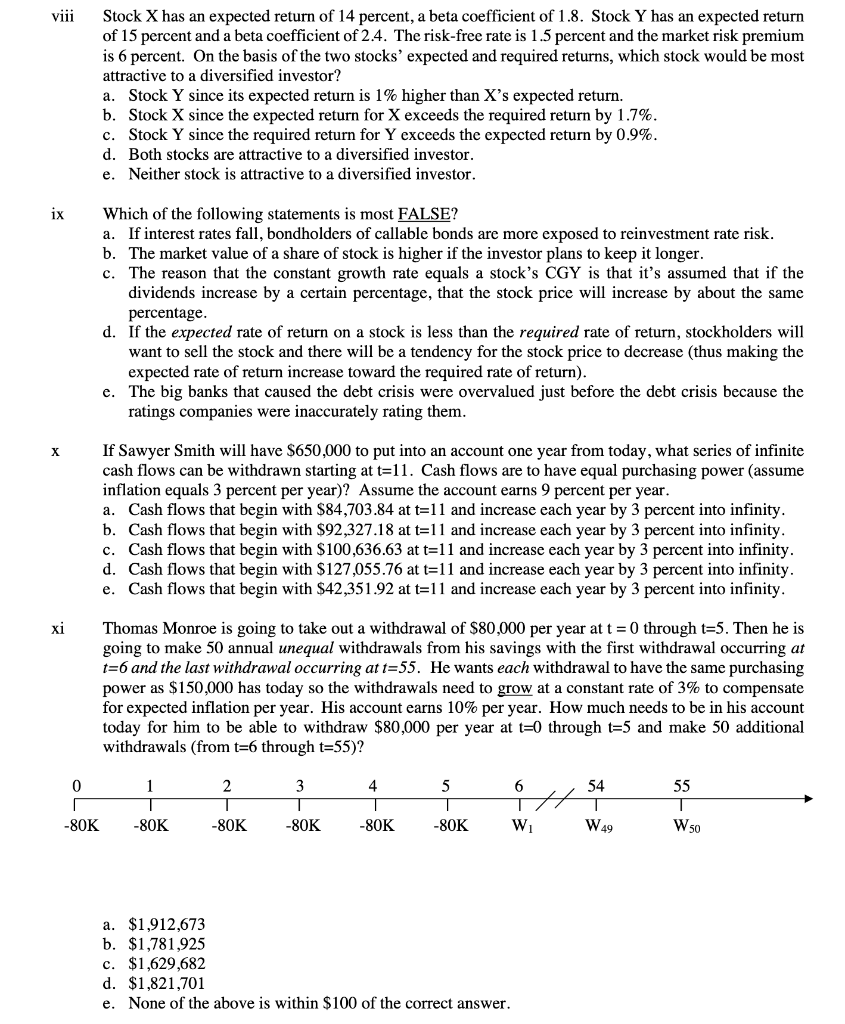

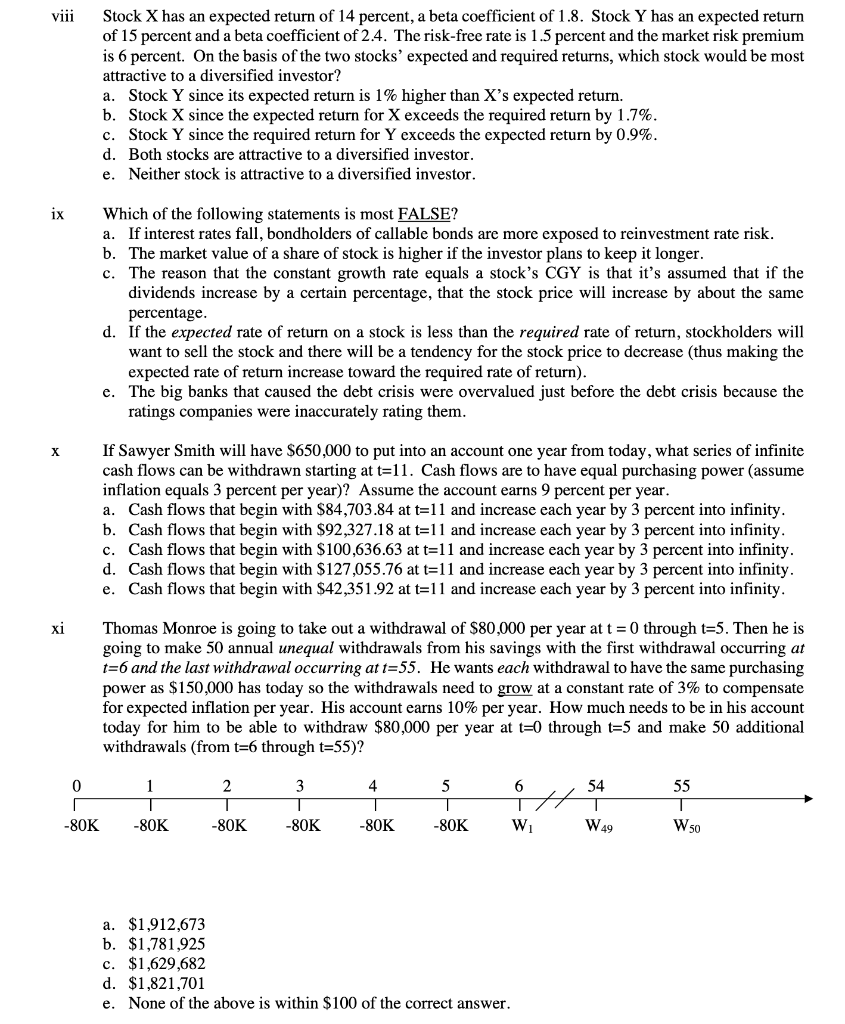

viii Stock X has an expected return of 14 percent, a beta coefficient of 1.8. Stock Y has an expected return of 15 percent and a beta coefficient of 2.4. The risk-free rate is 1.5 percent and the market risk premium is 6 percent. On the basis of the two stocks' expected and required returns, which stock would be most attractive to a diversified investor? a. Stock Y since its expected return is 1% higher than X's expected return. b. Stock X since the expected return for X exceeds the required return by 1.7%. c. Stock Y since the required return for Y exceeds the expected return by 0.9%. d. Both stocks are attractive to a diversified investor. e. Neither stock is attractive to a diversified investor. ix Which of the following statements is most FALSE? a. If interest rates fall, bondholders of callable bonds are more exposed to reinvestment rate risk. b. The market value of a share of stock is higher if the investor plans to keep it longer. c. The reason that the constant growth rate equals a stock's CGY is that it's assumed that if the dividends increase by a certain percentage, that the stock price will increase by about the same percentage. d. If the expected rate of return on a stock is less than the required rate of return, stockholders will want to sell the stock and there will be a tendency for the stock price to decrease (thus making the expected rate of return increase toward the required rate of return). e. The big banks that caused the debt crisis were overvalued just before the debt crisis because the ratings companies were inaccurately rating them. X If Sawyer Smith will have $650,000 to put into an account one year from today, what series of infinite cash flows can be withdrawn starting at t=11. Cash flows are to have equal purchasing power (assume inflation equals 3 percent per year)? Assume the account earns 9 percent per year. a. Cash flows that begin with $84,703.84 at t=11 and increase each year by 3 percent into infinity. b. Cash flows that begin with $92,327.18 at t=11 and increase each year by 3 percent into infinity. c. Cash flows that begin with $100,636.63 at t=11 and increase each year by 3 percent into infinity. d. Cash flows that begin with $127,055.76 at t=11 and increase each year by 3 percent into infinity. e. Cash flows that begin with $42,351.92 at t=11 and increase each year by 3 percent into infinity. xi Thomas Monroe is going to take out a withdrawal of $80,000 per year at t = 0 through t=5. Then he is going to make 50 annual unequal withdrawals from his savings with the first withdrawal occurring at t=6 and the last withdrawal occurring at t=55. He wants each withdrawal to have the same purchasing power as $150,000 has today so the withdrawals need to grow at a constant rate of 3% to compensate for expected inflation per year. His account earns 10% per year. How much needs to be in his account today for him to be able to withdraw $80,000 per year at t=0 through t=5 and make 50 additional withdrawals (from t=6 through t=55)? 0 1 5 2 T -80K 3 T -80K 4 1 -80K 6 54 TH T W W49 55 1 W 50 -80K -80K -80K a. $1,912,673 b. $1,781,925 c. $1,629,682 d. $1,821,701 e. None of the above is within $100 of the correct