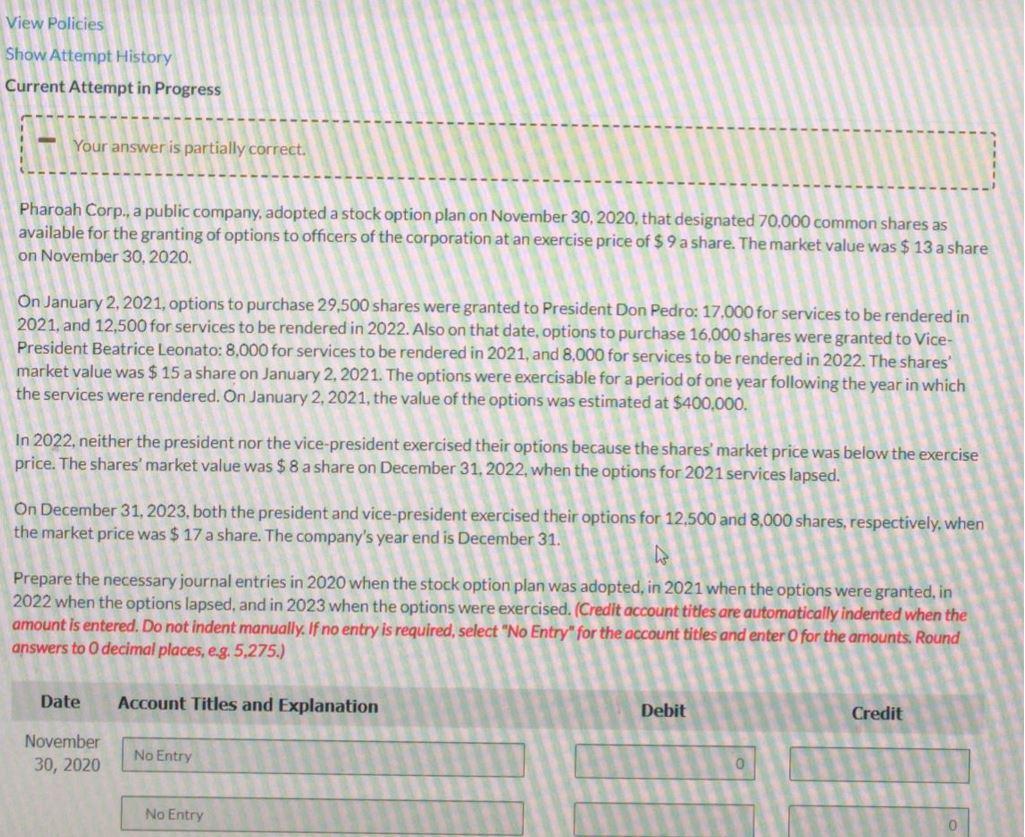

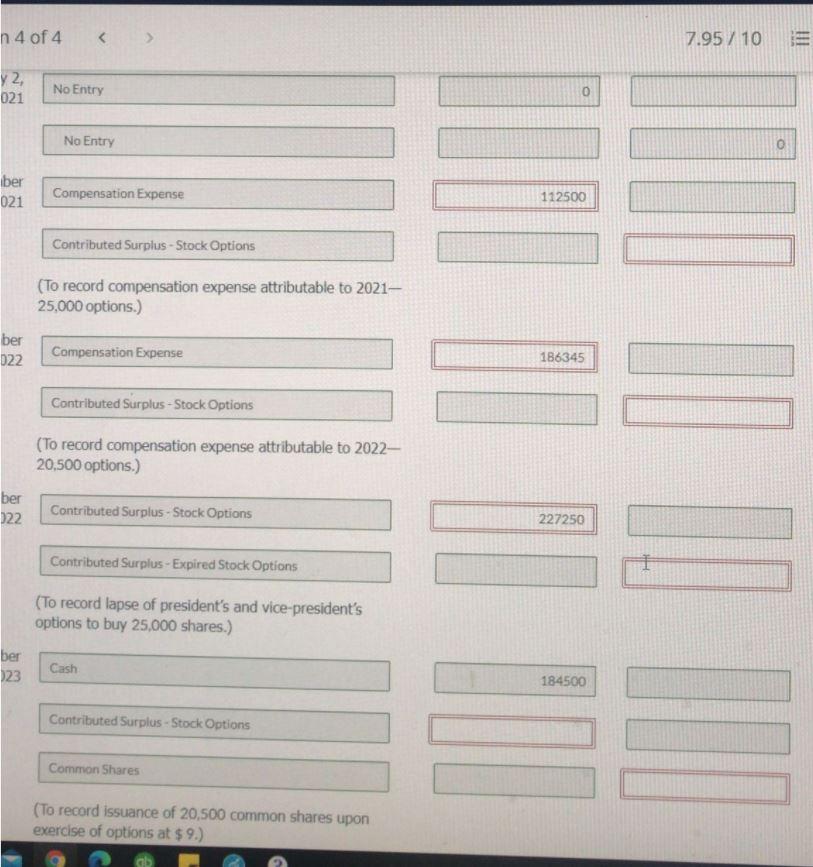

View Policies Show Attempt History Current Attempt in Progress Your answer is partially correct. Pharoah Corp., a public company, adopted a stock option plan on November 30, 2020, that designated 70,000 common shares as available for the granting of options to officers of the corporation at an exercise price of $ 9 a share. The market value was $13 a share on November 30, 2020. On January 2, 2021, options to purchase 29,500 shares were granted to President Don Pedro: 17.000 for services to be rendered in 2021, and 12,500 for services to be rendered in 2022. Also on that date, options to purchase 16,000 shares were granted to Vice- President Beatrice Leonato: 8,000 for services to be rendered in 2021, and 8,000 for services to be rendered in 2022. The shares market value was $15 a share on January 2, 2021. The options were exercisable for a period of one year following the year in which the services were rendered. On January 2, 2021, the value of the options was estimated at $400.000. In 2022, neither the president nor the vice-president exercised their options because the shares' market price was below the exercise price. The shares' market value was $ 8 a share on December 31, 2022, when the options for 2021 services lapsed. On December 31, 2023. both the president and vice-president exercised their options for 12,500 and 8,000 shares, respectively, when the market price was $17 a share. The company's year end is December 31. Prepare the necessary journal entries in 2020 when the stock option plan was adopted, in 2021 when the options were granted, in 2022 when the options lapsed, and in 2023 when the options were exercised. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit November 30, 2020 No Entry No Entry 0 n 4 of 4 7.95 / 10 E 72, 021 No Entry 0 No Entry ber 021 Compensation Expense 112500 Contributed Surplus - Stock Options (To record compensation expense attributable to 2021 25,000 options.) ber 022 Compensation Expense 186345 Contributed Surplus - Stock Options (To record compensation expense attributable to 2022 20,500 options.) ber 122 Contributed Surplus - Stock Options 227250 I. Contributed Surplus - Expired Stock Options (To record lapse of president's and vice-president's options to buy 25,000 shares.) ber 123 Cash 184500 Contributed Surplus - Stock Options Common Shares (To record issuance of 20,500 common shares upon exercise of options at $9.)