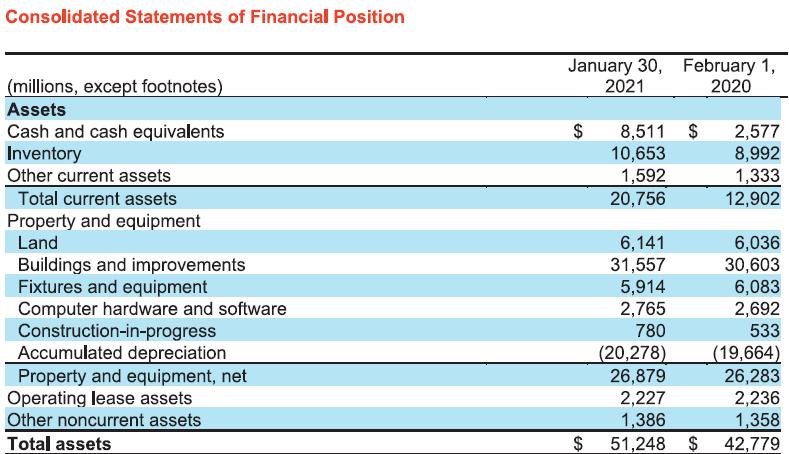

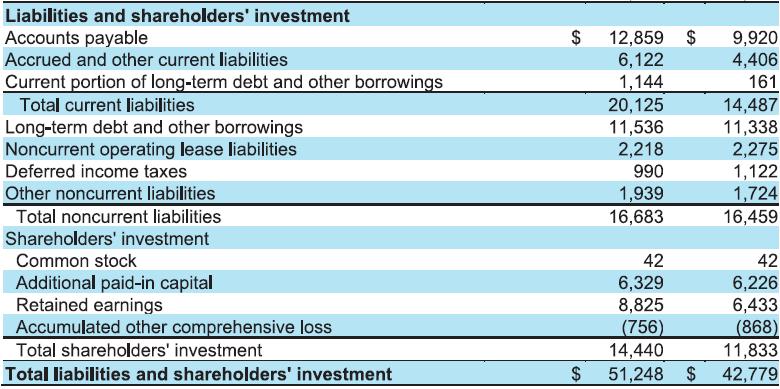

Refer to the financial statements of Target Corporation in Appendix B at the end of this book.

Question:

Refer to the financial statements of Target Corporation in Appendix B at the end of this book. All dollar amounts are in millions.

Data from in Appendix B

1. What is the format of Target’s income statement and how do you know this?

a. Single-step format because Other Revenue is included in Total revenue.

b. Multiple-step format because the company reports interest expense separately from operating expenses.

c. Single-step format because the statement is condensed.

d. Multiple-step format because the company separates continued operations from discontinued operations.

2. How much did Target’s sales revenue increase or decrease in the most recent year?

a. Decreased $15,270

b. Increased $15,449

c. Increased $15,270

d. Decreased $15,449

3. What is the largest expense on the income statement for the most recent year, and how much did it change from the previous year (in millions)?

a. Selling, general and administrative expenses, which increased $2,382

b. Cost of sales, which decreased $1,565

c. Depreciation and amortization, which increased $133

d. Cost of sales, which increased $11,313

4. A Target shareholder has complained that “more dividends should be paid because the company had net earnings of $4,368 million. Since this amount is all cash, more of it should go to the owners.” Is this a valid assumption and why?

a. The assumption is not valid, because the reported amount of net earnings is based on applying accrual accounting principles in which revenues are recorded when earned and expenses are recorded when incurred, regardless of when cash is received or paid.

b. The assumption is valid, because the income statement is based on applying the cash accounting principles in which cash received is revenue and cash paid is an expense.

c. The assumption is valid because Target has $8,511 in cash to distribute.

d. The assumption is not valid, because, over the life of the business, total earnings will not equal total net cash flow.

5. What is Target’s net profit margin ratio for the most recent year based on total revenue and what does is suggest about Target?

a. 0.0390, suggesting that Target earned $3.90 for every dollar of total revenue.

b. 0.0699, suggesting that Target is doing very well.

c. 0.0467, suggesting that Target earned $4.67 for every dollar of total revenue.

d. 0.0473, suggesting that Target earned $4.73 for every dollar of sales.

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge