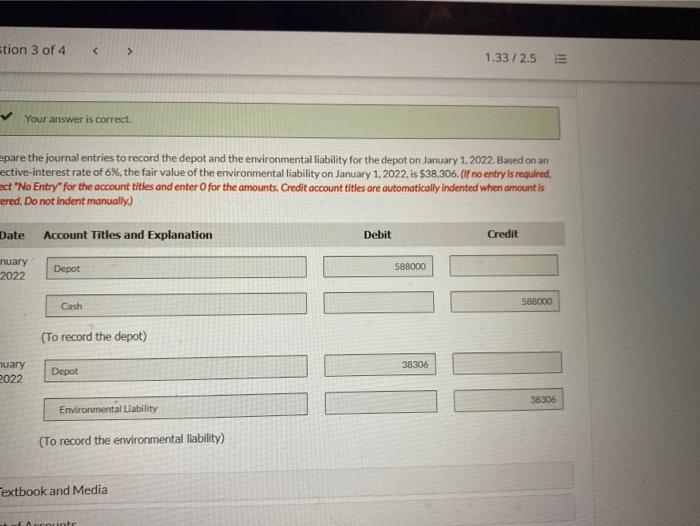

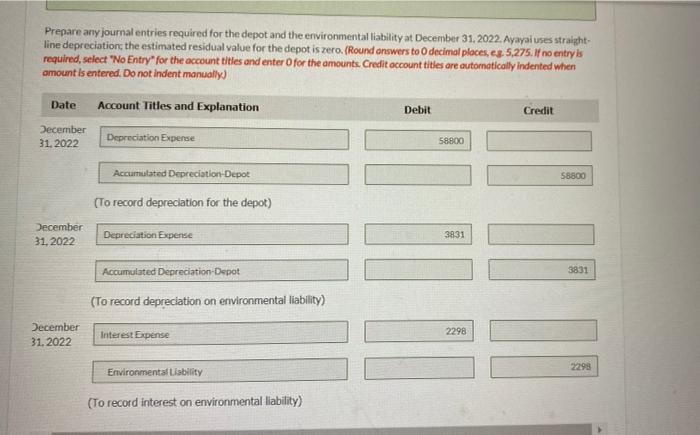

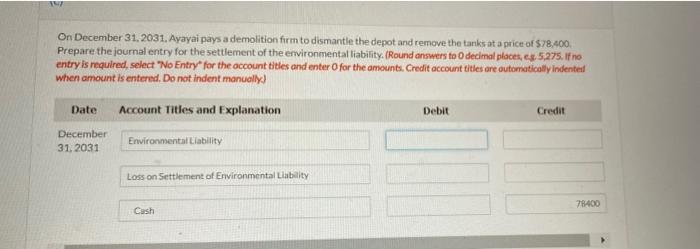

View Policies Show Attempt History Current Attempt in Progress Ayayai Company purchases an oil tanker depot on January 1, 2022, at a cost of $588,000. Ayayal expects to operate the depot for 10 years, at which time it is legally required to dismantle the depot and remove the underground storage tanks. It is estimated that it will cost $68,600 to dismantle the depot and remove the tanks at the end of the depot's useful life (a) Your answer is correct. stion 3 of 4 1.33/2.5 III Your answer is correct. epare the journal entries to record the depot and the environmental liability for the depot on January 1, 2022. Based on an ective-interest rate of 6%, the fair value of the environmental liability on January 1, 2022, is $38,306. Of no entry is required, act "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is ered. Do not indent manually) Date Account Titles and Explanation Debit Credit nuary 2022 Depot 588000 588000 Cash (To record the depot) 38306 nuary 2022 Depot 38306 Environmental Liability (To record the environmental liability) extbook and Media Anunts Prepare any journal entries required for the depot and the environmental liability at December 31, 2022. Ayayai uses straight- line depreciation, the estimated residual value for the depot is zero. (Round answers to decimal places, es 5,275. If no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit December 31. 2022 Depreciation Expense 58800 Accumulated Depreciation-Depot 58800 (To record depreciation for the depot) December 31, 2022 Depreciation Expense 3831 Accumulated Depreciation-Depot 3831 (To record depreciation on environmental liability) December 2298 Interest Expense 31.2022 2298 Environmental Liability (To record interest on environmental liability) On December 31, 2031. Ayayai pays a demolition form to dismantle the depot and remove the tanks at a price of $78,400. Prepare the journal entry for the settlement of the environmental liability. (Round answers to decimal places, s 5,275. If no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit December 31. 2031 Environmental Liability Loss on Settlement of Environmental Liability 78400 Cash