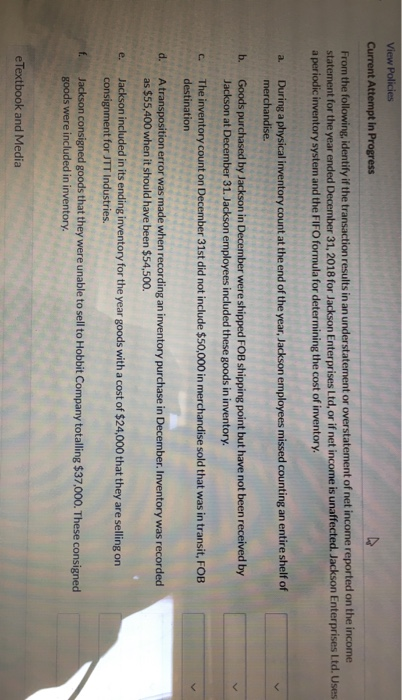

View Policies Current Attempt in Progress From the following, identify if the transaction results in an understatement or overstatement of net income reported on the income statement for the year ended December 31, 2018 for Jackson Enterprises Ltd, or if net income is unaffected. Jackson Enterprises Ltd. Uses a periodic inventory system and the FIFO formula for determining the cost of inventory. a. During a physical inventory count at the end of the year, Jackson employees missed counting an entire shelf of merchandise. b. Goods purchased by Jackson in December were shipped FOB shipping point but have not been received by Jackson at December 31. Jackson employees included these goods in inventory. The inventory count on December 31st did not include $50,000 in merchandise sold that was in transit, FOB destination c. d. A transposition error was made when recording an inventory purchase in December. Inventory was recorded as $55,400 when it should have been $54,500. e. Jackson included in its ending inventory for the year goods with a cost of $24,000 that they are selling on consignment for JTT Industries. Jackson consigned goods that they were unable to sell to Hobbit Company totalling $37,000. These consigned goods were included in inventory. e Textbook and Media View Policies Current Attempt in Progress From the following, identify if the transaction results in an understatement or overstatement of net income reported on the income statement for the year ended December 31, 2018 for Jackson Enterprises Ltd, or if net income is unaffected. Jackson Enterprises Ltd. Uses a periodic inventory system and the FIFO formula for determining the cost of inventory. a. During a physical inventory count at the end of the year, Jackson employees missed counting an entire shelf of merchandise. b. Goods purchased by Jackson in December were shipped FOB shipping point but have not been received by Jackson at December 31. Jackson employees included these goods in inventory. The inventory count on December 31st did not include $50,000 in merchandise sold that was in transit, FOB destination c. d. A transposition error was made when recording an inventory purchase in December. Inventory was recorded as $55,400 when it should have been $54,500. e. Jackson included in its ending inventory for the year goods with a cost of $24,000 that they are selling on consignment for JTT Industries. Jackson consigned goods that they were unable to sell to Hobbit Company totalling $37,000. These consigned goods were included in inventory. e Textbook and Media