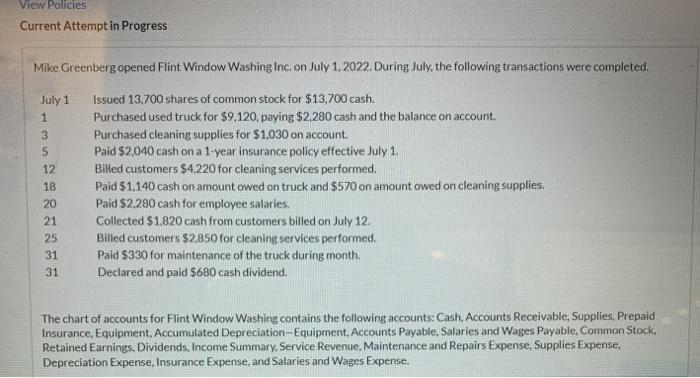

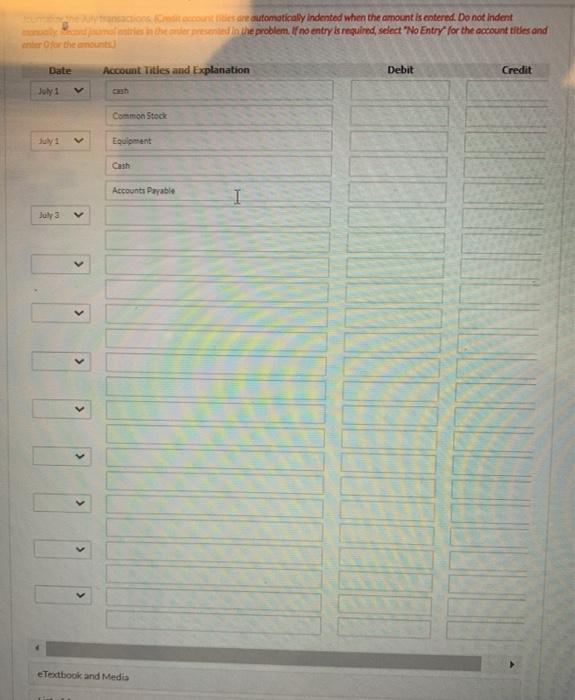

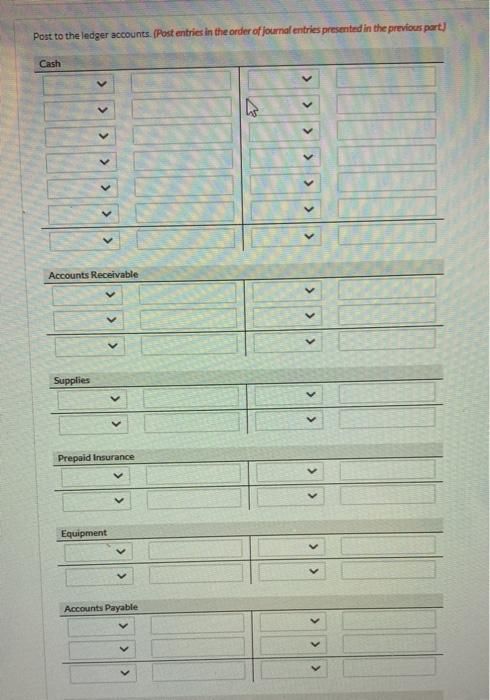

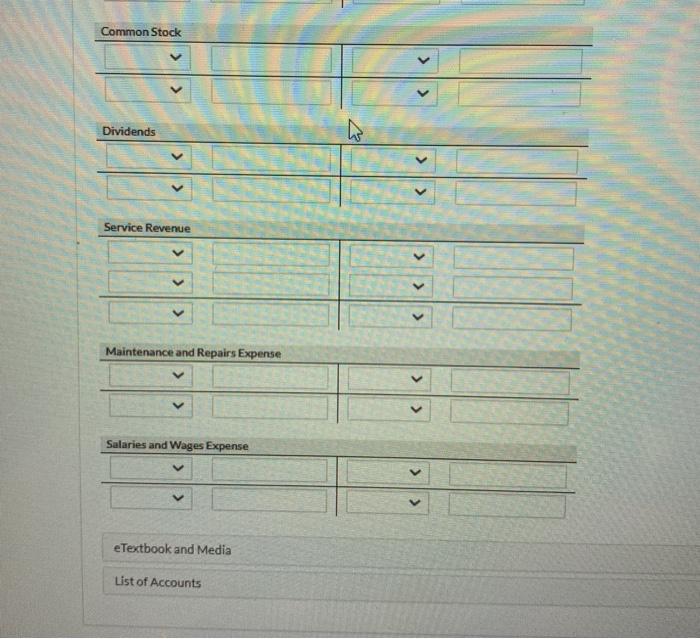

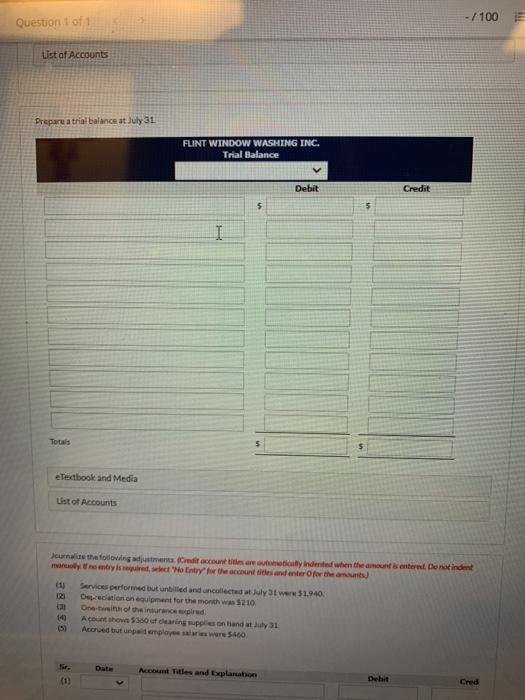

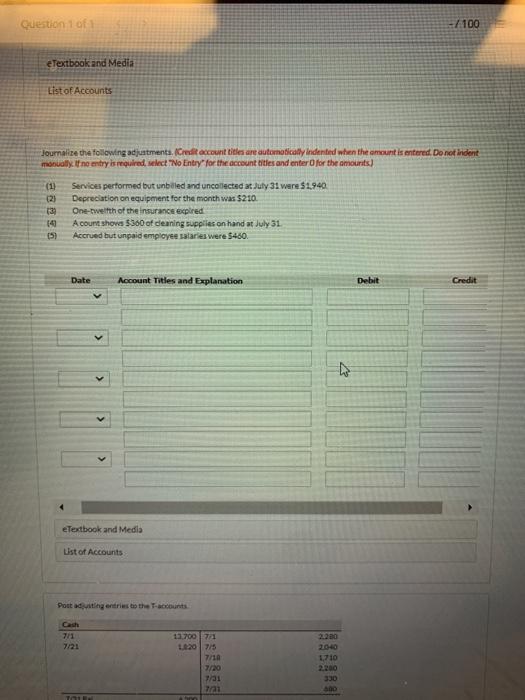

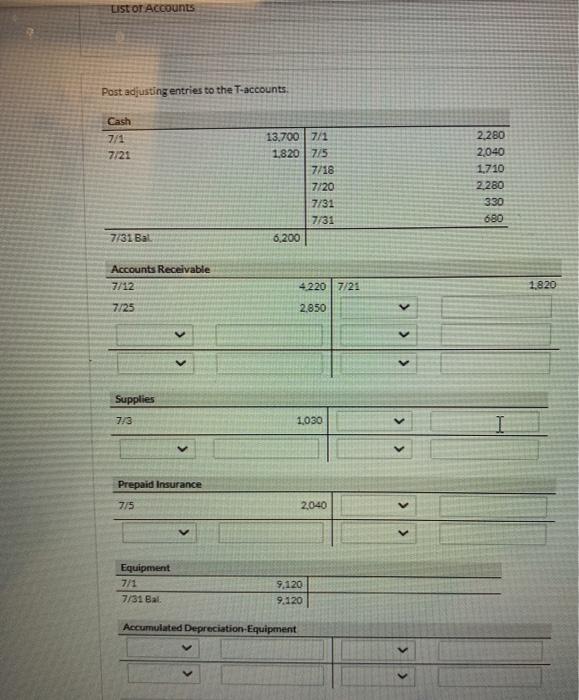

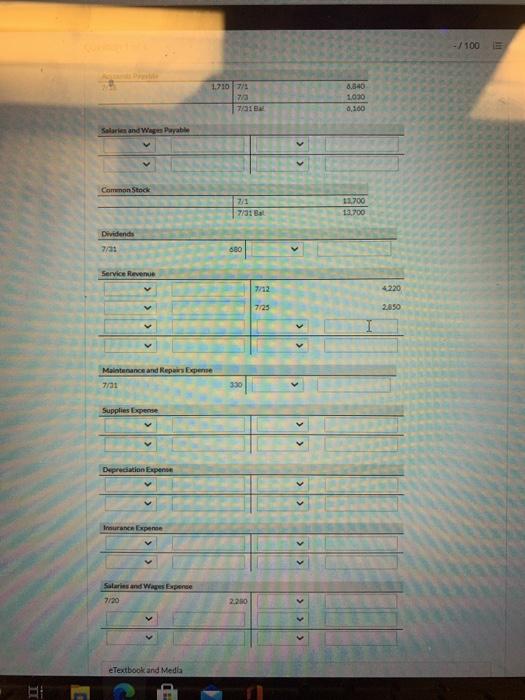

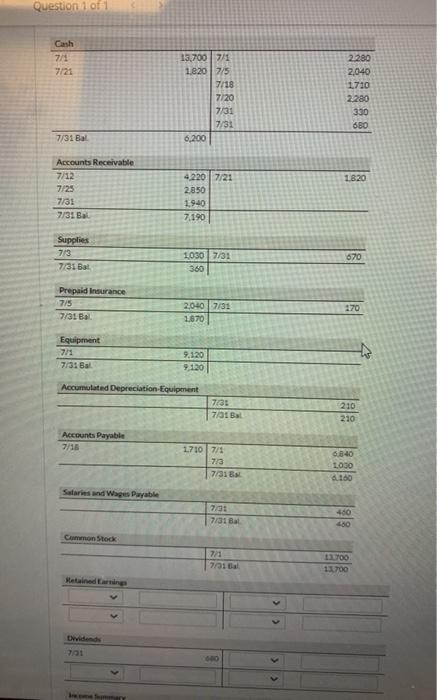

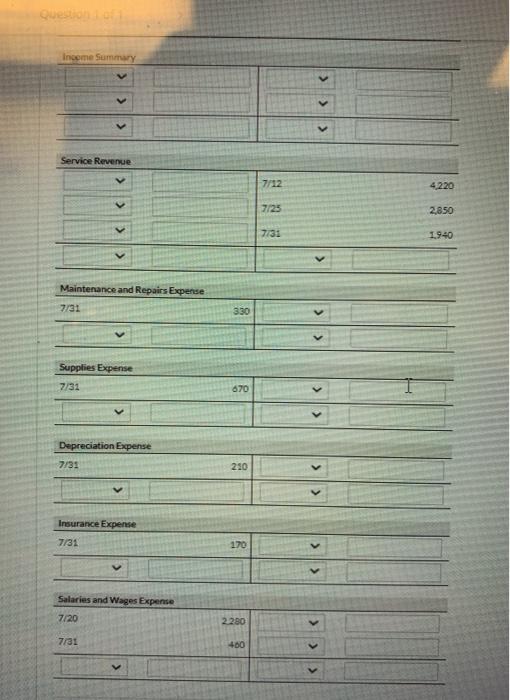

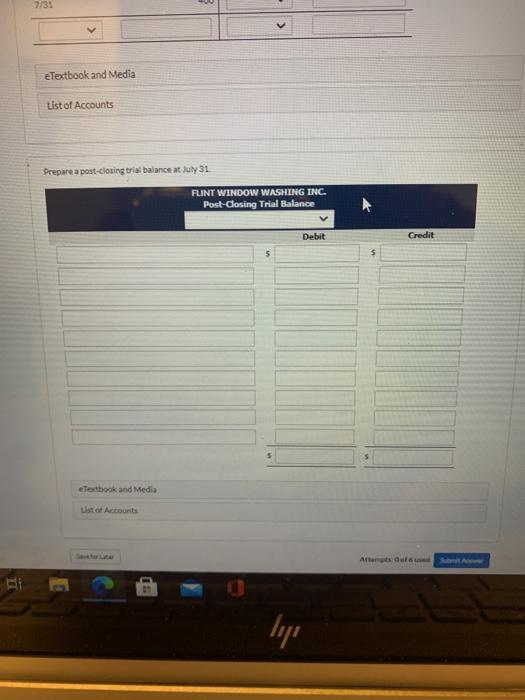

View Policies Current Attempt in Progress Mike Greenberg opened Flint Window Washing Inc on July 1, 2022. During July, the following transactions were completed. July 1 1 3 5 12 18 20 21 25 31 31 Issued 13,700 shares of common stock for $13,700 cash. Purchased used truck for $9,120, paying $2,280 cash and the balance on account. Purchased cleaning supplies for $1,030 on account Paid $2,040 cash on a 1-year insurance policy effective July 1. Billed customers $4.220 for cleaning services performed. Paid $1.140 cash on amount owed on truck and $570 on amount owed on cleaning supplies. Paid $2.280 cash for employee salaries. Collected $1.820 cash from customers billed on July 12. Billed customers $2,850 for cleaning services performed. Paid $330 for maintenance of the truck during month Declared and paid $680 cash dividend. The chart of accounts for Flint Window Washing contains the following accounts: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Equipment, Accumulated Depreciation-Equipment, Accounts Payable, Salaries and Wages Payable. Common Stock Retained Earnings. Dividends, Income Summary, Service Revenue, Maintenance and Repairs Expense, Supplies Expense, Depreciation Expense, Insurance Expense, and Salaries and Wages Expense. tractions contes are automatically indented when the amount is entered. Do not indent artis in the represented in the problem. If no entry is required, select "No Entry for the account titles and cher or the amount Date Account Tities and Explanation Debit Credit July 1 Common Stock July 1 Equipment Cash Accounts Payable I July > > eTextbook and Media Post to the ledger accounts. (Post entries in the order of journal entries presented in the previous part) Cash . > Supplies > Prepaid Insurance Equipment Accounts Payable > > Common Stock Dividends Service Revenue eTextbook and Media List of Accounts Postadstingers to the accounts 7/1 7/21 13,7007/1 1.8207/5 7/16 7/20 7/21 mai 2040 1,710 2200 330 LIST OF Accounts Post adjusting entries to the T-accounts Cash 7/1 7/21 13.700 | 7/2 1.820 7/5 7/18 7/20 7/31 7731 6,200 2.280 2,040 1.710 2.280 330 680 7/31 Bal Accounts Receivable 7/12 42207/23 1,820 7/25 2.850 Supplies 7/3 1,030 I Prepaid Insurance 775 2040 / 100 1,710 7/1 wa 8.340 1.030 6,160 Salaries and Wages Payabile Camon Stock 741 11.700 13.700 Dividence 7/31 680 Service Revenue 7/12 4220 7/25 2,850 Maintenance and Repairs Experte 7/31 330 Supplies Expense Depreciation Experte Insurance Expense Liabilities and Stockholders' Equity Textbook and Media Ust of Accounts ly e Textbook and Media List of Accounts Journalize and post closing entries and complete the closing process. (Credit account bites are automotically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry for the account titles and enter for the amounts. For accounts that have zero ending balance, the entry should be the balance date and zero for the amount) Date Account Titles and Explanation Debit Credit July 31 to close revenue account) July 31 I (To close expense accounts) July 31 (To close net income to retained earnings) July 31 (To dose dividends to retained earnings) Question 1 of 1 Cash 7/ 7/21 13.700 771 1.8207/5 7/18 7/20 7/31 7/31 6.200 2280 2,040 1.710 2.280 350 880 7/31 Bal 1820 Accounts Receivable 7/12 7/23 7731 7/31B 42207/21 2.850 1940 7.190 Supplies 7/3 7/31 Bat 670 10307/31 360 Prepaid Insurance 775 7/31 Bal 2,0407/31 1,870 170 Equipment 7/31 9,120 9,120 Accumulated Depreciation Equipment 7/30 7701 Bal 210 210 Accounts Payable 7/16 1710 7/1 7173 7/31 6.840 1030 4160 Salaries and Wages Puyable 460 480 Con Stock 771 7/31 12700 11.700 Metained in wide 100 Income Summary >