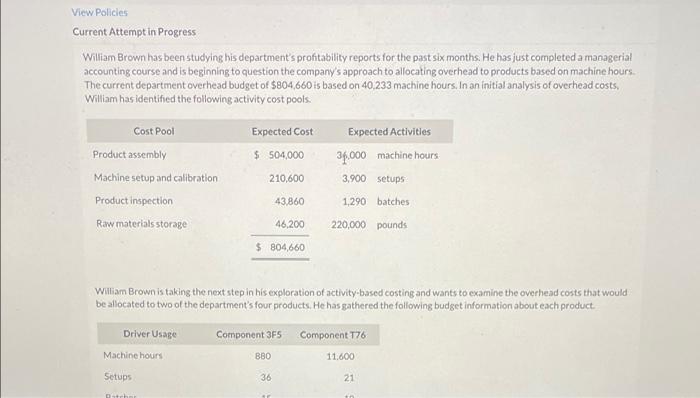

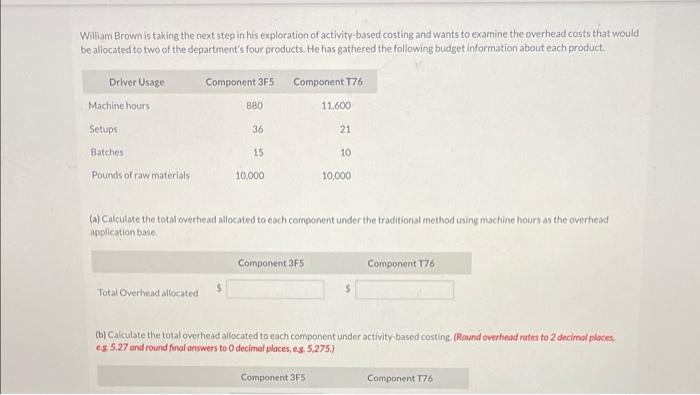

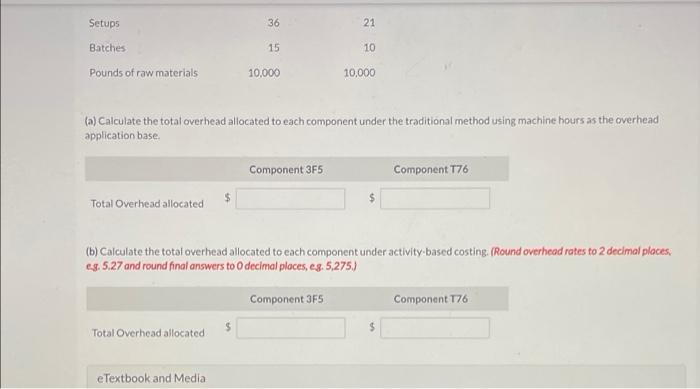

View Policies Current Attempt in Progress William Brown has been studying his departments profitability reports for the past six months. He has just completed a managerial accounting course and is beginning to question the company's approach to allocating overhead to products based on machine hours The current department overhead budget of $804,660 is based on 40,233 machine hours. In an initial analysis of overhead costs, William has identified the following activity cost pools. Expected Cost Expected Activitles 37.000 machine hours $504,000 Cost Pool Product assembly Machine setup and calibration Product inspection Raw materials storage 210,600 3,900 Setups 43.860 1,290 batches 46,200 220,000 pounds $ 804,660 William Brown is taking the next step in his exploration of activity-based costing and wants to examine the overhead costs that would be allocated to two of the department's four products. He has gathered the following budget information about each product Driver Usage Component 35 Component 776 Machine hours BB0 11.600 Setups 36 21 Dutch William Brown is taking the next step in his exploration of activity-based costing and wants to examine the overhead costs that would be allocated to two of the department's four products. He has gathered the following budget information about each product Driver Usage Component 3F5 Component T76 Machine hours 880 11.600 Setups 36 21 Batches 15 10 Pounds of raw materials 10.000 10,000 (a) Calculate the total overhead allocated to each component under the traditional method using machine hours as the overhead application base Component 3F5 Component 176 Total Overhead allocated (b) Calculate the total overhead allocated to each component under activity based costing (Round overhead rates to 2 decimal places 6.3. 5.27 and round final answers to decimal places, es, 5,275) Component 3FS Component 176 Setups 36 21 Batches 15 10 Pounds of raw materials 10,000 10,000 (a) Calculate the total overhead allocated to each component under the traditional method using machine hours as the overhead application base Component 3F5 Component 176 $ $ Total Overhead allocated (b) Calculate the total overhead allocated to each component under activity based costing (Round overhead rates to 2 decimal places, e. 5.27 and round final answers to decimal places, eg,5,275) Component 3F5 Component 176 $ Total Overhead allocated eTextbook and Media