Answered step by step

Verified Expert Solution

Question

1 Approved Answer

View Policies Current Attempt in Progress Within a large rental corporation where the commercial rental segment dominated, Gary managed the residential rental segment. Gary enjoyed

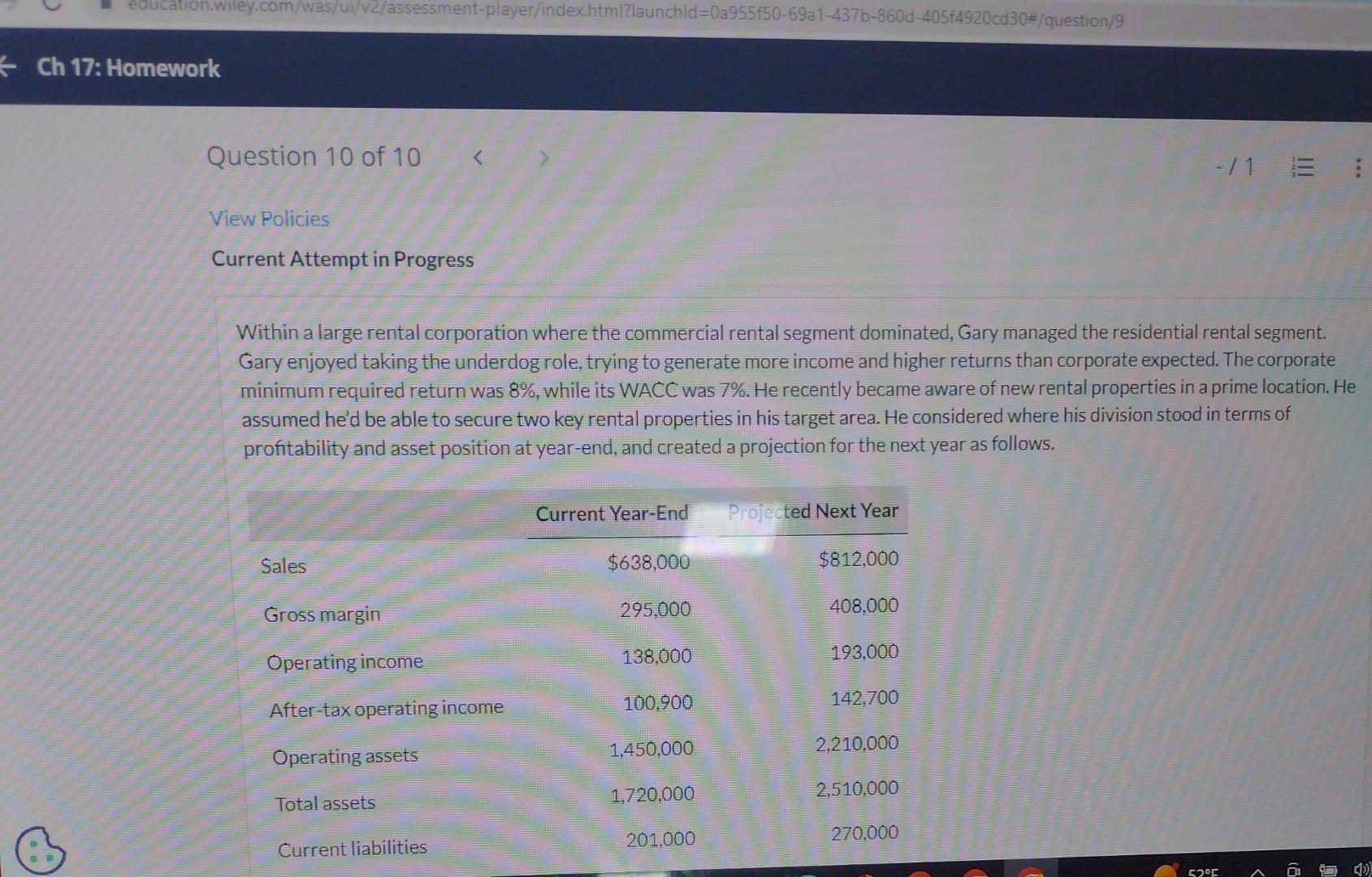

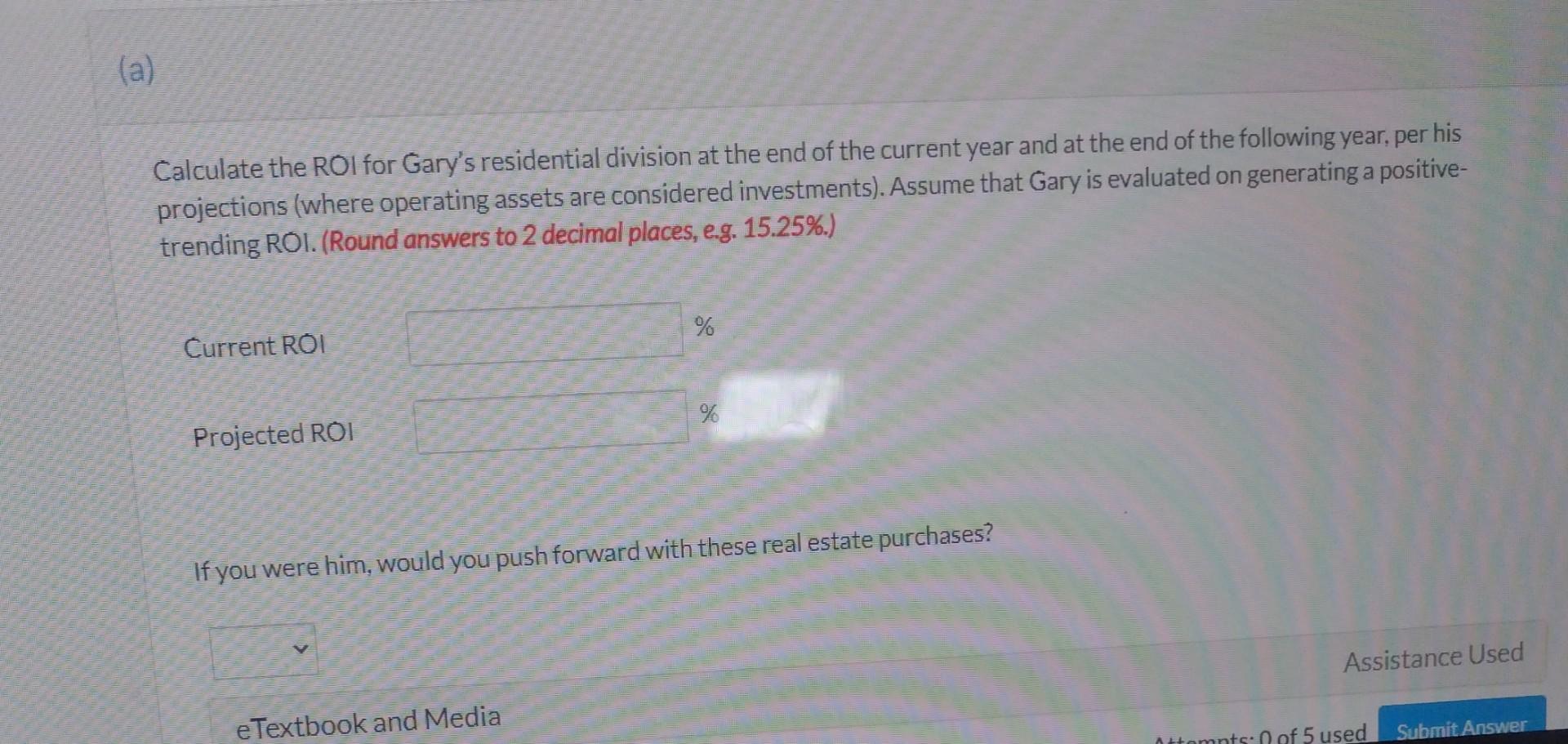

View Policies Current Attempt in Progress Within a large rental corporation where the commercial rental segment dominated, Gary managed the residential rental segment. Gary enjoyed taking the underdog role, trying to generate more income and higher returns than corporate expected. The corporate minimum required return was 8%, while its WACC was 7%. He recently became aware of new rental properties in a prime location. He assumed he'd be able to secure two key rental properties in his target area. He considered where his division stood in terms of profitability and asset position at year-end, and created a projection for the next year as follows. Calculate the ROl for Gary's residential division at the end of the current year and at the end of the following year, per his projections (where operating assets are considered investments). Assume that Gary is evaluated on generating a positivetrending ROI. (Round answers to 2 decimal places, e.g. 15.25\%.) Current ROI Projected ROI If you were him, would you push forward with these real estate purchases? The parts of this question must be completed in order. This part will be available when you complete the part above. (C) The parts of this question must be completed in order. This part will be available when you complete the part above. (d) The parts of this question must be completed in order. This part will be available when you complete the part above. View Policies Current Attempt in Progress Within a large rental corporation where the commercial rental segment dominated, Gary managed the residential rental segment. Gary enjoyed taking the underdog role, trying to generate more income and higher returns than corporate expected. The corporate minimum required return was 8%, while its WACC was 7%. He recently became aware of new rental properties in a prime location. He assumed he'd be able to secure two key rental properties in his target area. He considered where his division stood in terms of profitability and asset position at year-end, and created a projection for the next year as follows. Calculate the ROl for Gary's residential division at the end of the current year and at the end of the following year, per his projections (where operating assets are considered investments). Assume that Gary is evaluated on generating a positivetrending ROI. (Round answers to 2 decimal places, e.g. 15.25\%.) Current ROI Projected ROI If you were him, would you push forward with these real estate purchases? The parts of this question must be completed in order. This part will be available when you complete the part above. (C) The parts of this question must be completed in order. This part will be available when you complete the part above. (d) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started