VIII. PRO-FORMA FINANCIAL STATEMENTS for FACEBOOK

___ Clearly state how much each of your recommended objectives and strategiesis expected to cost.

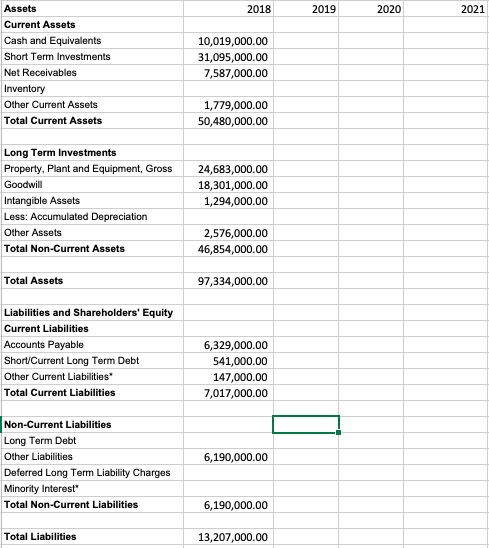

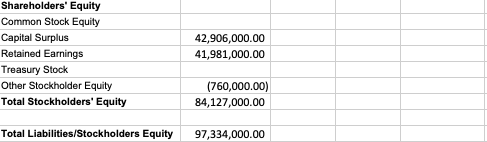

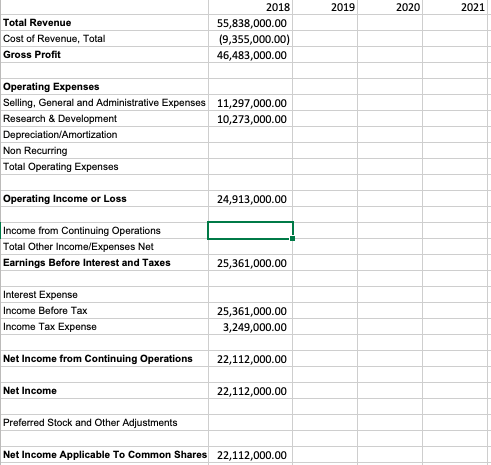

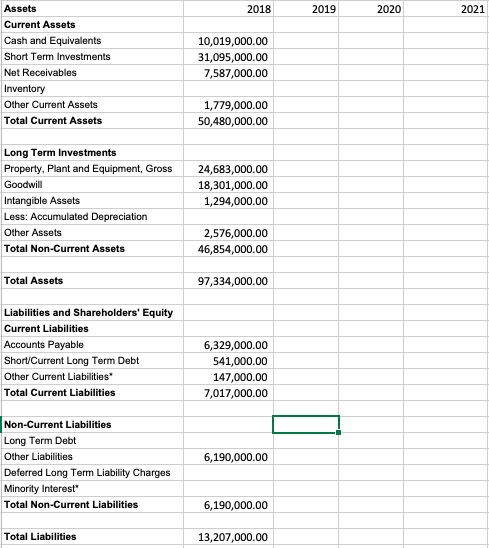

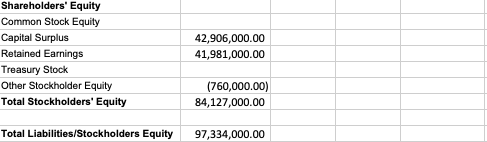

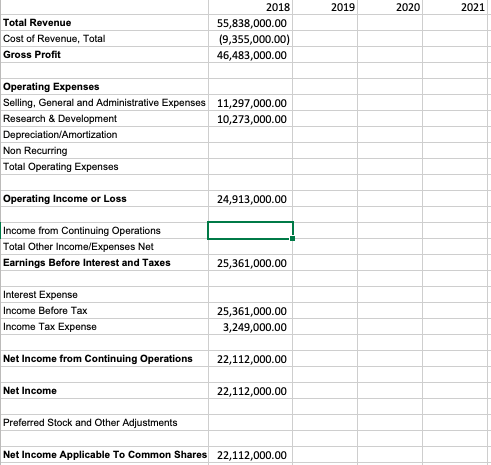

___ Provide the following two pro forma financial statements: (1)four-year (i.e., an actual base yearand three years of projections) pro forma Profit and Loss Statement, and (2) a four-year (i.e., an actual base year and three years of projections) Balance Sheet. .

___ Clearly document all assumptionsand include a short narrative for each assumption in the Notes section following your financial statements.

___ All expenditures/costs associated with implementing your recommended strategies should be included in the financial statements. Likewise, the financial benefits associated with implementing your strategies and attaining your objectives should be included in the pro forma financial statements. And, these figures (i.e., costs and benefits) should be clearly identified by the footnotes and written financial notes.

___ Projected expenses reflect a percent of sales increase plus added strategic costs.

___ Taxes are correctly calculated. ___ Net Income is correctly calculated and appropriately added to the Balance Sheet.

___ The Balance Sheet balances.

___ Accounts Receivable, Inventories and Payables are treated appropriately as a % of sales increase.

Assets Current Assets Cash and Equivalents Short Term Investments Net Receivables 2018 2019 2021 10,019,000.00 1,095,000.00 7,587,000.00 Other Current Assets Total Current Assets 1,779,000.00 50,480,000.00 Long Term Investments Property, Plant and Equipment, Gross 24,683,000.00 18,301,000.00 1,294,000.00 Intangible Assets Less: Accumulated Depreciation Other Assets Total Non-Current Assets 2,576,000.00 46,854,000.00 Total Assets 97,334,000.00 Liabilities and Shareholders' Equity Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities Total Current Liabilities 6,329,000.00 541,000.00 147,000.00 7,017,000.00 Non-Current Liabilities Long Term Debt Other Liabilities Deferred Long Term Liability Charges Minority Interest Total Non-Current Liabilities 6,190,000.00 6,190,000.00 Total Liabilities 13,207,000.00 Shareholders' Equity Common Stock Equity Capital Surplus Retained Earnings Treasury Stock Other Stockholder Equity Total Stockholders' Equity 42,906,000.00 41,981,000.00 (760,000.00) 84,127,000.00 Total Liabilities/Stockholders Equity 97,334,000.00 2018 55,838,000.00 (9,355,000.00) 46,483,000.00 2019 2020 2021 Total Revenue Cost of Revenue, Total Gross Profit Operating Expenses Selling, General and Administrative Expenses Research & Development Depreciation/Amortization Non Recurring Total Operating Expenses 11,297,000.00 10,273,000.00 Operating Income or Loss 24,913,000.00 Total Other Income/Expenses Net Earnings Before Interest and Taxes 25,361,000.00 Interest Expense Income Before Tax Income Tax Expense 25,361,000.00 3,249,000.00 22,112,000.00 22,112,000.00 Net Income from Continuing Operations Net Income Preferred Stock and Other Adjustments Net Income Applicable To Common Shares 22,112,000.00 Assets Current Assets Cash and Equivalents Short Term Investments Net Receivables 2018 2019 2021 10,019,000.00 1,095,000.00 7,587,000.00 Other Current Assets Total Current Assets 1,779,000.00 50,480,000.00 Long Term Investments Property, Plant and Equipment, Gross 24,683,000.00 18,301,000.00 1,294,000.00 Intangible Assets Less: Accumulated Depreciation Other Assets Total Non-Current Assets 2,576,000.00 46,854,000.00 Total Assets 97,334,000.00 Liabilities and Shareholders' Equity Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities Total Current Liabilities 6,329,000.00 541,000.00 147,000.00 7,017,000.00 Non-Current Liabilities Long Term Debt Other Liabilities Deferred Long Term Liability Charges Minority Interest Total Non-Current Liabilities 6,190,000.00 6,190,000.00 Total Liabilities 13,207,000.00 Shareholders' Equity Common Stock Equity Capital Surplus Retained Earnings Treasury Stock Other Stockholder Equity Total Stockholders' Equity 42,906,000.00 41,981,000.00 (760,000.00) 84,127,000.00 Total Liabilities/Stockholders Equity 97,334,000.00 2018 55,838,000.00 (9,355,000.00) 46,483,000.00 2019 2020 2021 Total Revenue Cost of Revenue, Total Gross Profit Operating Expenses Selling, General and Administrative Expenses Research & Development Depreciation/Amortization Non Recurring Total Operating Expenses 11,297,000.00 10,273,000.00 Operating Income or Loss 24,913,000.00 Total Other Income/Expenses Net Earnings Before Interest and Taxes 25,361,000.00 Interest Expense Income Before Tax Income Tax Expense 25,361,000.00 3,249,000.00 22,112,000.00 22,112,000.00 Net Income from Continuing Operations Net Income Preferred Stock and Other Adjustments Net Income Applicable To Common Shares 22,112,000.00