/Downloads/Case%20Study%20-%20Company%20x%20Financial%20Analysis%20(1).pdf

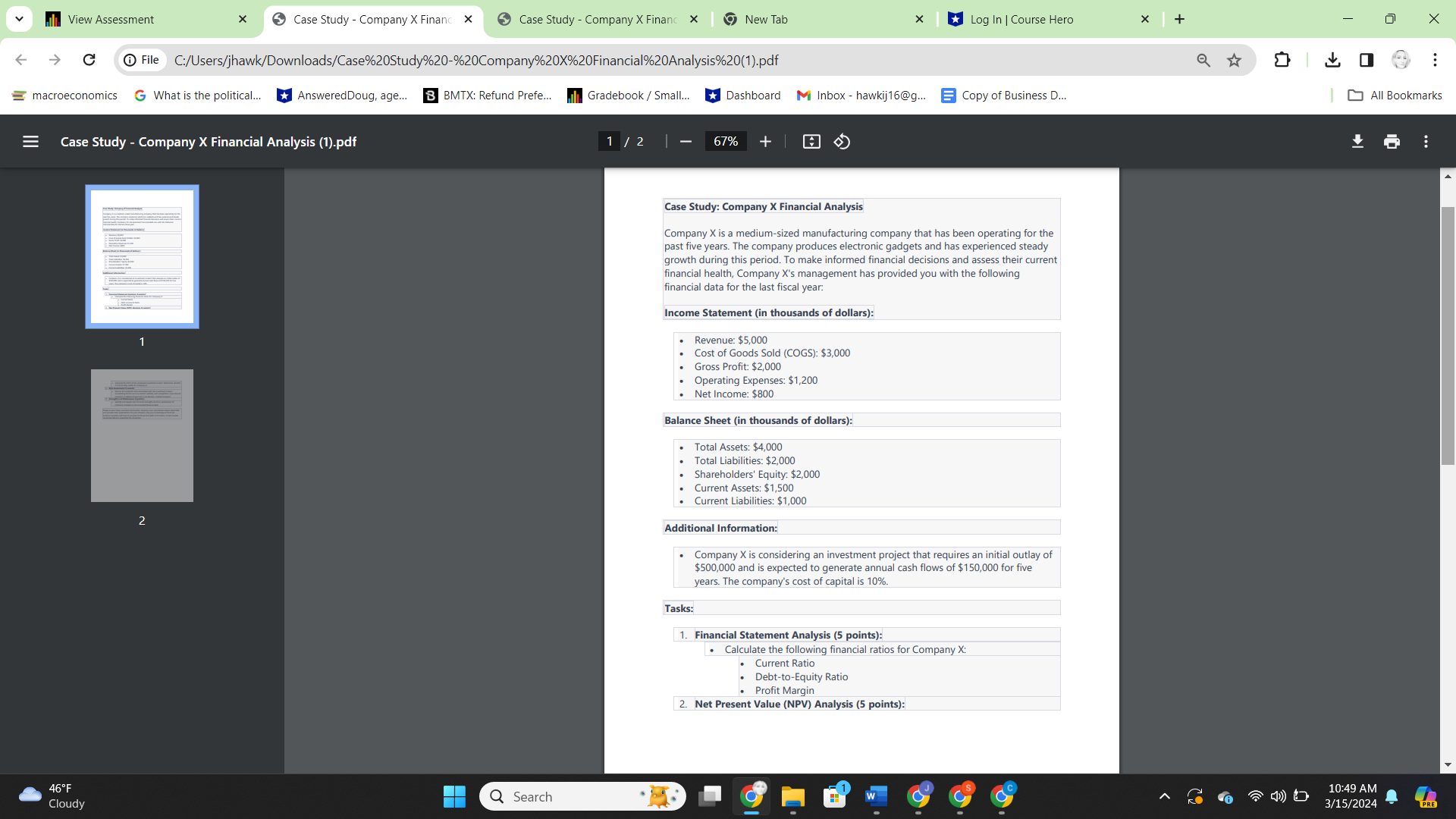

> View Assessment Case Study Company X Financ Case Study - Company X Financ New Tab Log In | Course Hero C File C:/Users/jhawk/Downloads/Case%20Study%20-%20Company%20x%20Financial%20Analysis%20(1).pdf macroeconomics G What is the political... Answered Doug, age... BBMTX: Refund Prefe... Gradebook / Small... Dashboard MInbox hawkij16@g... Copy of Business D... = Case Study - Company X Financial Analysis (1).pdf 1 / 2 67% + A 46F Cloudy 2 Q Search Case Study: Company X Financial Analysis Company X is a medium-sized manufacturing company that has been operating for the past five years. The company produces electronic gadgets and has experienced steady growth during this period. To make informed financial decisions and assess their current financial health, Company X's management has provided you with the following financial data for the last fiscal year: Income Statement (in thousands of dollars): Revenue: $5,000 Cost of Goods Sold (COGS): $3,000 Gross Profit: $2,000 Operating Expenses: $1,200 Net Income: $800 Balance Sheet (in thousands of dollars): . Total Assets: $4,000 Total Liabilities: $2,000 Shareholders' Equity: $2,000 Current Assets: $1,500 Current Liabilities: $1,000 Additional Information: . Tasks: Company X is considering an investment project that requires an initial outlay of $500,000 and is expected to generate annual cash flows of $150,000 for five years. The company's cost of capital is 10%. 1. Financial Statement Analysis (5 points): Calculate the following financial ratios for Company X: Current Ratio Debt-to-Equity Ratio . Profit Margin 2. Net Present Value (NPV) Analysis (5 points): + Q 0 G ... All Bookmarks b 10:49 AM 3/15/2024 PRE > View Assessment Case Study Company X Financ Case Study - Company X Financ New Tab Log In | Course Hero C File C:/Users/jhawk/Downloads/Case%20Study%20-%20Company%20x%20Financial%20Analysis%20(1).pdf Q macroeconomics G What is the political... Answered Doug, age... BBMTX: Refund Prefe... Gradebook / Small... Dashboard M Inbox-hawkij16@g... Copy of Business D... = Case Study - Company X Financial Analysis (1).pdf 46F Cloudy 2 Q Search 2 / 2 67% + Calculate the NPV of the proposed investment project. Determine whether it is financially viable for Company X. 3. Risk Assessment (5 points): Discuss the potential risks associated with the investment project, considering factors such as market volatility and competition. How should Company X address these risks in its decision-making process? 4. Strengths and Weaknesses (5 points): Identify and explain two financial strengths and two weaknesses of Company X based on the provided financial data. Please answer these questions thoroughly, showing your calculations where applicable, and provide clear explanations for your answers. Use your knowledge of financial analysis concepts and tools to analyze the financial health of Company X and provide recommendations regarding the investmen 0 G ... All Bookmarks b 10:49 AM 3/15/2024 PRE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started