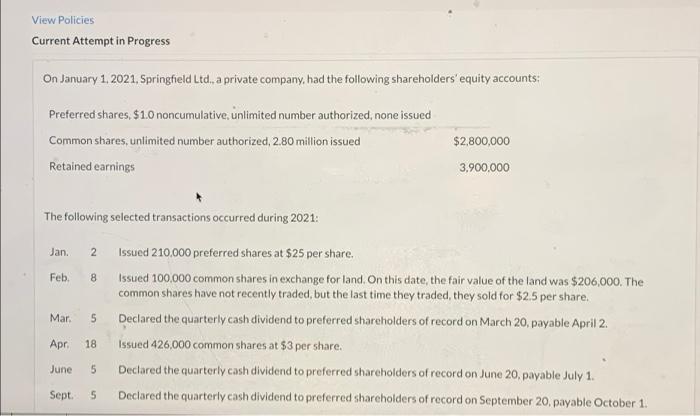

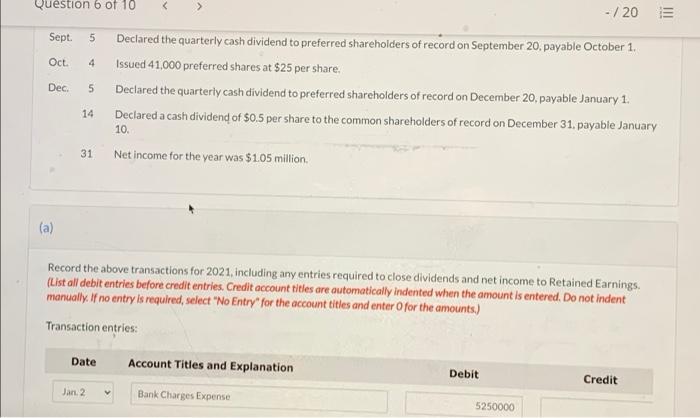

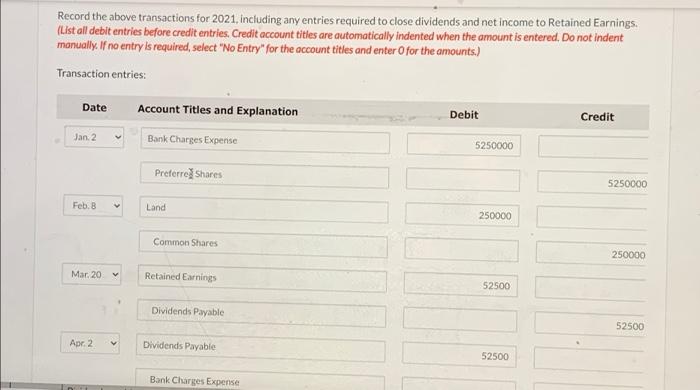

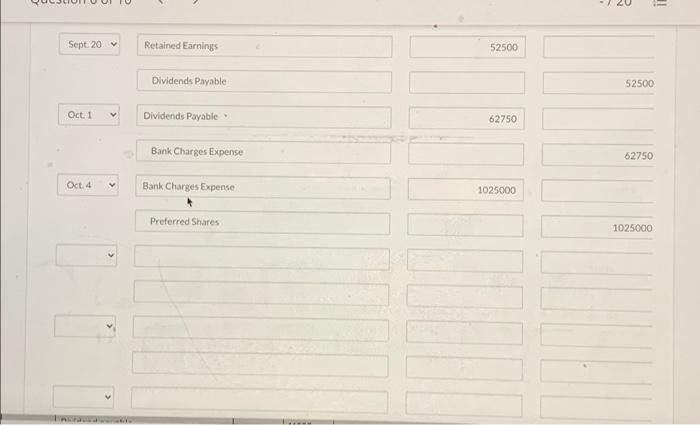

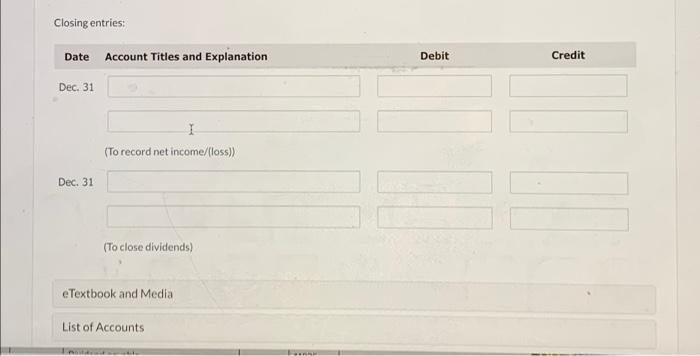

View Policies Current Attempt in Progress On January 1, 2021, Springfield Ltd, a private company. had the following shareholders' equity accounts: Preferred shares. $1.0 noncumulative, unlimited number authorized, none issued Common shares, unlimited number authorized, 2.80 million issued Retained earnings $2,800,000 3.900.000 The following selected transactions occurred during 2021: Jan. 2 Feb 8 Mar 5 Issued 210.000 preferred shares at $25 per share. Issued 100,000 common shares in exchange for land. On this date, the fair value of the land was $206,000. The common shares have not recently traded, but the last time they traded, they sold for $2.5 per share. Declared the quarterly cash dividend to preferred shareholders of record on March 20, payable April 2. Issued 426,000 common shares at $3 per share. Declared the quarterly cash dividend to preferred shareholders of record on June 20, payable July 1. Declared the quarterly cash dividend to preferred shareholders of record on September 20, payable October 1. Apr 18 June 5 Sept. 5 Question 6 of 10 - /20 E Sept. 5 Oct. 4 Declared the quarterly cash dividend to preferred shareholders of record on September 20, payable October 1. Issued 41,000 preferred shares at $25 per share. Declared the quarterly cash dividend to preferred shareholders of record on December 20, payable January 1. Declared a cash dividend of $0.5 per share to the common shareholders of record on December 31. payable January Dec. 5 14 10. 31 Net income for the year was $1.05 million (a) Record the above transactions for 2021, including any entries required to close dividends and net income to Retained Earnings. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Transaction entries: Date Account Titles and Explanation Debit Credit Jan 2 Bank Charges Expense 5250000 Record the above transactions for 2021, including any entries required to close dividends and net income to Retained Earnings. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered, Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Transaction entries: Date Account Titles and Explanation Debit Credit Jan 2 Bank Charges Expense 5250000 Preferre Shares 5250000 Feb. 8 Land 250000 Common Shares 250000 Mar. 20 v Retained Earnings 52500 Dividends Payable 52500 Apr 2 Dividends Payable 52500 Bank Charges Expense - 20 . Sept. 20 Retained Earnings 52500 Dividends Payable 52500 Oct. 1 Dividends Payable 62750 Bank Charges Expense 62750 Oct. 4 Bank Charges Expense 1025000 Preferred Shares 1025000 Closing entries: Date Account Titles and Explanation Debit Credit Dec. 31 I (To record net income/loss)) Dec. 31 (To close dividends) e Textbook and Media List of Accounts