Answered step by step

Verified Expert Solution

Question

1 Approved Answer

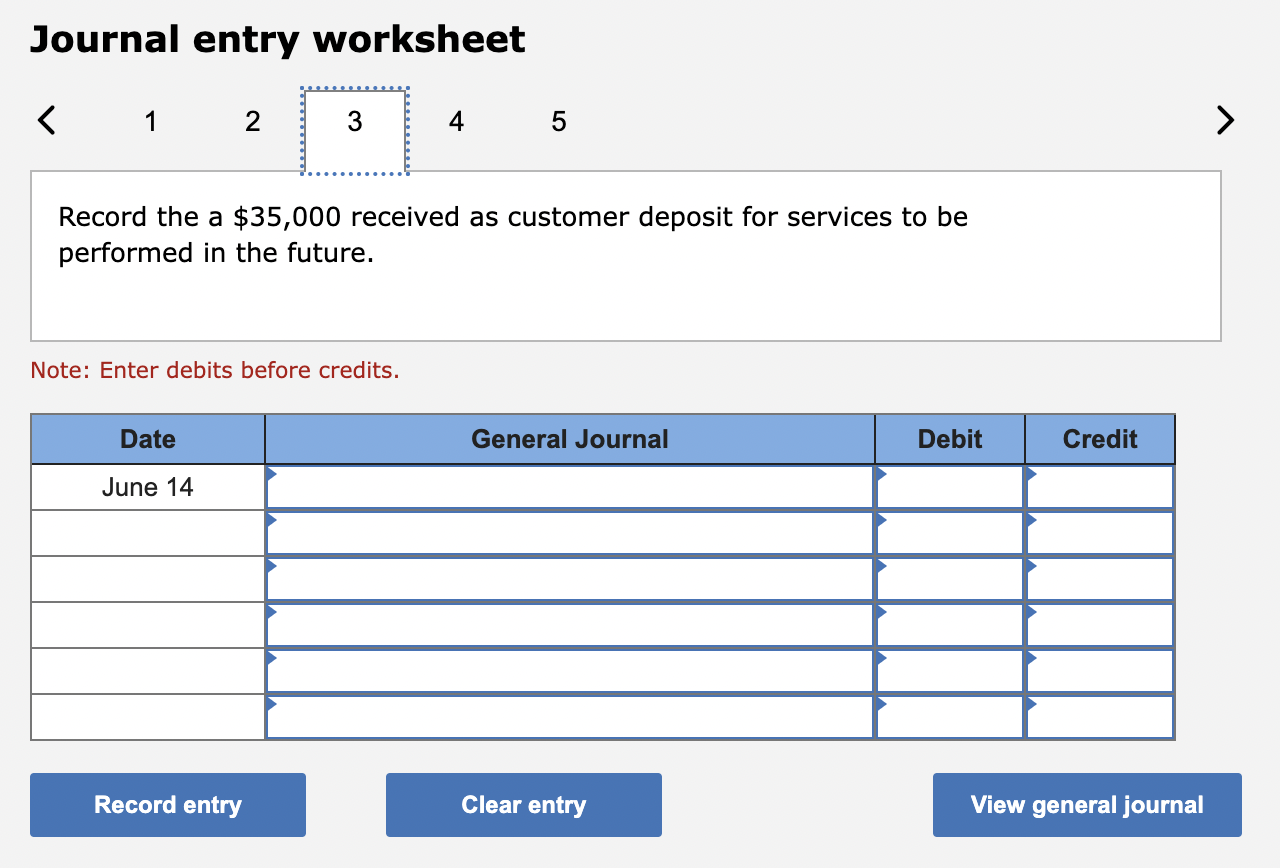

Vigeland Company completed the following transactions during Year 1. Vigeland's fiscal year ends on December 31. Purchased and paid for merchandise. The invoice amount

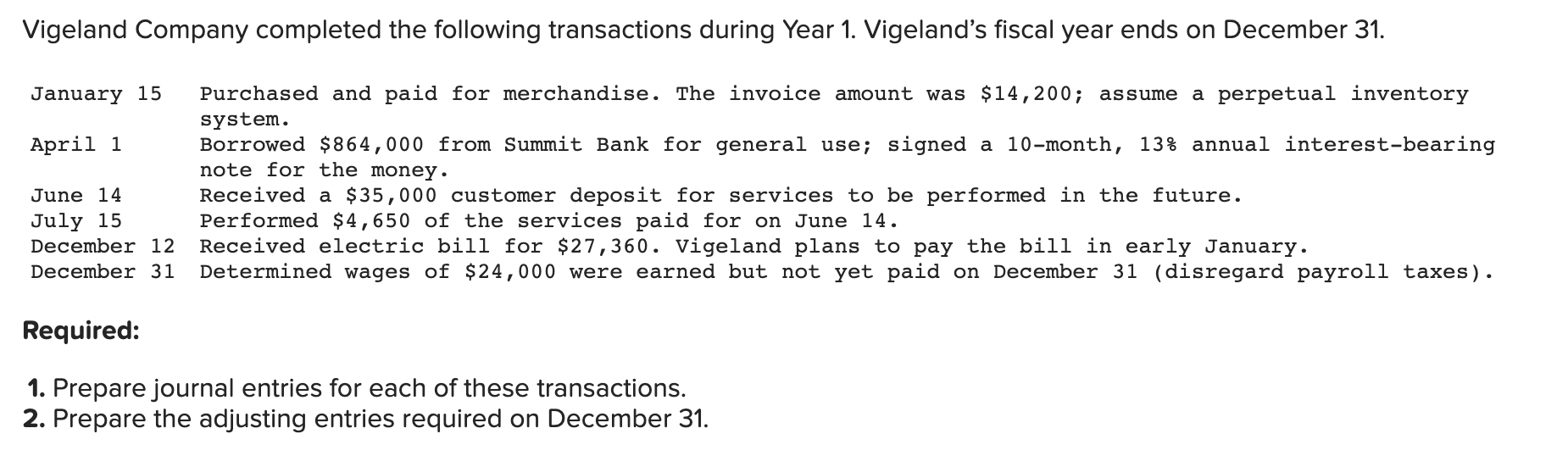

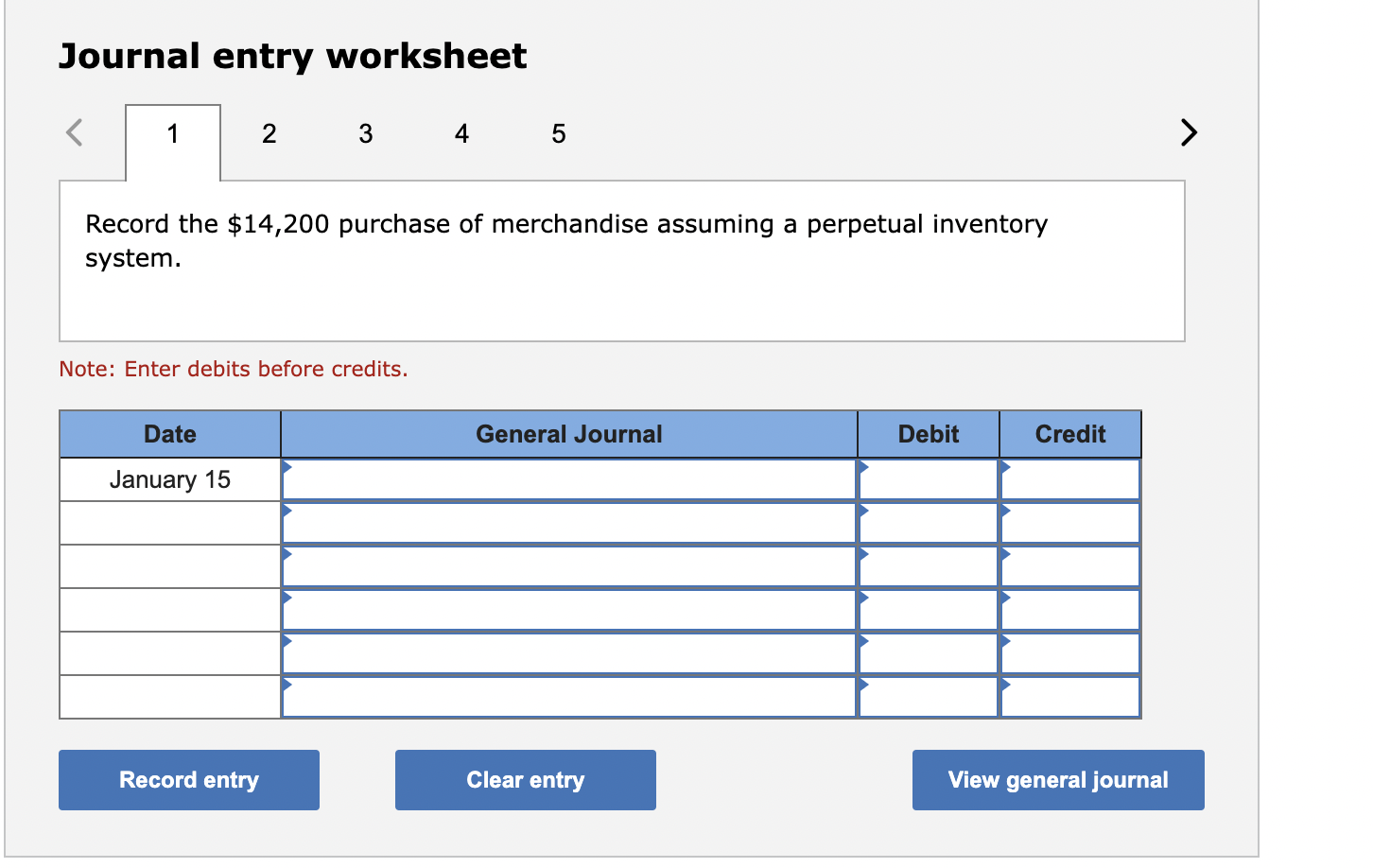

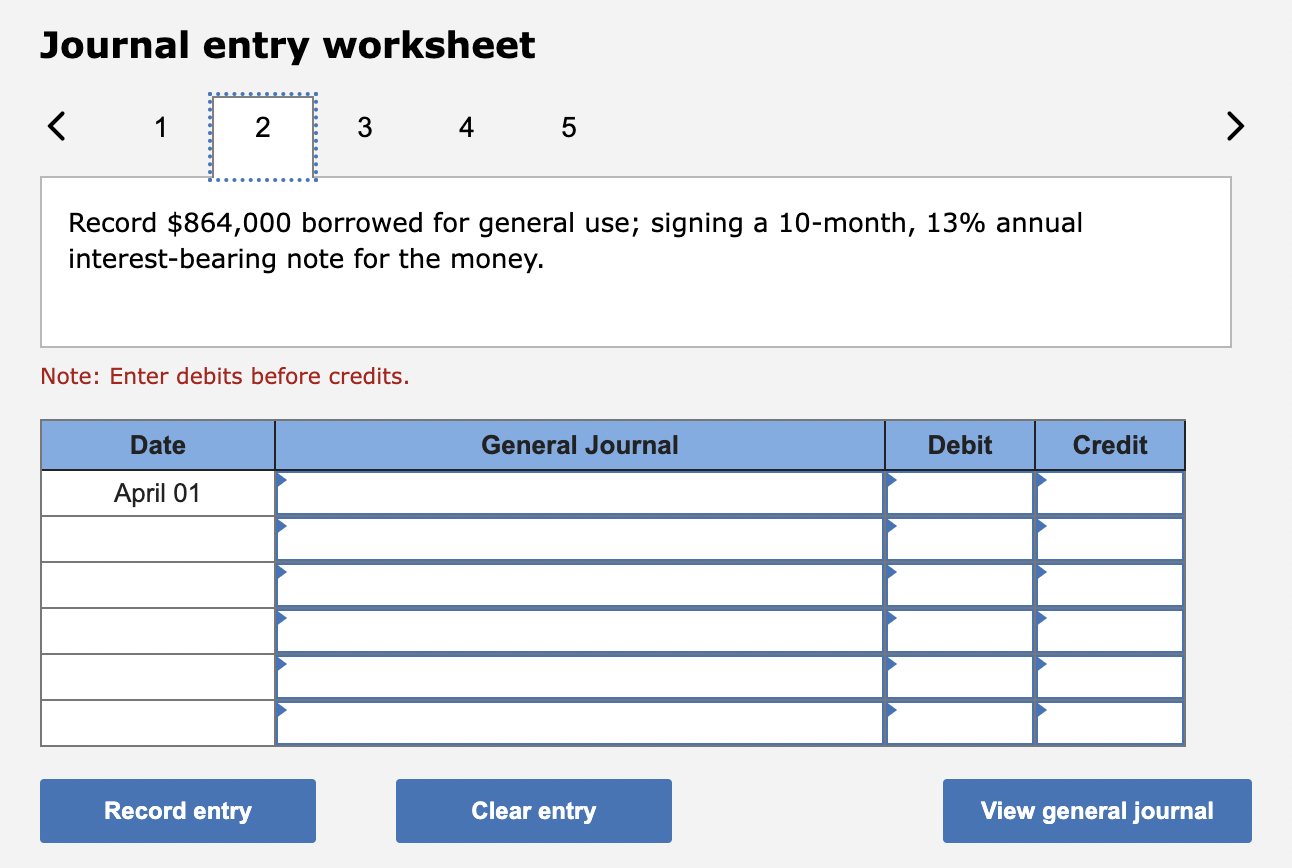

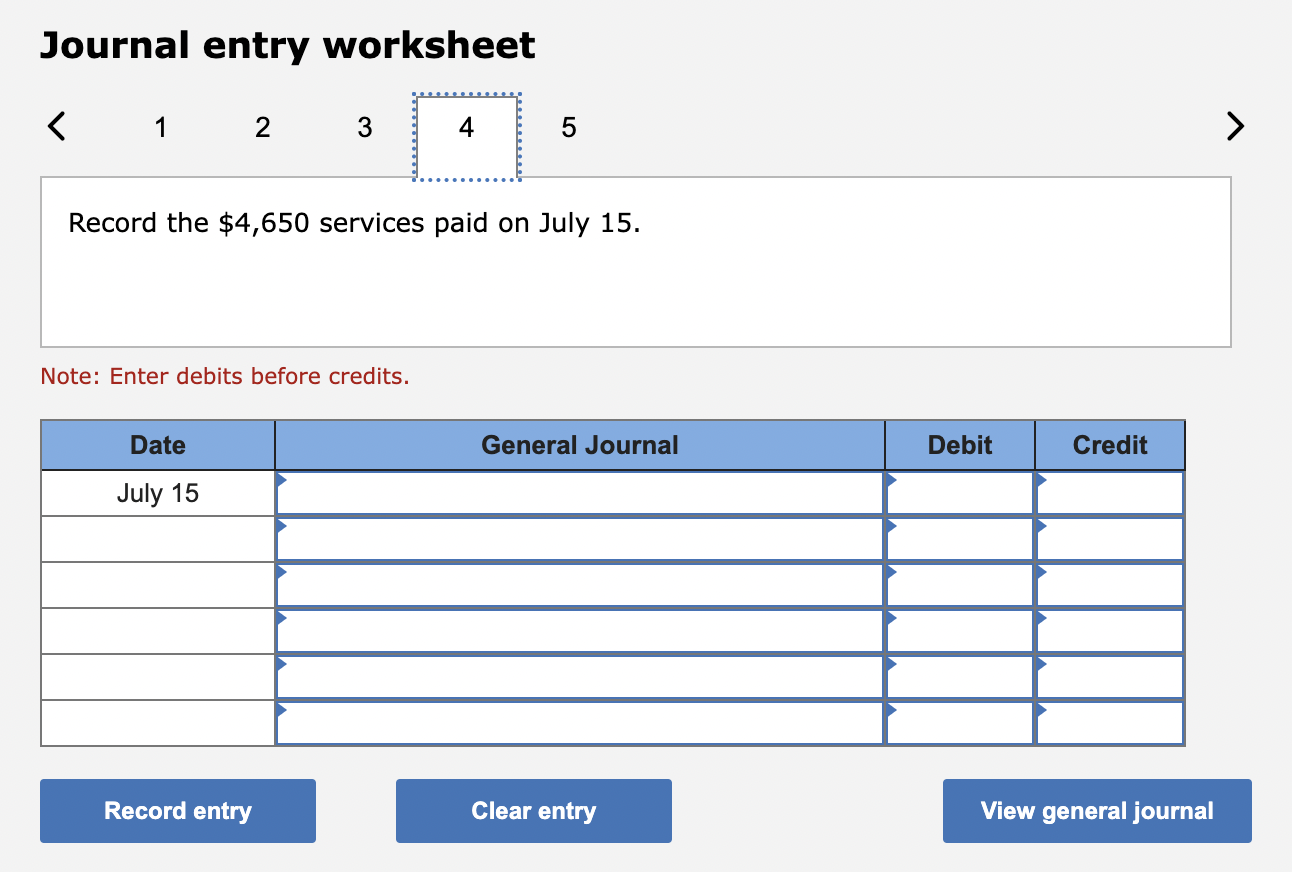

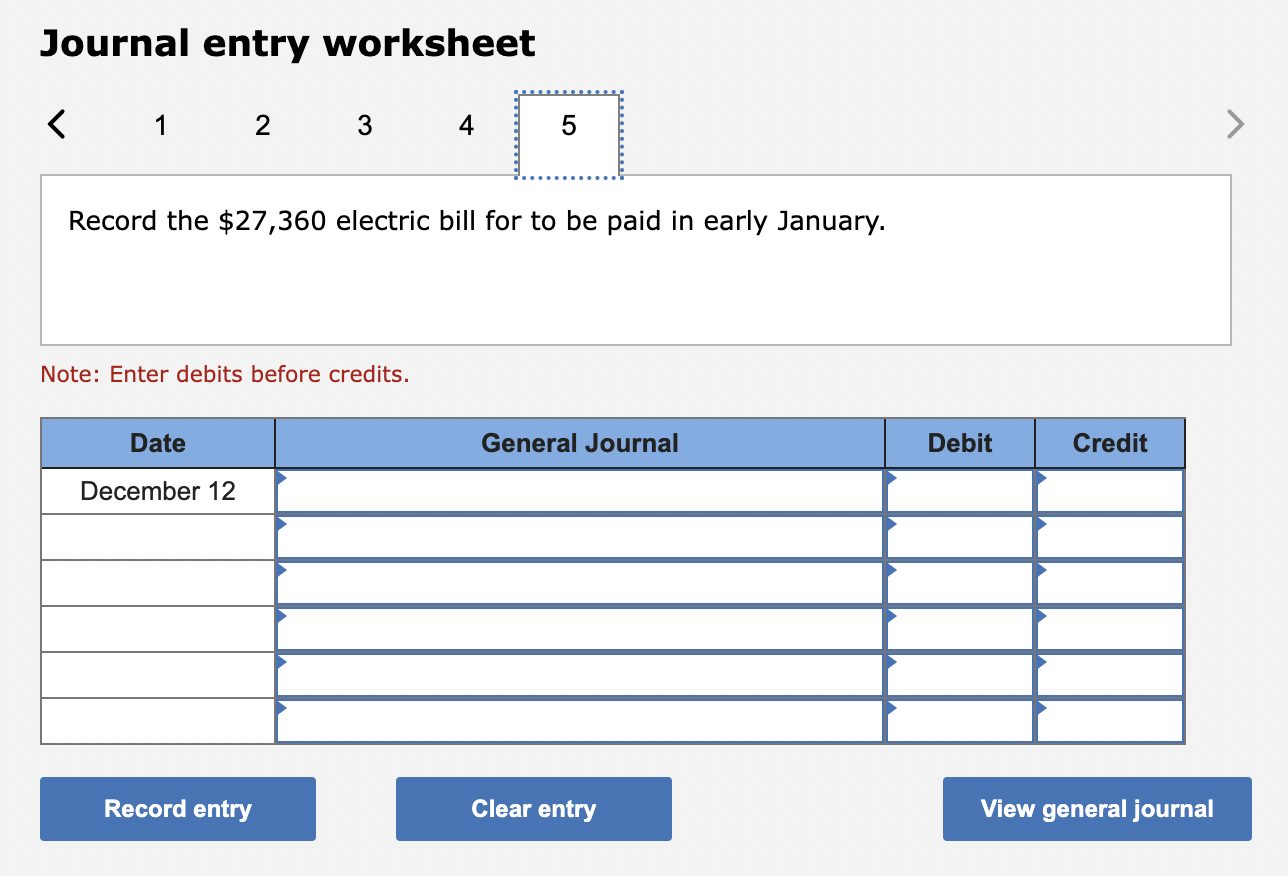

Vigeland Company completed the following transactions during Year 1. Vigeland's fiscal year ends on December 31. Purchased and paid for merchandise. The invoice amount was $14,200; assume a perpetual inventory system. Borrowed $864,000 from Summit Bank for general use; signed a 10-month, 13% annual interest-bearing note for the money. Received a $35,000 customer deposit for services to be performed in the future. Performed $4,650 of the services paid for on June 14. December 12 Received electric bill for $27,360. Vigeland plans to pay the bill in early January. December 31 Determined wages of $24,000 were earned but not yet paid on December 31 (disregard payroll taxes). January 15 April 1 June 14 July 15 Required: 1. Prepare journal entries for each of these transactions. 2. Prepare the adjusting entries required on December 31. Journal entry worksheet 1 2 Date January 15 3 Record the $14,200 purchase of merchandise assuming a perpetual inventory system. Note: Enter debits before credits. Record entry 4 5 General Journal Clear entry Debit Credit View general journal > Journal entry worksheet < 1 2 Date April 01 3 Record $864,000 borrowed for general use; signing a 10-month, 13% annual interest-bearing note for the money. Note: Enter debits before credits. Record entry 4 5 General Journal Clear entry Debit Credit View general journal Journal entry worksheet < 1 3 Note: Enter debits before credits. Date June 14 Record the a $35,000 received as customer deposit for services to be performed in the future. Record entry 4 5 General Journal Clear entry Debit Credit View general journal Journal entry worksheet < 1 2 3 Record the $4,650 services paid on July 15. Note: Enter debits before credits. Date July 15 Record entry 5 General Journal Clear entry Debit Credit View general journal Journal entry worksheet < 1 2 3 4 Record the $27,360 electric bill for to be paid in early January. Note: Enter debits before credits. Date December 12 Record entry 5 General Journal Clear entry Debit Credit View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the journal entries for the transactions 1 January 15 Mercha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started