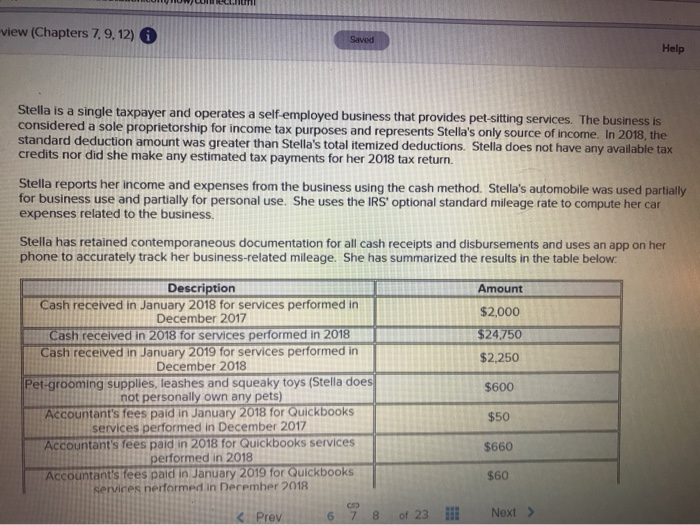

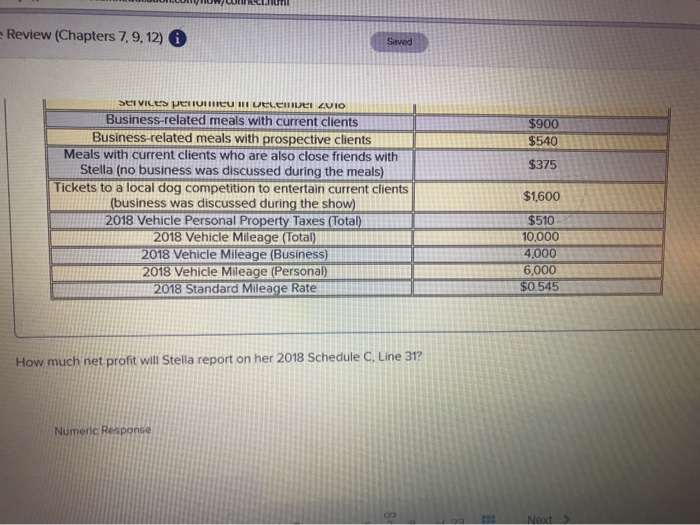

view (Chapters 7,9,12) Help Stella is a single taxpayer and operates a self-employed business that provides pet sitting services. The business is considered a sole proprietorship for income tax purposes and represents Stella's only source of income. In 2018, the standard deduction amount was greater than Stella's total itemized deductions. Stella does not have any available tax credits nor did she make any estimated tax payments for her 2018 tax return. Stella reports her income and expenses from the business using the cash method. Stella's automobile was used partially for business use and partially for personal use. She uses the IRS' optional standard mileage rate to compute her car expenses related to the business Stella has retained contemporaneous documentation for all cash receipts and disbursements and uses an app on her phone to accurately track her business-related mileage. She has summarized the results in the table below: Amount $2,000 $24.750 $2,250 $600 Description Cash received in January 2018 for services performed in December 2017 Cash received in 2018 for services performed in 2018 Cash received in January 2019 for services performed in December 2018 Pet-grooming supplies, leashes and squeaky toys (Stella does not personally own any pets) Accountant's fees paid in January 2018 for Quickbooks services performed in December 2017 Accountant's fees paid in 2018 for Quickbooks services performed in 2018 Accountants lees paid in January 2019 for Quickbooks Services nerformed in December 2018 6 7 8 $50 $660 $60 of 23 Next > I.COMWWW . IN e Review (Chapters 7,9,12) Saved $900 $540 $375 SCIVILES perlu Utlender ZVIO Business-related meals with current clients Business-related meals with prospective clients Meals with current clients who are also close friends with Stella (no business was discussed during the meals) Tickets to a local dog competition to entertain current clients (business was discussed during the show) 2018 Vehicle Personal Property Taxes (Total) 2018 Vehicle Mileage (Total) 2018 Vehicle Mileage (Business) 2018 Vehicle Mileage (Personal) 2018 Standard Mileage Rate $1,600 $510 10,000 4,000 6,000 $0.545 How much net profit will Stella report on her 2018 Schedule C, Line 31? Numeric Response Next view (Chapters 7,9,12) Help Stella is a single taxpayer and operates a self-employed business that provides pet sitting services. The business is considered a sole proprietorship for income tax purposes and represents Stella's only source of income. In 2018, the standard deduction amount was greater than Stella's total itemized deductions. Stella does not have any available tax credits nor did she make any estimated tax payments for her 2018 tax return. Stella reports her income and expenses from the business using the cash method. Stella's automobile was used partially for business use and partially for personal use. She uses the IRS' optional standard mileage rate to compute her car expenses related to the business Stella has retained contemporaneous documentation for all cash receipts and disbursements and uses an app on her phone to accurately track her business-related mileage. She has summarized the results in the table below: Amount $2,000 $24.750 $2,250 $600 Description Cash received in January 2018 for services performed in December 2017 Cash received in 2018 for services performed in 2018 Cash received in January 2019 for services performed in December 2018 Pet-grooming supplies, leashes and squeaky toys (Stella does not personally own any pets) Accountant's fees paid in January 2018 for Quickbooks services performed in December 2017 Accountant's fees paid in 2018 for Quickbooks services performed in 2018 Accountants lees paid in January 2019 for Quickbooks Services nerformed in December 2018 6 7 8 $50 $660 $60 of 23 Next > I.COMWWW . IN e Review (Chapters 7,9,12) Saved $900 $540 $375 SCIVILES perlu Utlender ZVIO Business-related meals with current clients Business-related meals with prospective clients Meals with current clients who are also close friends with Stella (no business was discussed during the meals) Tickets to a local dog competition to entertain current clients (business was discussed during the show) 2018 Vehicle Personal Property Taxes (Total) 2018 Vehicle Mileage (Total) 2018 Vehicle Mileage (Business) 2018 Vehicle Mileage (Personal) 2018 Standard Mileage Rate $1,600 $510 10,000 4,000 6,000 $0.545 How much net profit will Stella report on her 2018 Schedule C, Line 31? Numeric Response Next