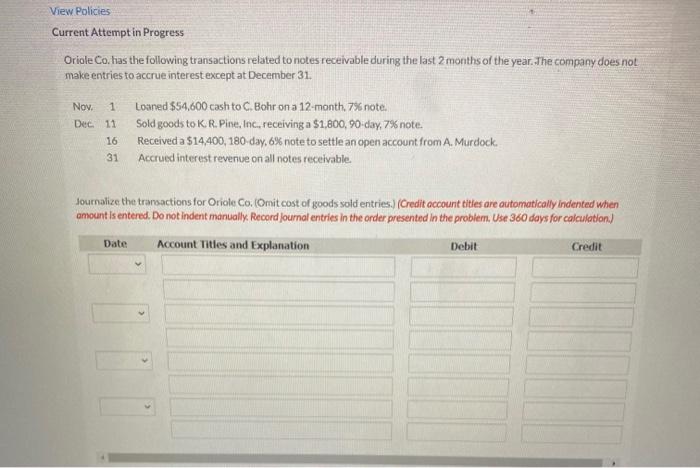

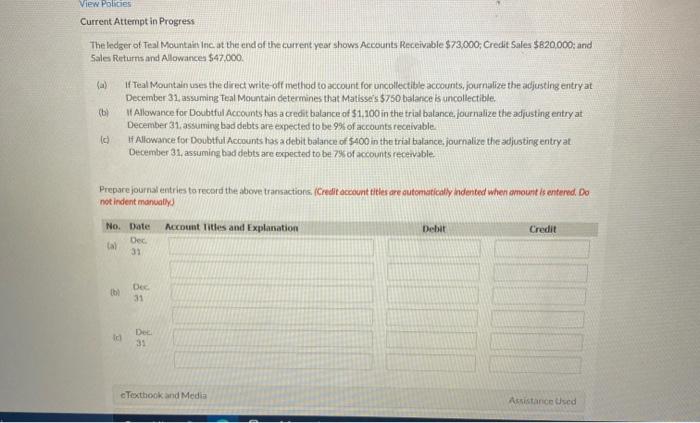

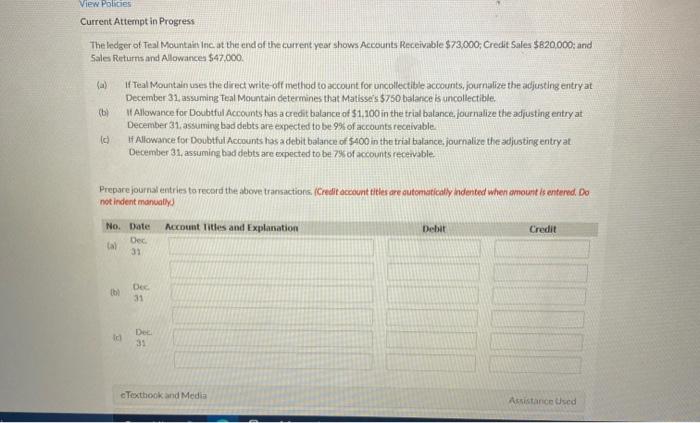

View Policies Current Attempt in Progress Oriole Co. has the following transactions related to notes receivable during the last 2 months of the year. The company does not make entries to accrue interest except at December 31. Nov. 1 Loaned $54,600 cash to Bohr on a 12 month. 76 note. Dec 11 Sold goods to K. R. Pine, Inc., receiving a $1,800, 90-day, 7% note. 16 Received a $14,400, 180 day, 6% note to settle an open account from A. Murdock. 31 Accrued interest revenue on all notes receivable. Journalize the transactions for Oriole Co. (Omit cost of goods sold entries.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Use 360 days for calculation) Date Account Titles and Explanation Debit Credit View Policies Current Attempt in Progress The ledger of Teal Mountain Inc at the end of the current year shows Accounts Receivable $73,000; Credit Sales $820,000 and Sales Returns and Allowances $47.000. If Teal Mountain uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at December 31, assuming Teal Mountain determines that Matissa's $750 balance is uncollectible. (6) Allowance for Doubtful Accounts has a credit balance of $1,100 in the trial balance. Journalize the adjusting entry at December 31, assuming bad debts are expected to be 9% of accounts receivable. Id If Allowance for Doubtful Accounts has a debit balance of $400 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be.7% of accounts receivable Prepare journal entries to record the above transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually Account Titles and Exploration Debit Credit No. Date Dec Cal 31 Dec 31 Id Del 31 Texthook and Media Assistance Used View Policies Current Attempt in Progress The ledger of Teal Mountain Inc at the end of the current year shows Accounts Receivable $73,000; Credit Sales $820,000 and Sales Returns and Allowances $47.000. If Teal Mountain uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at December 31, assuming Teal Mountain determines that Matissa's $750 balance is uncollectible. (6) Allowance for Doubtful Accounts has a credit balance of $1,100 in the trial balance. Journalize the adjusting entry at December 31, assuming bad debts are expected to be 9% of accounts receivable. Id If Allowance for Doubtful Accounts has a debit balance of $400 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be.7% of accounts receivable Prepare journal entries to record the above transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually Account Titles and Exploration Debit Credit No. Date Dec Cal 31 Dec 31 Id Del 31 Texthook and Media Assistance Used