Answered step by step

Verified Expert Solution

Question

1 Approved Answer

View Preview File Edit View Go Tools Window Help K II > pdf-50.pdf (page 4 of 20) Zoom Share Question 3 6 * 100%

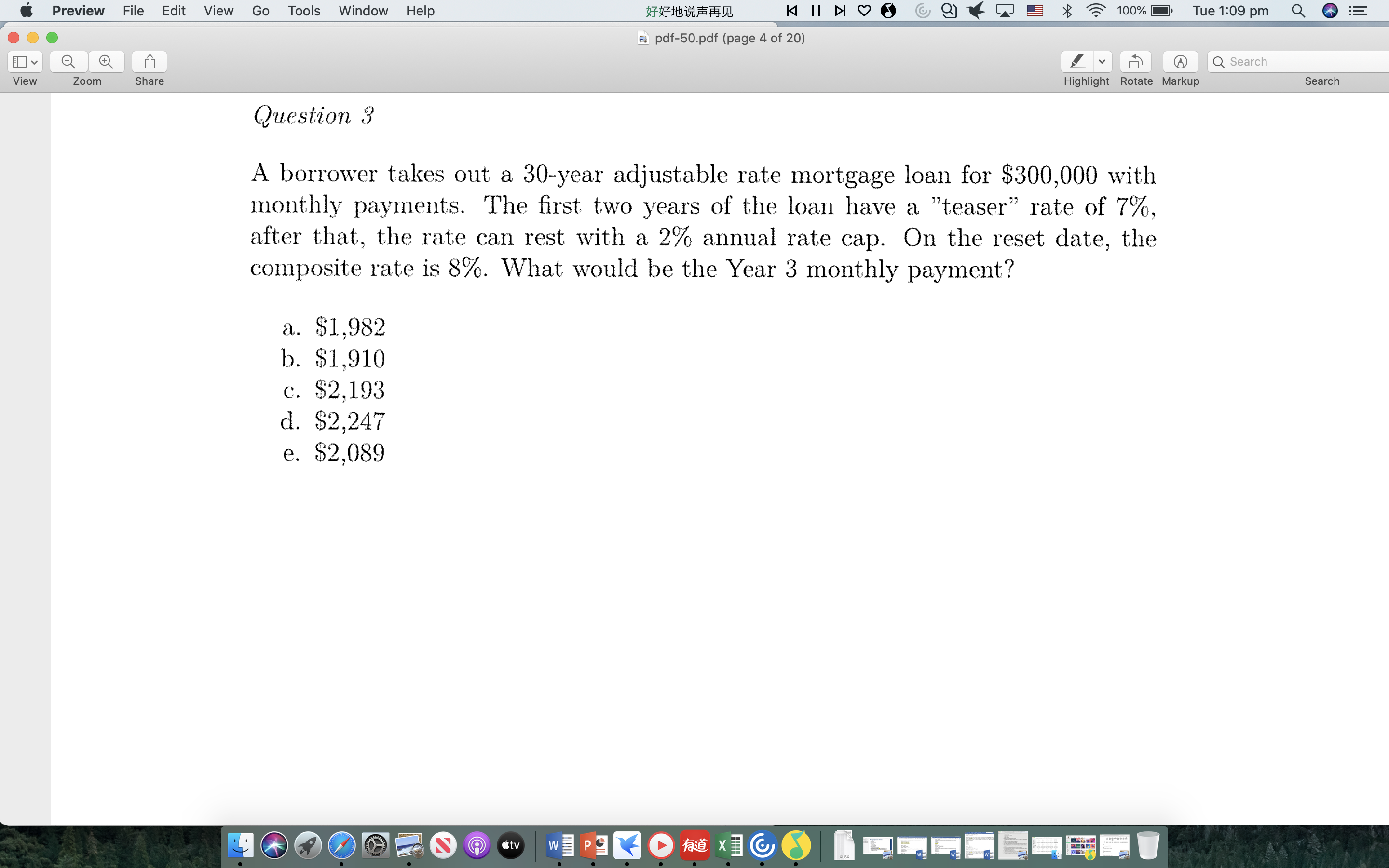

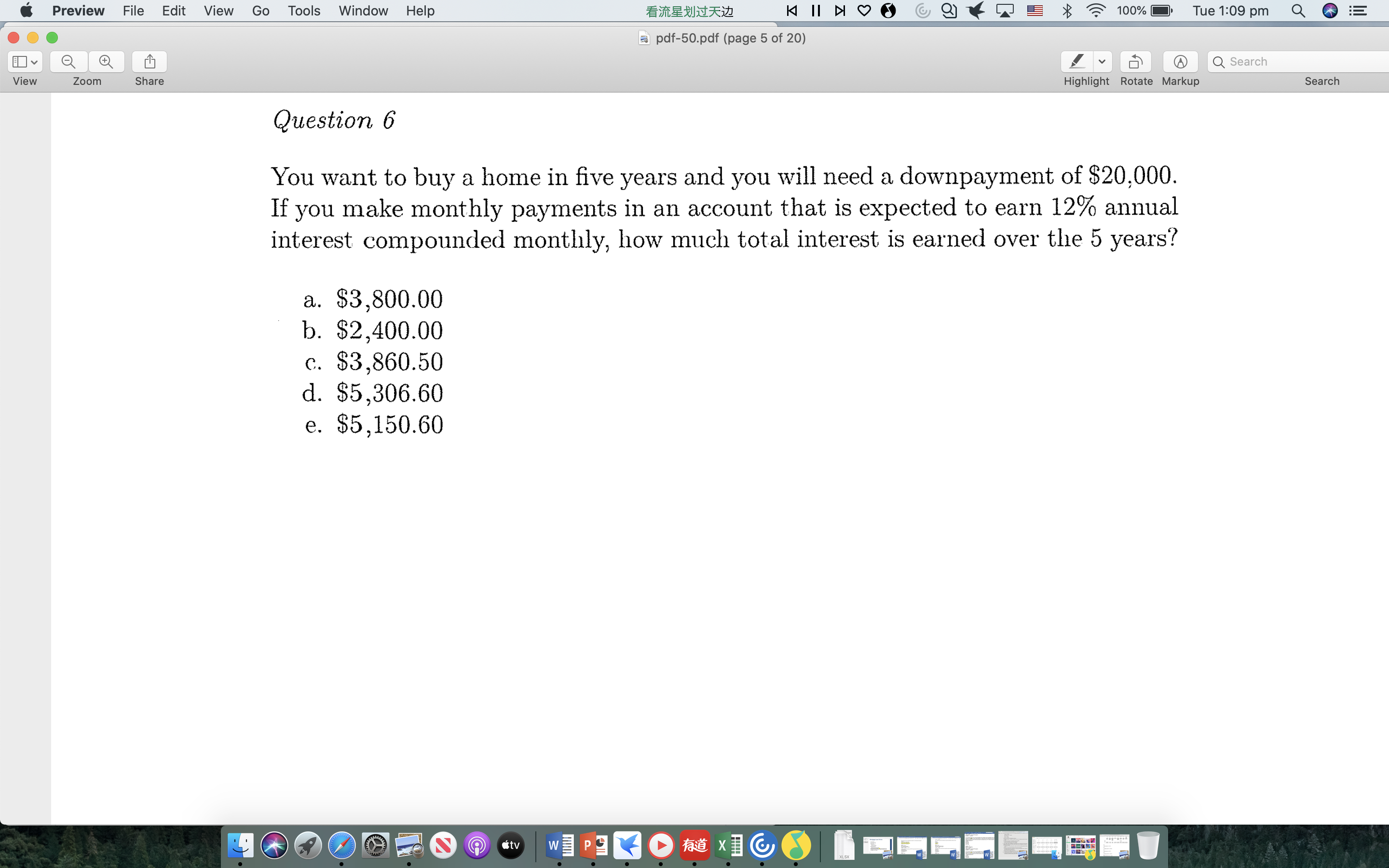

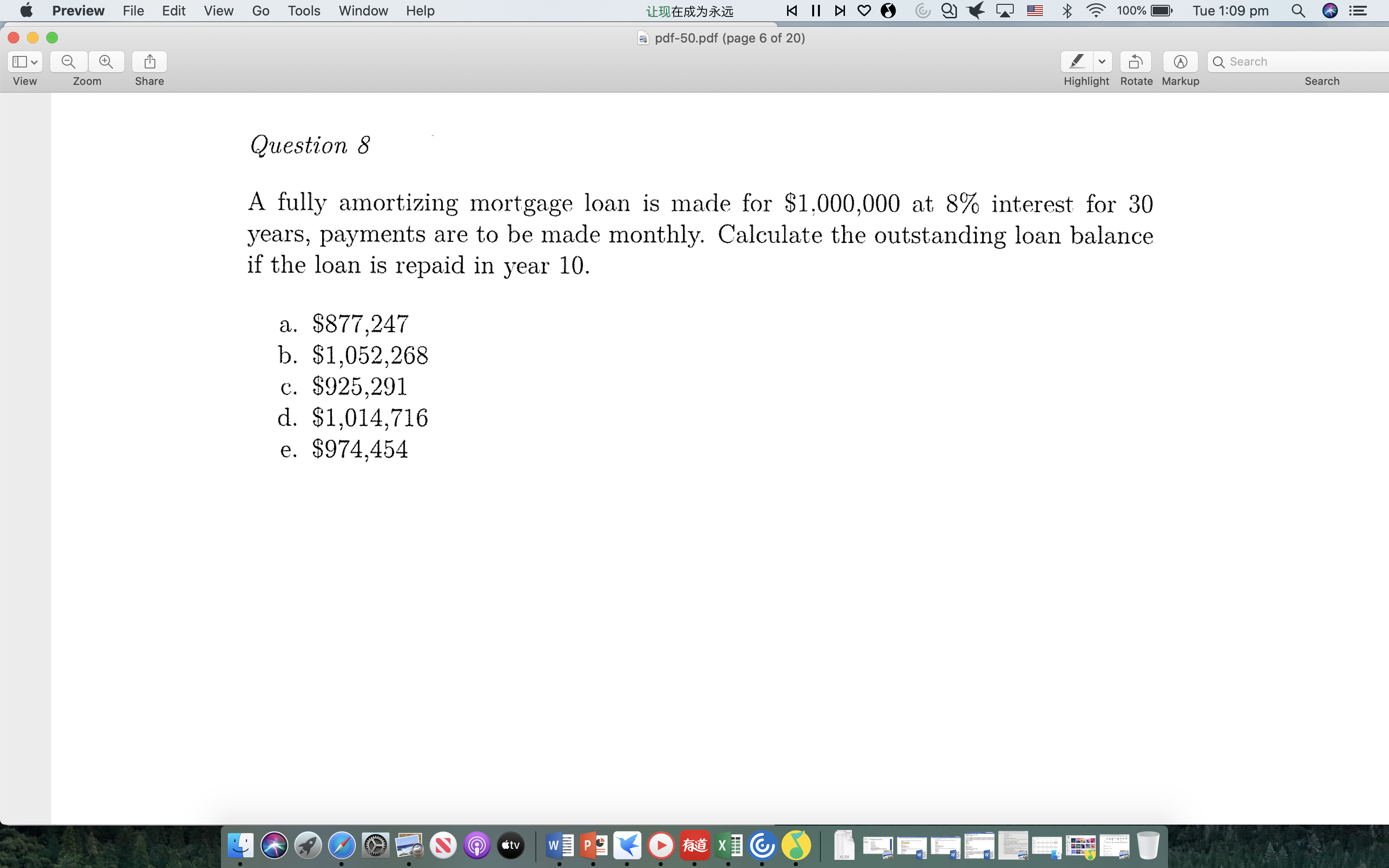

View Preview File Edit View Go Tools Window Help K II > pdf-50.pdf (page 4 of 20) Zoom Share Question 3 6 * 100% Tue 1:09 pm Highlight Rotate Markup Search Search A borrower takes out a 30-year adjustable rate mortgage loan for $300,000 with monthly payments. The first two years of the loan have a "teaser" rate of 7%, after that, the rate can rest with a 2% annual rate cap. On the reset date, the composite rate is 8%. What would be the Year 3 monthly payment? a. $1,982 b. $1,910 c. $2,193 d. $2,247 e. $2,089 View Preview K II N pdf-50.pdf (page 5 of 20) File Edit View Go Tools Window Help Zoom Share Question 6 6 * 100% Tue 1:09 pm Highlight Rotate Markup Search Search You want to buy a home in five years and you will need a downpayment of $20,000. If you make monthly payments in an account that is expected to earn 12% annual interest compounded monthly, how much total interest is earned over the 5 years? a. $3,800.00 b. $2,400.00 c. $3,860.50 d. $5,306.60 e. $5,150.60 View Preview K II N pdf-50.pdf (page 6 of 20) File Edit View Go Tools Window Help Zoom Share Question 8 6 * 100% Tue 1:09 pm Search Highlight Rotate Markup Search A fully amortizing mortgage loan is made for $1,000,000 at 8% interest for 30 years, payments are to be made monthly. Calculate the outstanding loan balance if the loan is repaid in year 10. a. $877,247 b. $1,052,268 c. $925,291 d. $1,014,716 e. $974,454

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started