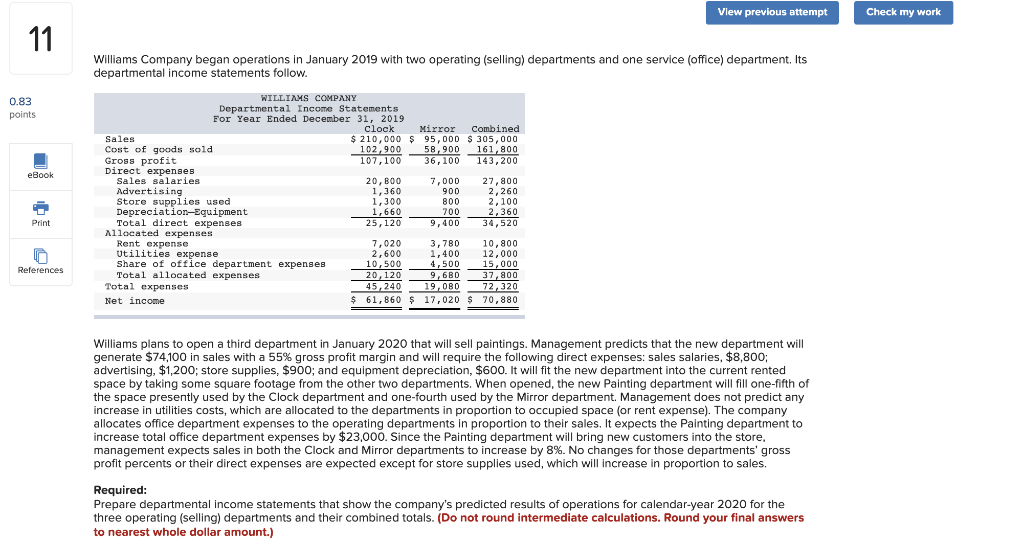

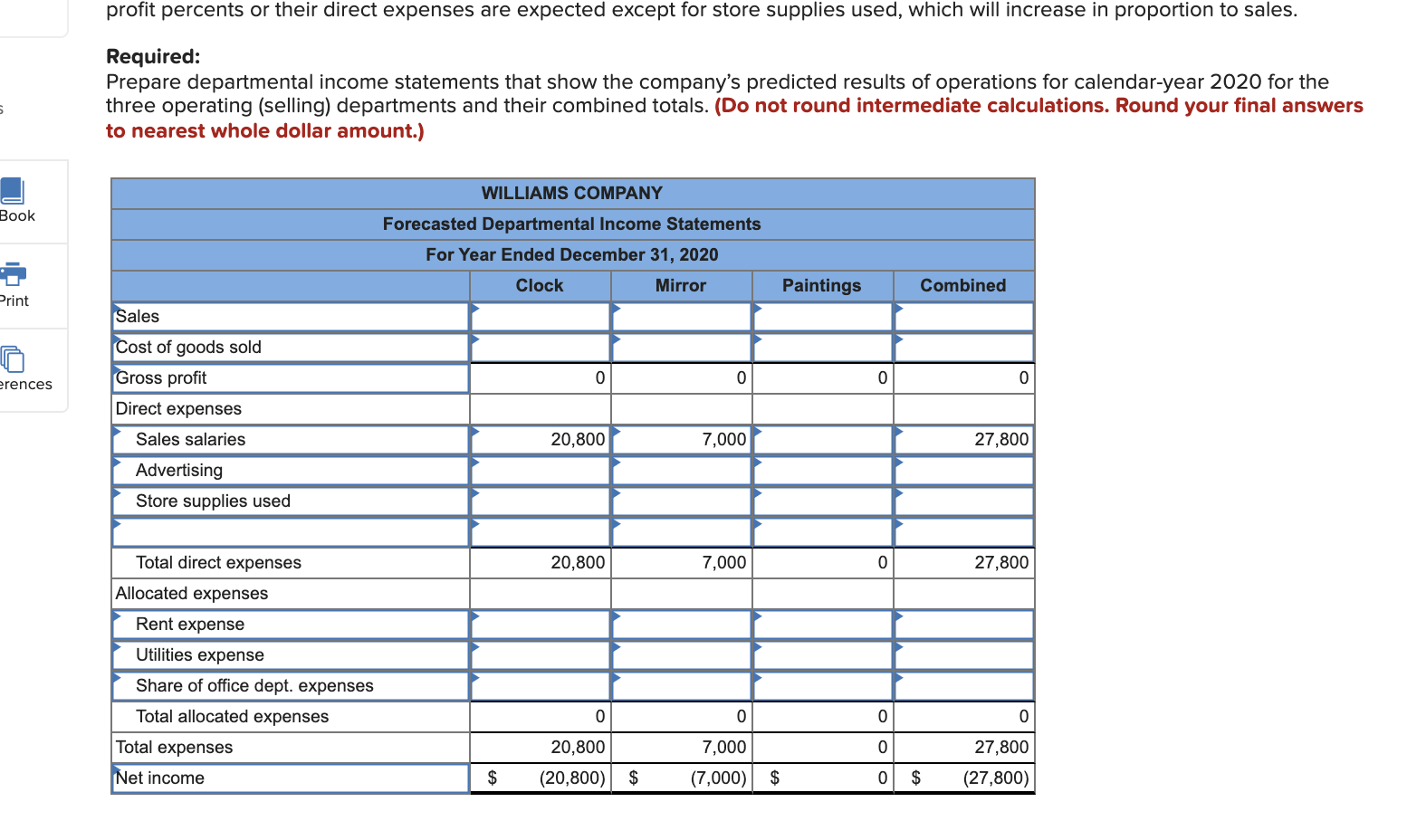

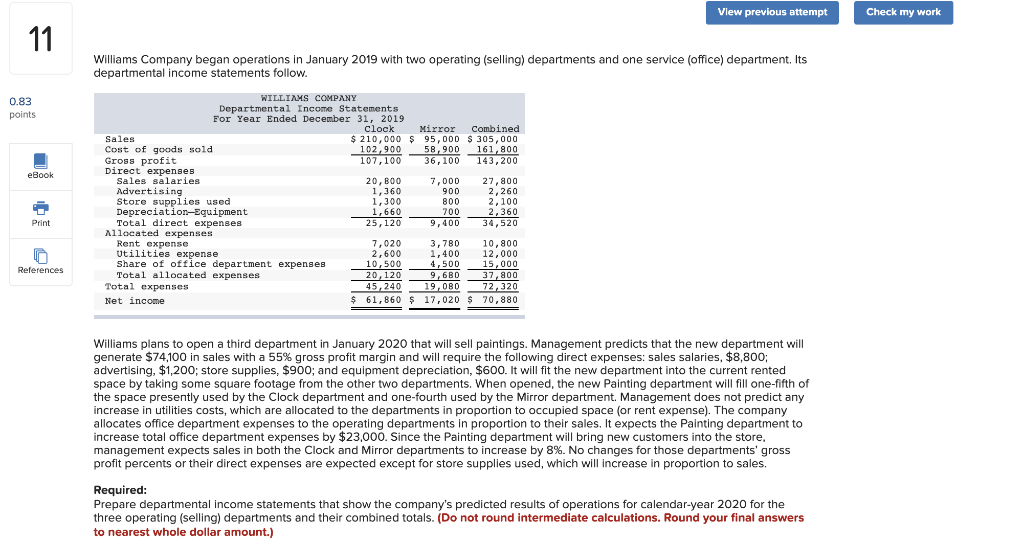

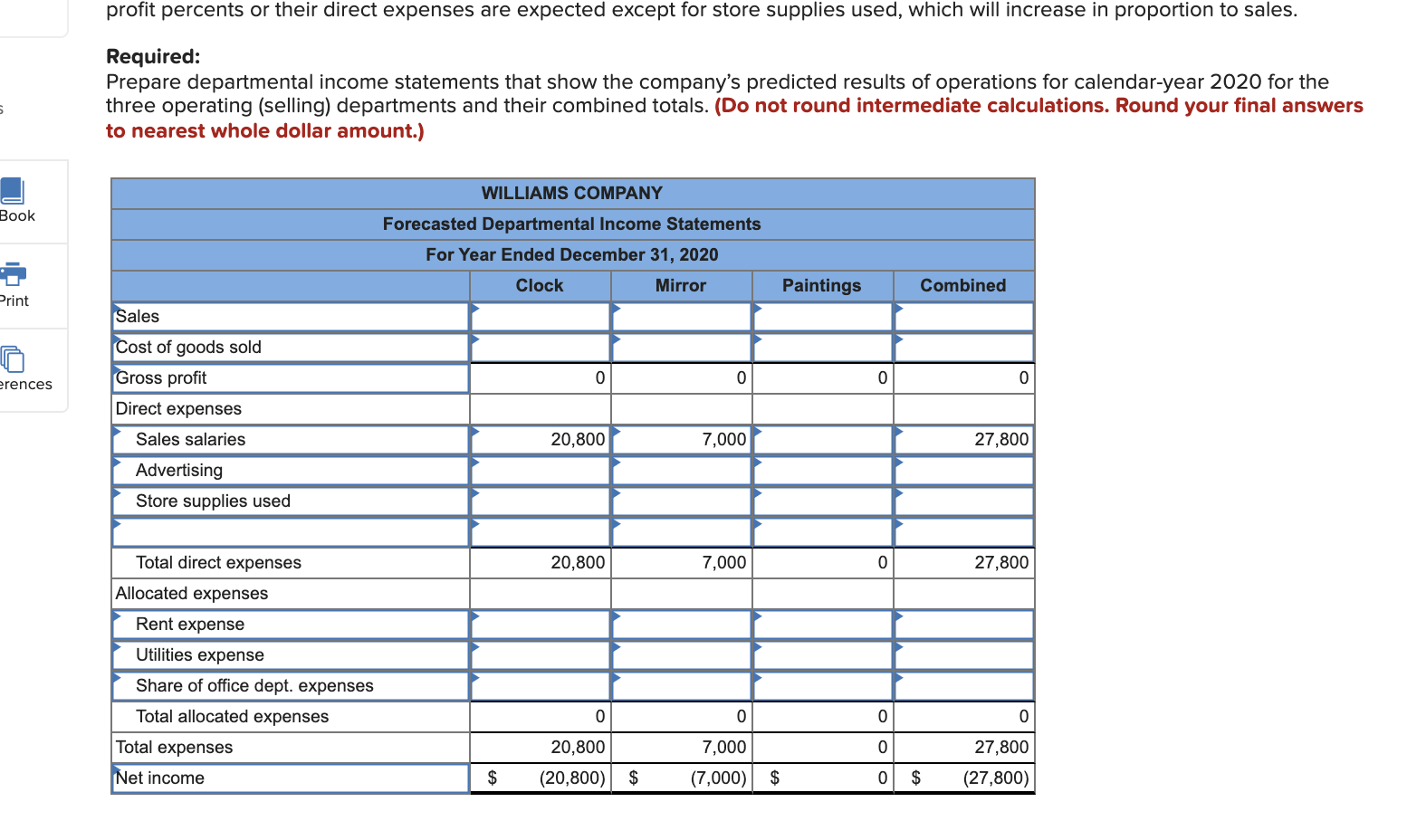

View previous attempt Check my work 11 Williams Company began operations in January 2019 with two operating (selling) departments and one service (office) department. Its departmental income statements follow. 0.83 points eBook WILLIAMS COMPANY Departmental Income Statements For Year Ended December 31, 2019 clock Mirror Combined Sales $ 210,000 $ 95,000 $ 305,000 Cost of goods sold 102,900 58,900 161,800 Gross profit 107,100 36,100 143,200 Direct expenses Sales salaries 20,800 7,000 27,800 Advertising 1,360 900 2,260 Store supplies used 1,300 800 2,100 Depreciation-Equipment 1,660 700 2,360 Total direct expenses 25,120 9,400 34,520 Allocated expenses Rent expense 7,020 3,780 10,800 Utilities expense 2,600 1,400 12,000 Share of office department expenses 10,500 4,500 15,000 Total allocated expenses 20, 120 9,680 37,800 Total expenses 45, 240 19,OBO 72,320 Net income $ 61,860 $ 17,020 $ 70,880 Print References Williams plans to open a third department in January 2020 that will sell paintings. Management predicts that the new department will generate $74,100 in sales with a 55% gross profit margin and will require the following direct expenses: sales salaries, $8,800; advertising, $1,200; store supplies, $900; and equipment depreciation, $600. It will fit the new department into the current rented space by taking some square footage from the other two departments. When opened, the new Painting department will fill one-fifth of the space presently used by the Clock department and one-fourth used by the Mirror department Management does not predict any increase in utilities costs, which are allocated to the departments in proportion to occupied space (or rent expense). The company allocates office department expenses to the operating departments in proportion to their sales. It expects the Painting department to increase total office department expenses by $23,000. Since the Painting department will bring new customers into the store. management expects sales in both the Clock and Mirror departments to increase by 8%. No changes for those departments' gross profit percents or their direct expenses are expected except for store supplies used, which will increase in proportion to sales. Required: Prepare departmental income statements that show the company's predicted results of operations for calendar-year 2020 for the three operating (selling) departments and their combined totals. (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) profit percents or their direct expenses are expected except for store supplies used, which will increase in proportion to sales. Required: Prepare departmental income statements that show the company's predicted results of operations for calendar-year 2020 for the three operating (selling) departments and their combined totals. (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) Book WILLIAMS COMPANY Forecasted Departmental Income Statements For Year Ended December 31, 2020 Clock Mirror Paintings Combined Print Sales 0 0 0 0 erences Cost of goods sold Gross profit Direct expenses Sales salaries Advertising Store supplies used 20,800 7,000 27,800 20,800 7,000 0 27,800 Total direct expenses Allocated expenses Rent expense Utilities expense Share of office dept. expenses Total allocated expenses Total expenses Net income 0 0 0 0 0 20,800 (20,800) 7,000 (7,000) 27,800 (27,800) $ $ $ 0 $