Answered step by step

Verified Expert Solution

Question

1 Approved Answer

VII. Report for CEO At the most recent strategic planning meeting, the board of directors of your company has voted to issue additional stock

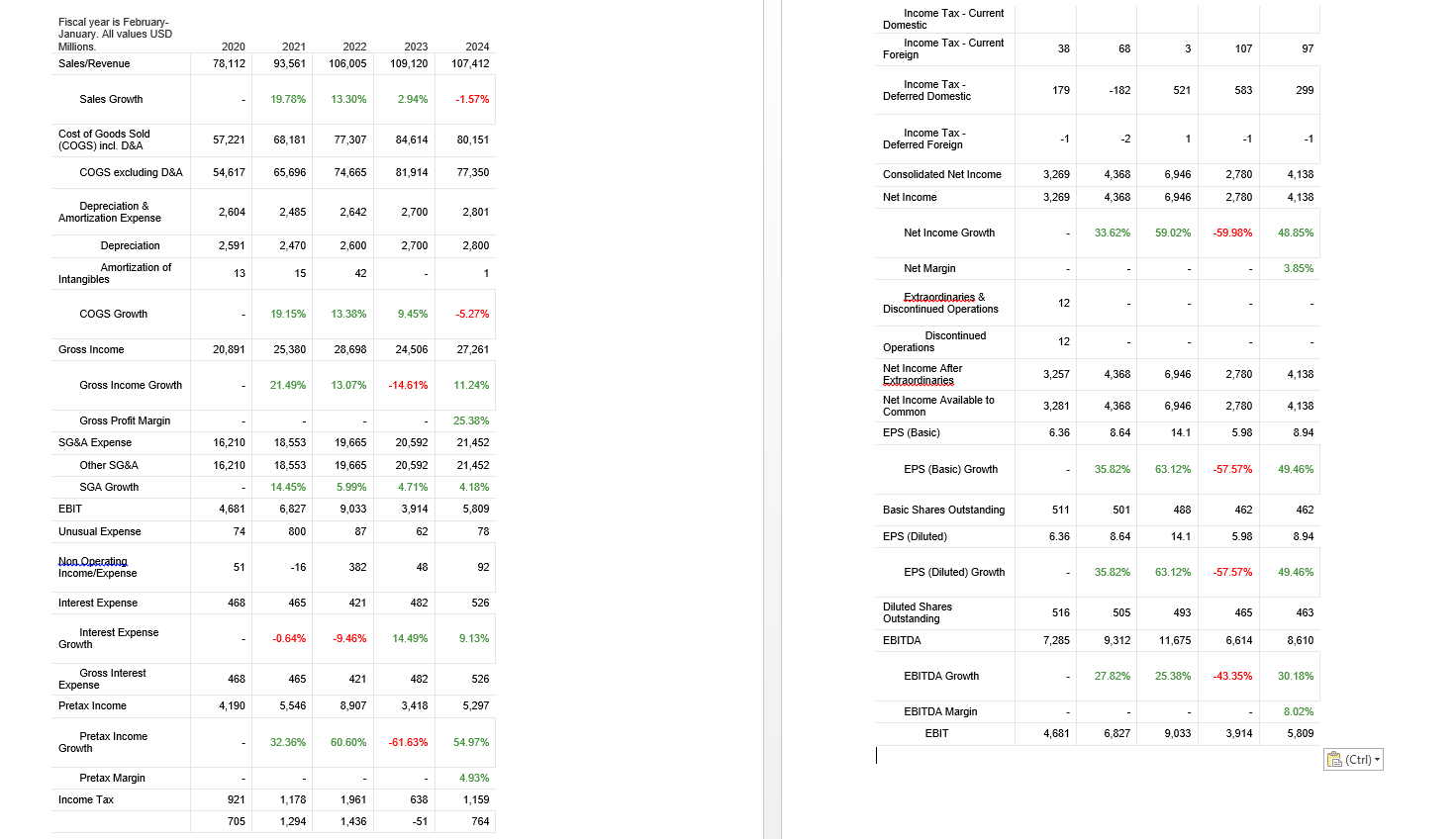

VII. Report for CEO At the most recent strategic planning meeting, the board of directors of your company has voted to issue additional stock to raise capital for major expansions for the company in the next five years. The board is considering $5 billion. Take the most recent financial statements and prepare a set of projected financial statements based on the given assumptions. The CEO requests that you prepare a written report (including the financial statements) for her. A. Generate a projected income statement based on the given scenario. B. Analyze the impact on the income statement based on the given scenario. Income Tax - Current Fiscal year is February- Domestic January. All values USD Millions. 2020 Sales/Revenue 78,112 2021 93,561 2022 106,005 2023 109,120 2024 107,412 Income Tax - Current Foreign 38 68 3 107 97 Income Tax - 179 -182 521 583 299 19.78% 13.30% 2.94% -1.57% Deferred Domestic Sales Growth Cost of Goods Sold Income Tax - (COGS) incl. D&A 57,221 68,181 77,307 84,614 80,151 Deferred Foreign -1 -2 1 -1 -1 COGS excluding D&A 54,617 65,696 74,665 81,914 77,350 Consolidated Net Income 3,269 4,368 6,946 2,780 4,138 Net Income 3,269 4,368 6,946 2,780 4,138 Depreciation & 2,604 2,485 2,642 2,700 2,801 Amortization Expense Net Income Growth 33.62% 59.02% -59.98% 48.85% Depreciation 2,591 2,470 2,600 2,700 2,800 Amortization of 13 15 42 1 Net Margin 3.85% Intangibles COGS Growth 19.15% 13.38% 9.45% -5.27% Extraordinaries & Discontinued Operations 12 Discontinued 12 Gross Income 20,891 25,380 28,698 24,506 27,261 Operations Gross Income Growth 21.49% 13.07% -14.61% 11.24% Net Income After Extraordinaries 3,257 4,368 6,946 2,780 4,138 Net Income Available to 3,281 4,368 6,946 2,780 4,138 Common Gross Profit Margin 25.38% EPS (Basic) 6.36 8.64 14.1 5.98 8.94 SG&A Expense 16,210 18,553 19,665 20,592 21,452 Other SG&A 16,210 18,553 19,665 20,592 21,452 EPS (Basic) Growth 35.82% 63.12% -57.57% 49.46% SGA Growth 14.45% 5.99% 4.71% 4.18% EBIT 4,681 6,827 9,033 3,914 5,809 Basic Shares Outstanding 511 501 488 462 462 Unusual Expense 74 800 87 62 78 EPS (Diluted) 6.36 8.64 14.1 5.98 8.94 Non Operating 51 -16 60 382 48 92 2 Income/Expense EPS (Diluted) Growth 35.82% 63.12% -57.57% 49.46% Interest Expense 468 465 421 482 526 Diluted Shares Interest Expense -0.64% -9.46% 14.49% 9.13% Growth Outstanding EBITDA Gross Interest 468 465 421 482 526 EBITDA Growth 516 505 493 465 463 7,285 9,312 11,675 6,614 8,610 27.82% 25.38% -43.35% 30.18% Expense Pretax Income 4,190 5,546 8,907 3,418 5,297 Pretax Income - 32.36% 60.60% -61.63% 54.97% Growth EBITDA Margin 8.02% EBIT 4,681 6,827 9,033 3,914 5,809 (Ctrl) Pretax Margin 4.93% Income Tax 921 1,178 1,961 638 1,159 705 1,294 1,436 -51 764

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started